AzmanL

Summary

Following my coverage of Workday, Inc. (NASDAQ:WDAY), I recommended a hold rating as I did not see any attractive upside to the share price. Reality has proven otherwise, as the stock went up to $276. This post is to provide an update on my thoughts on the business and stock. I am revising my rating from hold to buy as I turned more bullish on WDAY’s ability to accelerate growth in FY25. As WDAY shows that growth can accelerate back to 20%, I expect the market to re-rate valuation upwards as the WDAY growth narrative is back on the table.

Investment thesis

Starting with WDAY 3Q24 financial results, revenue came 100bps ahead of my FY24 growth estimate, with strength seen in both Professional Services and Subscription revenue. WDAY also continued to show margin expansion with its EBIT margin expanding by 500bps to 25%. FCF margin also regained its 21% level (similar to 3Q23) after a 100bps expansion from 2Q24.

WDAY 3Q24 results were great, and I think there is a good probability that growth can accelerate from here. Specifically, WDAY disclosed very positive, forward-looking growth metrics that are pushing me to believe growth can accelerate faster than I expected. For instance, the 12-month subscription backlog grew 22% y/y, which was an acceleration from the 21% growth seen in 2Q24. It was also mentioned by management that the macro has remained stable, neither improving nor worsening compared to previous quarters. This clearly sounds like stabilization to me, which is a positive as the macro condition was evidently negative for the majority of CY2023. Within WDAY, I think there is also compelling evidence that suggests businesses are picking up on spending their IT budget. Management emphasized during the call the broad strength of net new deals and its current customer base, which includes large and medium-sized businesses as well as regions, especially the US and EMEA. Specifically regarding net-new deals, management mentioned that new full-platform wins are increasing and that win rates are staying strong. They also shared that Workday now has more than 5,000 core HCM customers.

WDAY’s growth strength was not limited to the domestic market; they have also found further success in the international market, specifically in EMEA. For reference, international revenue grew 17% to $462 million, making it 25% of total revenue. This growth was an acceleration from the 15% seen in 2Q24, and importantly, EMEA has surpassed $1 million in ARR [annual recurring revenue]. While EMEA was in the spotlight, growth momentum was seen in other countries as well, like the UK, Germany, France, and Spain. Looking ahead, I expect WDAY’s international region to become a larger growth driver and also a more predictable one. Both of these will stem from the improved sales team and go-to-market strategy that management is enforcing. The implication of the success in international growth is that it extends the growth runway of WDAY, as international is 50% of WDAY’s TAM. Over the course of WDAY’s history as a public company, most of its revenue has come from the states, and growth has certainly decelerated over the years as the industry has matured and also because the WDAY revenue base is a lot larger today. Hence, for growth to accelerate, successfully penetrating the international market is vital.

We discussed with you at our Financial Analyst Day. Starting with international, which represents over half our addressable opportunity. In EMEA, I’m pleased to say that our leadership additions are driving improved and more consistent results. 3Q24 earnings results call

Finally, I think the increased usage of AI is a long-term growth driver for WDAY. WDAY, as a platform, has access to a vast amount of data from various functions (payroll, attendance, general ledger, etc.). This puts WDAY in the best position to come out with AI offerings that can improve efficiency and be accurate. Importantly, WDAY is able to leverage AI to improve its value proposition to managers and developers. For example,

- For managers: WDAY leverages AI to help managers better identify talent across the organization and assemble a team for the right project. WDAY can do this because it already has all the necessary data regarding the employees in the organization.

- For developers: WDAY leverages AI to reduce the need for coding. This dramatically reduces the complexity of building apps, which also means faster deployment time.

As WDAY increases its value proposition, I think it is natural that its win rates will increase accordingly, accelerating growth.

Valuation

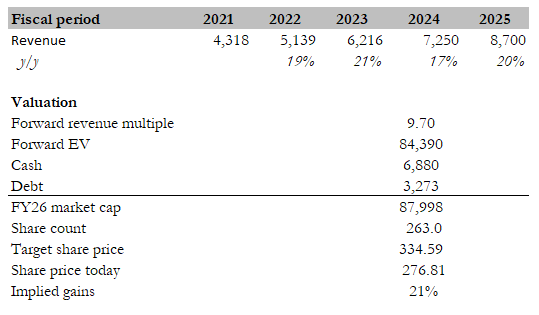

Own calculation

My target price for WDAY, based on my model, is $334. My model assumptions are that WDAY will achieve management FY24 revenue guidance (17% growth) and see growth accelerate back to 20% in FY25. The reason for using management guidance in FY24 is due to two reasons. Firstly, the guidance was given in December (management has 4 weeks of data already). Secondly, management has a good track record of meeting revenue guidance for the past 10 years (only missing once in 4Q21). For FY25, I have a stronger growth assumption as

- I believe underlying businesses are starting to deploy more IT budgets (as seen from WDAY winning more deals);

- The international segment, which is growing faster than the domestic segment, will become a larger growth contributor as it becomes a larger part of the business.

- WDAY’s AI product will lead to improvements in win rates.

In my opinion, a large part of why the WDAY valuation has been detracting is because its growth has been decelerating and the market is worried that it will continue to do so. Hence, if WDAY is able to achieve what I expect, I believe the market will rerate WDAY forward revenue multiples upwards as the WDAY growth narrative is back on the table. I am modeling WDAY to trade back to its historical average of 9.7x.

Risks

The space that WDAY is competing in is very competitive, with a lot of deep-pocketed competitors like Oracle and SAP. These players have a lot of connections and distribution partners that they can leverage to compete against WDAY. While I am positive that WDAY is a leader amongst the pack, irrational competition by any of these large players could cause volatility in WDAY’s growth trajectory. Competition aside, if the macro conditions continue to worsen from here, I am afraid that underlying businesses will do another round of IT budget cuts, which will impact WDAY growth.

Conclusion

In conclusion, I am revising my recommendation on WDAY from hold to buy. WDAY’s 3Q24 results, operating metrics, and management comments have led me to be more bullish about WDAY’s growth prospect in FY25. For instance, 12-month subscription backlog growth accelerated to 22% and WDAY continue to see strong international success. Additionally, the long-term potential of AI integration enhances the platform’s value proposition, which I expect to enhance WDAY’s win rates.