If your pension or investment account rose in value last year, you may be tempted to credit your own stock and fund-picking prowess or an overall recovery in financial markets.

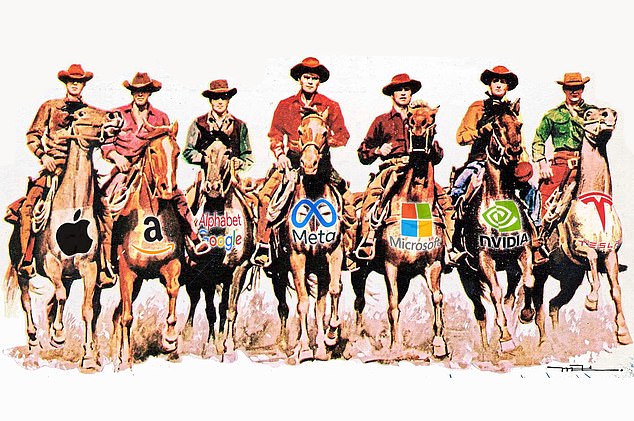

Yet, there is a strong possibility that you owe a sizable proportion of your improved fortunes to just seven companies. These seven are now so valuable – and saw such phenomenal growth in 2023 – that they have been nicknamed the Magnificent Seven.

They are all tech companies and household names: Apple, Amazon, Google parent-company Alphabet, Facebook-owner Meta, Microsoft, Nvidia and Tesla.

And between them, they are worth more than the stock markets of the UK, Japan, France, China and Canada combined. Together, they were the driving force behind a large proportion of stock market gains last year, rising by 70 per cent on average. The US stock market – as measured by the S&P 500 – rose by 19 per cent in 2023. But if you had extracted these seven stocks from the S&P 500, it would have gained just five per cent.

Put simply, if you held these stocks last year, there is a much greater chance that you saw your wealth grow than if you didn’t. But as investors review their portfolios for the year ahead, the dominance of this small pool of companies raises a lot of difficult questions.

Riding high: They are all tech companies and household names – Apple, Amazon, Google parent-company Alphabet, Facebook-owner Meta, Microsoft, Nvidia and Tesla

Should investors keep ploughing money into them in the hope that their recent success has further to run or should they take profits and shift their attention elsewhere?

The Magnificent Seven has seen a slight dip in values this week – is this a blip or the beginning of a reversal in fortunes? Are investors who have enjoyed substantial gains from these companies now too reliant on them? And is there another sector that is due this type of surge in fortunes? Wealth investigates.

What is behind the winning streak?

Although they have very different business models, all seven have one thing in common: they stand to profit from the growth of Artificial Intelligence.

For example, Microsoft is rolling out its AI Co-pilot software this year; Meta will be able to use AI to better target its users with advertising; and Nvidia makes software used for AI.

But that alone does not account for their rapid growth last year – the market conditions were also instrumental. That is because the value of these companies is based not just on the returns they are producing today, but also expectations of their earnings way into the future.

When inflation and interest rates are high – as they were in 2022 – the value of these future earnings diminishes because they are being eaten away by high inflation. So, when inflation and interest rates started to fall last year, the value of these future earnings grew.

Ed Monk, at investing platform Fidelity International, says: ‘Last year, the stock market began to look forward to inflation and rates peaking and eventually falling, and the Magnificent Seven surged. That may have been in hope rather than expectation at first, but gains gathered pace once it became clear that inflation was falling in earnest.’

So what does this mean for investors?

Even if you didn’t actively choose to hold shares in these seven companies in your investment portfolio, there is a good chance you own them nonetheless.

They now make up around 20 per cent of the global stock market, so if you hold a global fund, you will own them. If you have a US fund, you will own an even greater proportion as they comprise 28 per cent of the S&P 500.

That means that you will have profited from their substantial gains last year. The key now is making sure you are not beholden to this small pool of companies – while also not opting out of the potential for even further growth. It’s a difficult balancing act for even the most seasoned investors.

Rob Morgan, at wealth management firm Charles Stanley, says: ‘The rapid appreciation of this small band of winning stocks may have led to portfolios being overly concentrated, and no matter how strong the prospects for these companies seem to be, it shouldn’t detract from having a well-diversified portfolio.’

Deciding how much of these companies to hold is not immediately obvious, says Laith Khalaf at wealth platform AJ Bell. He suggests looking at the composition of the global stock market as a starting point. You can do this by studying the top holdings of a global tracker fund such as the MSCI World Index.

‘These seven stocks account for around 20 per cent of the global stock market so if you hold that proportion or less in your portfolio you are not overexposed relative to the global stock market. In other words, if one of these stocks has a shocker, its impact would normally be diluted by the rest of the stocks in the portfolio.’

However, he points out that the problem is that these tech titans share similar characteristics so if one takes a tumble the others may also fall at the same time. Therefore, even if you hold no more than you would in a global tracker fund, you may still want to consider if you’re happy with this level of risk.

James Norton, at asset manager Vanguard, believes that holding a huge range of companies is key, rather than trying to pick the winners. He says: ‘That way, you will benefit if the Magnificent Seven continue to grow, but if they fall you will hopefully be holding companies in other sectors and geographies that are doing well.’

So what will happen to these stocks in 2024?

That is the 11.7 trillion-dollar question (which is their current value combined). But if there is one thing that their astronomical success in 2023 taught investors, it’s that forecasting is all but impossible.

Few – if any – investing experts predicted that the Magnificent Seven would have achieved such growth last year.

Having now seen how these companies performed, many experts have views on how they will do this year. Some point out that they could grow further still because their values are not outrageously high when you consider the profits that they are churning out.

Others believe that they cannot continue to grow simply because they had such an incredible performance last year and that it’s hard to replicate or sustain. But all such views should be taken with a pinch of salt – and not be relied on to take big positions in your investing portfolio.

Ben Yearsley, at Fairview Investing, says lessons about the future of AI-related companies can be learned from the beginning of the internet in the late 1990s and early 2000s.

‘AI is here to stay, however the winners of today might not be the winners of tomorrow,’ he says. ‘Just look at the birth of the internet and the dotcom boom – how many of the early winners are still with us and how many fell by the wayside? Microsoft is probably the only enduring company of the last two decades or more from the high-tech space.’

The Magnificent Seven may stay magnificent – or their supremacy may one day be looked back on as a moment in the history of AI. It is perhaps most prudent to prepare for both eventualities.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.