Khanchit Khirisutchalual

Elevator Pitch

Wolters Kluwer N.V. (OTCPK:WOLTF) [WKL:NA] stock is awarded a Hold investment rating. I outlined the key positives and negatives for WOLTF in my prior write-up published on September 22, 2023.

Wolters Kluwer’s Financial & Corporate Compliance business is the focus of this latest article. In my view, the key catalyst for WOLTF is an acceleration in revenue growth for this business segment as it shifts to a more favorable sales mix comprising a higher proportion of recurring revenue. I don’t think that this particular catalyst will materialize in the near term, and the stock’s current valuations are demanding. As such, I don’t see any reasons to change my existing Hold rating for Wolters Kluwer.

Readers should be aware that Wolters Kluwer’s shares are traded on both the Over-The-Counter market and Euronext Amsterdam. The three-month mean daily trading values for the company’s OTC shares and Amsterdam-listed shares were $15,000 and $80 million, respectively. There are US brokerages such as Interactive Brokers with foreign markets trading access that allow investors to deal in Wolters Kluwer’s Amsterdam-listed shares, which have better trading liquidity than its OTC shares.

Financial & Corporate Compliance Business’ Recent Performance Was Poor

Investors with an interest in considering Wolters Kluwer as a potential investment should pay attention to its Financial & Corporate Compliance business segment, which I will refer to as either the FCC business or the Compliance business in the article.

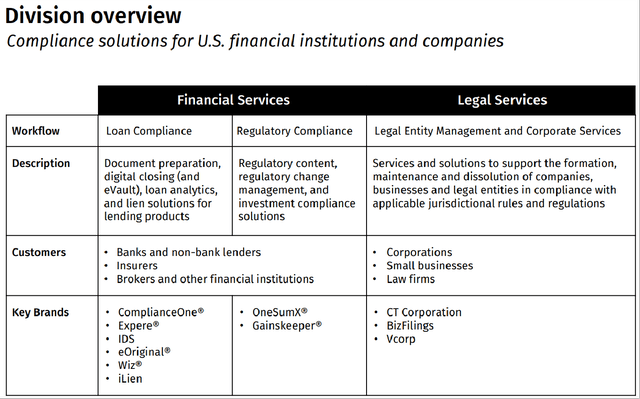

An Overview Of Wolters Kluwer’s FCC Business

Wolters Kluwer’s November 2023 Investor Presentation

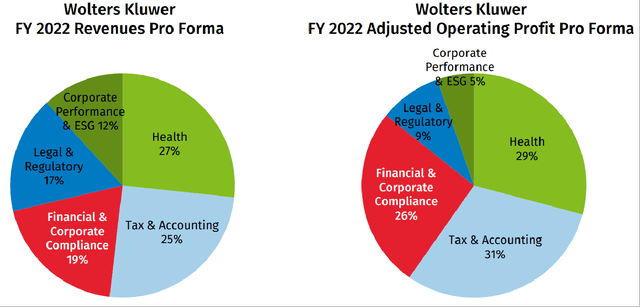

Compliance Business Is Third Largest Revenue And Earnings Contributor Among WOLTF’s Business Divisions

Wolters Kluwer’s November 2023 Investor Presentation

WOLTF releases the company’s complete financial statements twice every year, and it only offers brief business updates in the first and third quarters. The company’s top line performance for the first nine months of the current year was reasonably decent, as Wolters Kluwer registered a +5% growth in organic revenue and a +4% enhance in constant-currency sales in 9M 2023 as indicated in its Q3 2023 trading update.

But WOLTF’s FCC business didn’t do as well as the company’s other businesses. The FCC business recorded a modest +1% enhance in organic revenue for 9M 2023, while the company’s four other business divisions delivered higher organic sales growth rates in the +4%-8% range during the same time period. Moreover, Wolters Kluwer guided in its third quarter trading update that the FCC business is projected to suffer from organic revenue growth deceleration for FY 2023, implying that its organic top line expansion this year will be weaker than the +4% it achieved in FY 2022.

