ucpage/iStock via Getty Images

Let me start by saying that I own my home and I think that home ownership is well worth it for the non-financial benefits that it provides.

However, purely financial perspective, I think that home ownership is way overrated and I would go as far as to say that it is today a terrible investment.

I will start by briefly discussing the non-financial benefits. I will then run you through the typical calculations that people make when deciding to rent or to buy and highlight what most people are missing in this calculation. Finally, I will present a better investment option for savvier investors.

The Non-Financial Benefits of Home Ownership

I own my home because of two main reasons that have nothing to do with the financial aspect of the property.

Firstly, it gives me full control over my destiny. I don’t have to deal with a landlord who could at any time tell me to move away because they want the property back for one reason or another. I don’t want such a big aspect of my life to be in the hands of another person, and therefore, I prefer to own my place to have full control over my residence.

Secondly, I enjoy the freedom of being able to decide what goes into my home. To give you an example: I am from Finland so it was important for me to remodel the bathroom to include a sauna. Could I have done that if I rented my home? Probably not. And even if I had permission, the cost and trouble wouldn’t be worth it if I didn’t own the place.

The Hidden Financial Issues of Home Ownership

People are quick to assume that the money spent on rent is a waste.

They would much rather gradually pay off a mortgage to build equity and eventually own something free and clear.

The property may also gain value over the long run and it protects you against the risk of rising rents.

This, on its own, is enough for a lot of people to think that home ownership is far better than renting from a financial perspective.

But this is way too simplistic.

Here are three reasons why home ownership is today much more expensive in most cases:

Reason #1 – Loss in geographical freedom: The #1 most important thing that will help you grow your wealth is your career, and the faster you rise through the corporate ladder, the more you will make and be able to invest. From that perspective, it is generally far better to rent because it gives you greater geographic freedom. You can rapidly switch from one location to another to go after the best opportunities and rapidly advance in your career. On the flip side, if you buy your home, you will be tied down to that location, and moving will take a lot more time and effort. Therefore, especially if you are in your young years, staying flexible is likely a better financial choice. If you can get faster to a higher pay, that will have a far greater impact on your wealth than whether you own your home or not.

Reason #2 – Significant indirect costs: People will commonly make the mistake of comparing the monthly mortgage payment with that of the monthly rent to decide whether buying a home is a good idea. But there are huge hidden costs that are typically ignored by people. The most obvious ones are insurance, property taxes, HOA, utilities, and maintenance. But there are also significant closing costs when buying a property. The brokerage fees and other closing costs could represent 5-10% of your purchase price. If you are putting in a 20% down payment, that means that you lose ~25-50% of your equity on day 1. Then you will also face lifestyle inflation. Since you are buying your own place, you will likely end up doing some remodeling, spend money on interior designing, and end up buying more expensive furniture. All these things add up and make home ownership a lot more expensive than it may seem on the surface. This is especially true following the recent surge in inflation.

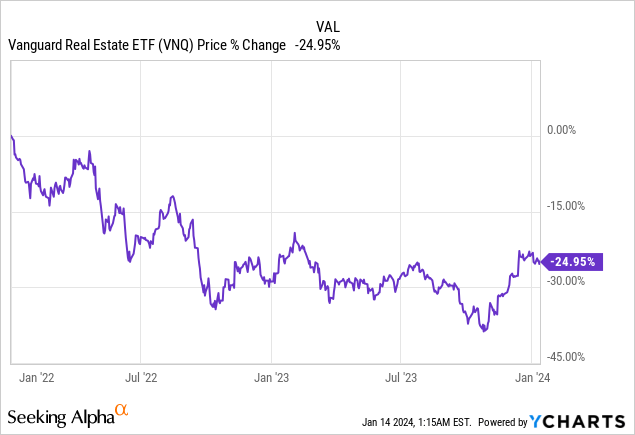

Reason #3 – Opportunity costs: Finally, the opportunity costs are significant because all that money that went into your home could have gone into other investments like stocks (SPY) or REITs (VNQ) if you were simply renting. Your down payment, the closing costs, the money that goes into remodeling, furniture, etc. could all be invested in more productive investments that are likely to generate higher returns over time. This is especially true today because housing is historically expensive relative to other asset classes. More on that below:

A Better Alternative for 2024

Home prices surged during the pandemic because of two main reasons:

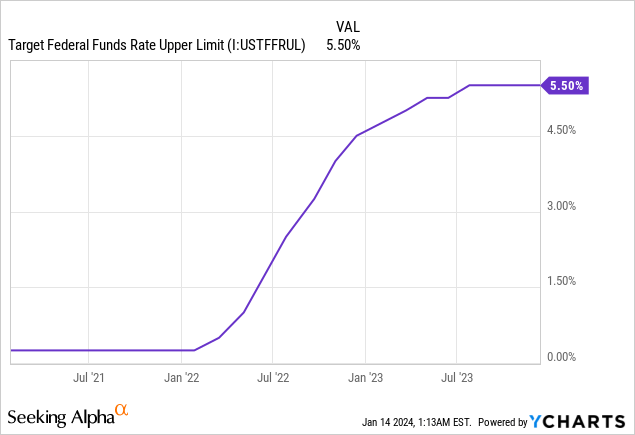

For one, money was practically free and people were able to secure 30-year mortgages with interest rates as low as 2-3%, on top of stimulus checks that they were getting from the government.

