Aaron Yoder/iStock via Getty Images

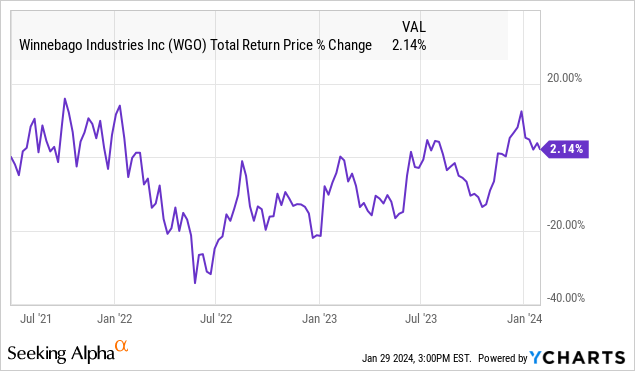

Winnebago Industries, Inc. (NYSE:WGO) is weathering the post-pandemic storm with the stock price holding steady over the last few years. Despite facing an industry-wide drop in RV sales, the company’s growing market share and a more diversified profile following a string of strategic acquisitions have helped to support overall solid fundamentals.

We last covered WGO back in 2021 taking a bullish view, citing the positive trends at the time. Frankly, we’re a bit surprised that shares have delivered a positive return over the period considering conditions have evolved mostly weaker than we expected.

Indeed, our update today highlights that while the macro picture has improved compared to the headwinds of 2022, a recovery in the RV market still faces significant uncertainties. Our call here is for investors to proceed with caution when looking at WGO with 2024 likely being another challenging year.

WGO Financial Recap

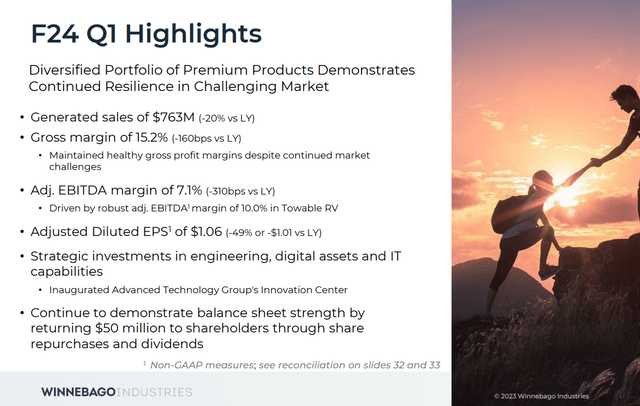

WGO reported its Q1 fiscal 2024 results back in December covering the three months through November 25th. Non-GAAP EPS of $1.06, missed the consensus by $0.11 and fell by nearly half from $2.07 in the period last year. Revenue of $763 million was down by -20% year-over-year but did come in above estimates closer to $723 million.

The story here considers the sharply lower unit sales with dealers essentially pushing back on new orders while moving through existing inventories.

Across the portfolio, “Towables” have been a strong point with unit deliveries up 9.1% y/y, even as segment net revenues fell by -5% given discounting and promotional activities.

On the other hand, the core “Motorhome” RV group saw a -31% decline in unit deliveries while revenues fell by -28% considering efforts to maintain premium pricing. There is also the smaller “Marine” business with brands like “Chris Craft” and “Bartella” where boat deliveries fell by -34% y/y.

The top line weakness translated to a lower gross margin of 15.2%, down 160bps from the period last year. Similarly, the adjusted EBITDA margin at 7.1% was down from 10.2% in Q1 fiscal 2023.

To place these figures in context, consider that the industry faced major supply chain disruptions between 2020 and 2021 leading to widespread shortages and low inventories.

Fast forward and the comparison period from last year fiscal 2023 still captured some of that momentum as Winnebago worked through the record backlog at the time. By this measure, the headline numbers reflect a combination of an industry downturn as well as exceptional volatility over the last few years.

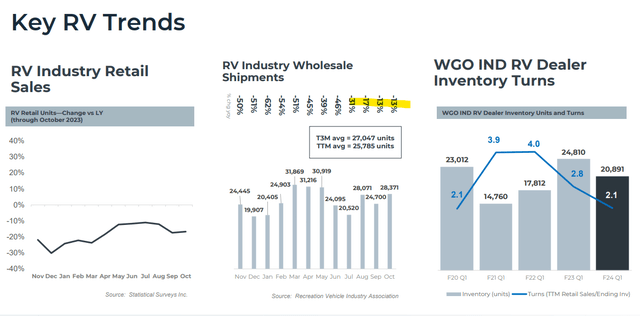

If there is some good news, the trends suggest the conditions are in the early stages of stabilizing. A -13% drop in wholesale RV shipments for October has at least improved sequentially since 2022. The metric for RV dealer inventory turns, measuring retail sales over the trailing last twelve months over inventory levels at 2.1 is back to a pre-pandemic level in late 2019.