At its earlier 1H 2023 earnings call (the company only hosts results briefing on an semi-annual basis), Wolters Kluwer acknowledged that “FCC does have more transactional revenues than other parts of the group.” This might help to supply an explanation for the Compliance business’ lackluster 9M 2023 revenue performance and its weak full-year top line outlook. As the economy weakens, there have been fewer M&A deals and new businesses being set up, and that translates into lower transactional revenue for WOLTF’s FCC business division.

But FCC Division’s Medium-To-Long Term Prospects Are Good

The FCC division’s year-to-date revenue performance has been disappointing, and the near-term outlook for this business segment is unexciting as seen with its full-year guidance. However, there two reasons to be optimistic about the FCC business’ prospects for the intermediate to long term.

One reason is that the Compliance business has room to enhance recurring revenue contribution for the future.

At the company’s November 30, 2023 investor call (transcript taken from S&P Capital IQ), which it referred to as a “Virtual educate-In” session for the FCC division, WOLTF shared that it has been “strategically shifting our business towards recurring revenue streams by driving innovation, increasing our focus on multiyear agreements with customers” in recent times. The company’s efforts have paid off, as the proportion of Wolters Kluwer’s total revenue for the FCC business that is recurring in nature grew from 61% for full-year FY 2022 to 67% in 9M 2023. But this also means that transactional or non-recurring revenue still accounted for about a third of the FCC business’ top line.

As an example of the potential drivers of an enhance in recurring revenue contribution, WOLTF’s lien solutions sub-segment within the FCC business typically generates revenue which is transactional in nature. But the company has plans to present new products and services for the lien solutions sub-segments which have recurring subscription components.

The other reason is that the FCC business division is a beneficiary of digitalization tailwinds for the long run.

Wolters Kluwer highlighted in its November 2023 investor presentation that only a single-digit percentage of Fannie Mae’s “purchase mortgage deliveries” are currently executed in the form of eNotes. This statistic supports WOLTF’s views at the November 30, 2023 investor call that “digital adoption is still in its infancy across all of our markets (for the FCC business) and is prime for growth, particularly in digital lending.”

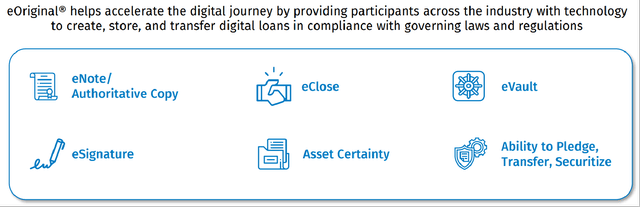

It is also worthy of note that Wolters Kluwer bought over a digital lending technology business known as eOriginal at the end of 2020 to put itself in a better position to capitalize on growth opportunities associated with digital lending.

eOriginal’s Business Profile

Wolters Kluwer’s November 2023 Investor Presentation

In a nutshell, WOLTF’s FCC business has good long-term growth potential, even though the segment hasn’t performed well this year thus far.

Concluding Thoughts

I have a Hold rating for Wolters Kluwer.

The stock is now trading at pretty rich consensus forward next twelve months’ EV/EBITDA and normalized P/E multiples of 18.2 times and 27.6 times, respectively as per S&P Capital IQ data. It will be reasonable to assume that WOLTF needs all of its businesses to be performing well to warrant advance valuation multiple expansion, which I don’t think will happen in the near term.

As it stands now, the weakest link for Wolters Kluwer is the company’s FCC business. The short-term revenue outlook for the FCC segment is unfavorable, as transactional revenue still makes up about one-third of the segment’s aggregate top line. It will take time for Wolters Kluwer to grow its recurring revenue contribution for its FCC business division, so a positive valuation re-rating for the stock is unlikely to happen anytime soon. In that respect, I select to keep my Hold rating for WOLTF unchanged.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.