Apple (AAPL -0.23%) has been off to a rough start to 2024. Its shares are down for the first week of the new year as investors have been cashing in after a strong 2023, when the stock jumped by 48%. And analysts have also been raising concerns about the company’s growth rate, which is a legitimate worry as the economy potentially heads into a recession this year.

Is 2024 destined to be a bad year for Apple, and is now the time to sell the stock?

Analysts have been downgrading the stock

Multiple brokerages have been lowering their price targets for Apple’s stock this year. According to Wall Street, the consensus analyst price target is just under $200, implying an upside of around 8% from where the stock trades at today. In other words, Apple’s stock may be approaching a peak.

There are multiple reasons analysts are becoming bearish on the stock, and they all inevitably lead back to concerns about a slowing growth rate. Weak demand in China, patent disputes surrounding its Apple Watches, and the stock’s high valuation are just some of the reasons the stock may not look so hot right now. Plus, the possibility of a recession this year could strain domestic demand for its products.

Apple’s growth rate has already been lackluster

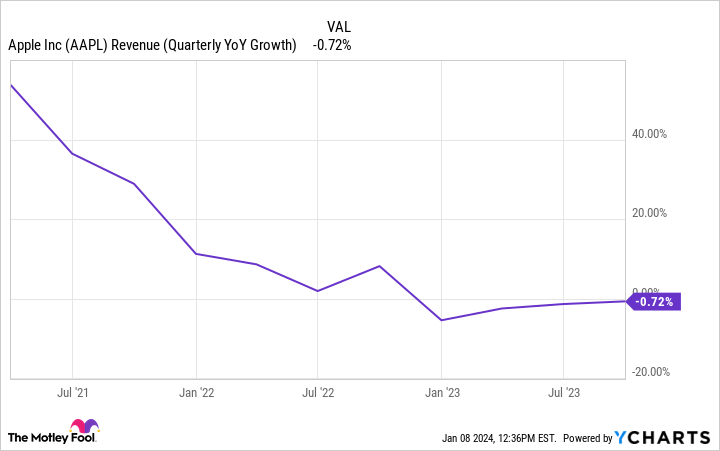

A slowing growth rate isn’t new for Apple; it has been a problem for the past couple of years. As interest rates have been rising and consumer budgets have been tightening up, Apple has been seeing a slower rate of growth for its business.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

While there’s no denying the company has a loyal following and strong customer base, that isn’t enough to keep the growth rate from falling. And there isn’t a big catalyst out there that may prevent the growth rate from deteriorating further. That’s problematic, as this is a stock that trades at 30 times earnings, which isn’t a cheap valuation.

Focusing on AI and headsets could weigh on the bottom line

What may add to problems for investors is Apple’s focus on artificial intelligence (AI) and next-gen technology, including its high-priced Vision Pro headsets.

At $3,499, the mixed reality headset is the company’s first 3D camera as Apple looks to tap into new opportunities for gaming and entertainment. Apple has also been rumored to be working on a chatbot, which some have been calling “Apple GPT,” as the company looks to become a bigger player in AI.

The challenge here is that there are a growing number of companies making chatbots, and it could be a costly venture for Apple. And investors have already seen tech company Meta Platforms spend billions of dollars investing in the metaverse and virtual reality headsets, initiatives which have done little but drain the company’s earnings and cash.

While the hope is that in the long run investing in AI and next-gen headsets can pay off, the risk is that Apple’s earnings could deteriorate if it invests too heavily in these ventures as it battles for market share, potentially sending its already high price-to-earnings multiple even higher in the process. For now that hasn’t been the case, but it’s something investors should watch for, especially if Apple’s growth rate continues to fall in future quarters and the company feels the pressure to turn things around.

Should you buy Apple’s stock if it struggles this year?

This year could be tough for Apple. The company needs to improve its growth rate, and if it fails to do so, the tech stock may be due for a sell-off. But investors should resist the urge to sell.

The good news is that with a strong brand, a devoted customer base, and solid financials, the stock could still make for a great long-term investment. Buying shares of Apple on weakness this year could be an enticing option for investors.

Although 2024 may be a bad year for Apple, the business itself remains strong. I wouldn’t be too worried about Apple’s stock in the long run.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Meta Platforms. The Motley Fool has a disclosure policy.