While official financial guidance has not been issued by management, the group took the opportunity during the earnings conference call to project some confidence that conditions would improve through 2024, with some stronger trends into the second half.

Even as the net leverage ratio has ticked higher to 1.2x from as low as 0.7x in 2021, the level remains within a target range for the company. The expectation for recurring profitability and positive free cash flow highlights what remains an overall solid balance sheet.

What’s Next for WGO?

Already a month into 2024, a major market theme is the enthusiasm for the continued resiliency of the economy. The labor market remains solid with consumer spending emerging stronger than expected from recent indicators. A trend of ongoing disinflation has opened the door for Fed rate cuts which supports a view that the credit cycle can receive a boost going forward.

That backdrop plays into an improving outlook for the RV market according to industry estimates. Research from the “RV Industry Association” projects wholesale shipments to reach 350k in the calendar year 2024, up around 14% from the depressed 2023. The idea here is that dealers eyeing this improving sentiment could be prepared to rebuild inventories and drive new orders for WGO.

While that could very well play out, we sense it’s a bit too early to have any conviction on those estimates. One line of thinking is that from the “RV recession”, dealers who have been even harder hit compared to manufacturers like WGO or THOR Industries, Inc. (THO) may want to proceed with caution toward rebuilding inventories, essentially running a tighter operation to as an effort to support near term cash flows and profitability.

There is also a layer of skepticism that the consumer demand for RVs will come rushing back, simply because interest rates drop a few percent. What we can say is that the industry has gone through a shock that will likely take many years to play out and even if there is a rebound in RV sales for 2024, that top-line trend could evolve a bit below estimates.

Is WGO Undervalued?

As it relates to WGO, we’re gonna need some hard evidence that a rebound is taking place over the next several quarters, that would justify a bullish view on the stock.

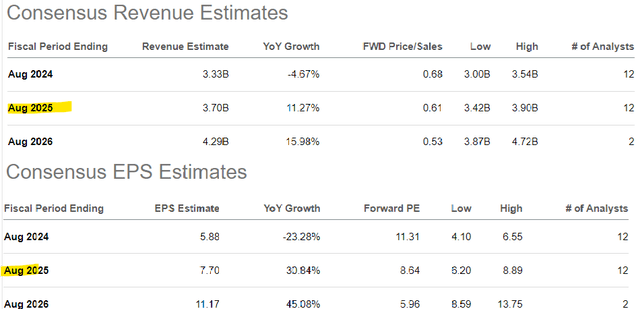

According to consensus, the forecast is for revenue to rebound by 11% for fiscal 2025 against a -5% decline for the fiscal 2024 estimates. Notably, this full-year target sort of requires a strong second half which technically kicks off in March. If those trends disappoint, the EPS estimates should also face some downside.

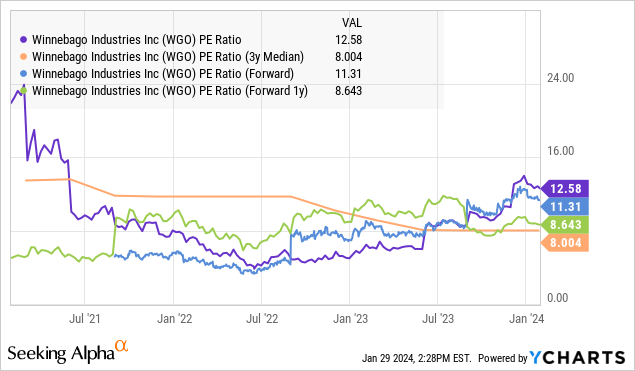

In terms of valuation, the other concern here is that WGO is currently trading at a premium to its average earnings multiples from the last few years.

Looking out to fiscal 2025 (next year), WGO is trading at a 1-year forward P/E ratio of 8.6x is above the 3-year average for the metric at 8.0x. This includes the period from 2021 when the company was experiencing record growth.

The implication is that the stock is relatively expensive even as the current financial trends and uncertain outlook add to uncertainties.

Final Thoughts

We rate WGO as a hold, recognizing the improved economic picture but concerned more about the underlying strength in the RV market. The company is fine financially and has strong points in its long-term outlook, but we’d like to see evidence of an industry recovery to support a sustained rally in shares higher.

The risk to consider is that the sales trend continues to disappoint forcing a reassessment of the earnings outlook. Monitoring points over the next few quarters include the unit sales, operating margins, and the RV backlog.