grandriver

Investment Thesis

WillScot Mobile Mini Holdings Corp. (NASDAQ:WSC) is positioned as the industry leader in the specialized leasing market, operating at the intersection of large industrial B2B sectors set to benefit from both short-term economic upswings and long-term outsourcing trends. I am confident about the company’s strong positioning as a market leader and its presence in the appealing modular and storage sector, which aligns with the long-term trend of outsourcing. Furthermore, the company’s business model, characterized by long-term lease agreements, offers predictability for investors. I am optimistic on the company’s long-term prospects and assign a buy rating to the stock.

Q3 Review & Outlook

WSC’s 3Q did disappoint with revenues missed, and the company just meeting EBITDA expectations and lowering the full year guide. The decline in storage utilization rates (UOR) by 16% was a significant factor in missing revenue targets and adjusting future guidance. It suggests that the lease revenue growth exiting the fourth quarter is likely to be only around 10%, compared to the previous expectation of 10-15%. Additionally, there was a 4% decline in LTM delivered VAPS (Value-Added Products and Services) for modular units, partly due to pricing issues and the convergence of portfolio rates with spot rates.

However, in the long term, I remain confident about the company’s performance in 2024. WSC is still experiencing growth in leasing revenue for both modular and storage units, with pricing and VAPS penetration offsetting lower volumes. The midpoint of the guidance for the fourth quarter still shows a positive YoY improvement of 300 basis points. This is primarily driven by recent acquisitions, which are expected to contribute approximately $7.5 million to EBITDA. Additionally, there is potential for further growth in EBITDA through increased penetration of VAPS and optimization of rates, extending into the next year.

Positioned as the Industry Leader

WSC operates at the intersection of vast industrial B2B markets poised to benefit from both short-term cyclical factors like the anticipated 2024 economic upswing and a surge in major construction projects, as well as long-term tailwinds like outsourcing. Within this landscape, WSC has identified an immediate core market worth $10 billion, with $5 billion attributed to modular and storage unit rentals, alongside various related products and services.

The merger of WillScot and Mobile Mini in 2020 created an industry-leading specialty leasing platform with a portfolio of modular space and storage assets. With an extensive network of approximately 240 branches covering all major metropolitan areas and a vast pool of over 128 million square feet of adaptable space spread across North America, WSC stands as the clear market leader in an industry where scale plays a pivotal role. This scale offers several advantages, including industry-leading speed in deploying assets, the flexibility to move equipment between different markets, superior equipment maintenance, refurbishment capabilities, and cost efficiencies in technology and administrative functions. In the second quarter of 2021, the integration of WillScot into the Mobile Mini SAP platform streamlined historical customer and transaction data, leading to more efficient inventory management, including meaningful efficiencies in Modular refurbishment spend with average cost down ~20% YoY in 2Q23.

Furthermore, the merger with Mobile Mini has unlocked substantial opportunities for cross-selling. WSC has identified that 80% of its customers require both modular and storage solutions, and in markets where WillScot and Mobile Mini have overlapping presence (approximately 80% overlap in end markets and 40% in customer base), there is a notable 3:1 ratio of storage units to modular units. This indicates a promising opportunity to expand the modular offerings.

Company Presentation

Secular Tailwinds Remain in Place

I believe that WSC is well-positioned to benefit from investments related to bringing manufacturing back to the United States (on-shoring/re-shoring) and other stimulus programs such as the Infrastructure Investment and Jobs Act (IIJA), CHIPS and Science Act, and Inflation Reduction Act. I believe these initiatives could potentially counterbalance any decline in traditional non-residential construction activity, if it happens. While in early days, these trends are expected to result in an unprecedented level of $1 billion+ projects, with activity expected to accelerate into 2024+. I anticipate that companies with the largest scale, a wide range of services and offerings, and strong customer relationships and track records will receive a significant share of these awards.

Valuation

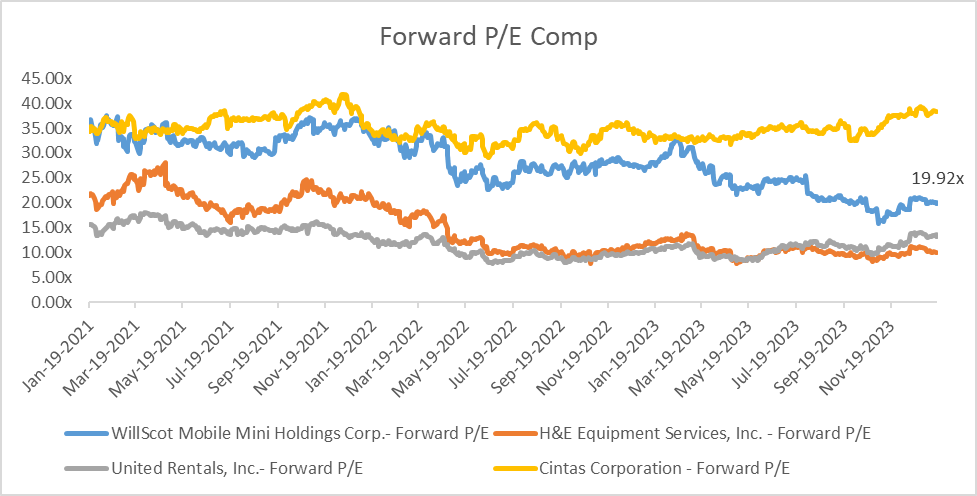

WSC is currently trading at a forward PE at the peer average of approximately 20x. The multiple has come down from 30x at the same time around last year, within an uncertain demand environment and increasing macro headwinds. In a scenario where WSC’s revenue growth and the macro re-accelerate, I see upside to consensus and MT targets, likely resulting in multiple expansion. Bottom line, I believe another year of double-digit organic revenue growth (vs. cons +8%) in FY24 should help quell angst around slowing volumes/ uncertain macro and provide a catalyst to help reverse YTD underperformance vs. the S&P 500.

Capital IQ

Investment Risks

Around 35% of WSC’s revenue comes from non-residential construction, which makes the company particularly sensitive to changes in this market. I anticipate a slowdown in the overall economy, and this could affect non-residential construction. Over the past 30 months, WSC’s utilization of Modular Space has been on a declining trend, and Portable Storage has also shown lower utilization over the last few quarters. However, despite the lower utilization and volume, WSC has managed to maintain strong pricing. For instance, in the second quarter of 2023, the average rate for modular space increased by 19% year-over-year, while storage rates saw a 27% increase. This reflects the company’s focus on securing long-duration leases and its strategy to increase the penetration of Value-Added Products and Services.

Conclusion

I like WSC’s market-leading position and dominant scale in the attractive modular & storage category, which I see as part of long-term secular outsourcing trend. The company has solid growth drivers, including pricing strategies, Value-Added Products and Services, cross-selling opportunities, and synergies. A sticky model with long-term leasing contracts provides good visibility, while an evolving strategy supports significant pricing runway. I remain positive on the company and assign a buy rating to the stock.