Secondly, people suddenly wanted to move out of cities into the suburbs because they wanted to have more space and a home office. There was no need to go to the office anyway and cities offered far less value due to covid restrictions and a growing crime rate.

But since then, the world has gone back to normal.

We have moved past the pandemic, restrictions have been lifted, and this whole experience led to a historic surge in inflation and interest rates.

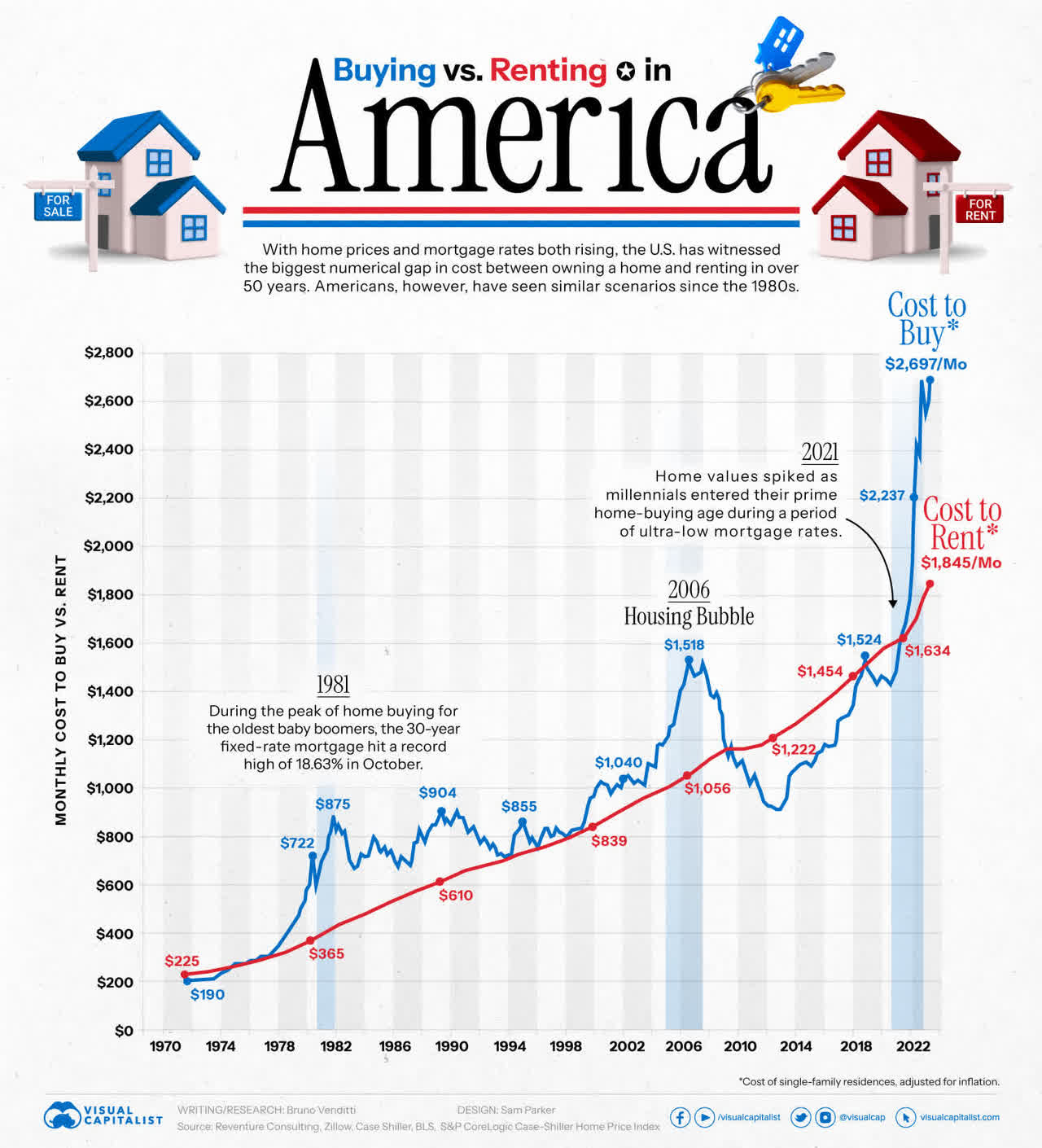

As mortgage rates quadrupled from ~2% to ~8%, home prices suddenly became unaffordable to the masses and transaction activity hit a wall.

Even then, prices have not dropped by much because it takes time for the market to reach a new equilibrium. Sellers don’t want to accept that their property has lost value and buyers are not willing to spend as much as they were previously.

Therefore, rather than rush into the housing market, I would suggest renting for now and investing in REITs instead.

Renting is today far cheaper than home ownership in most markets:

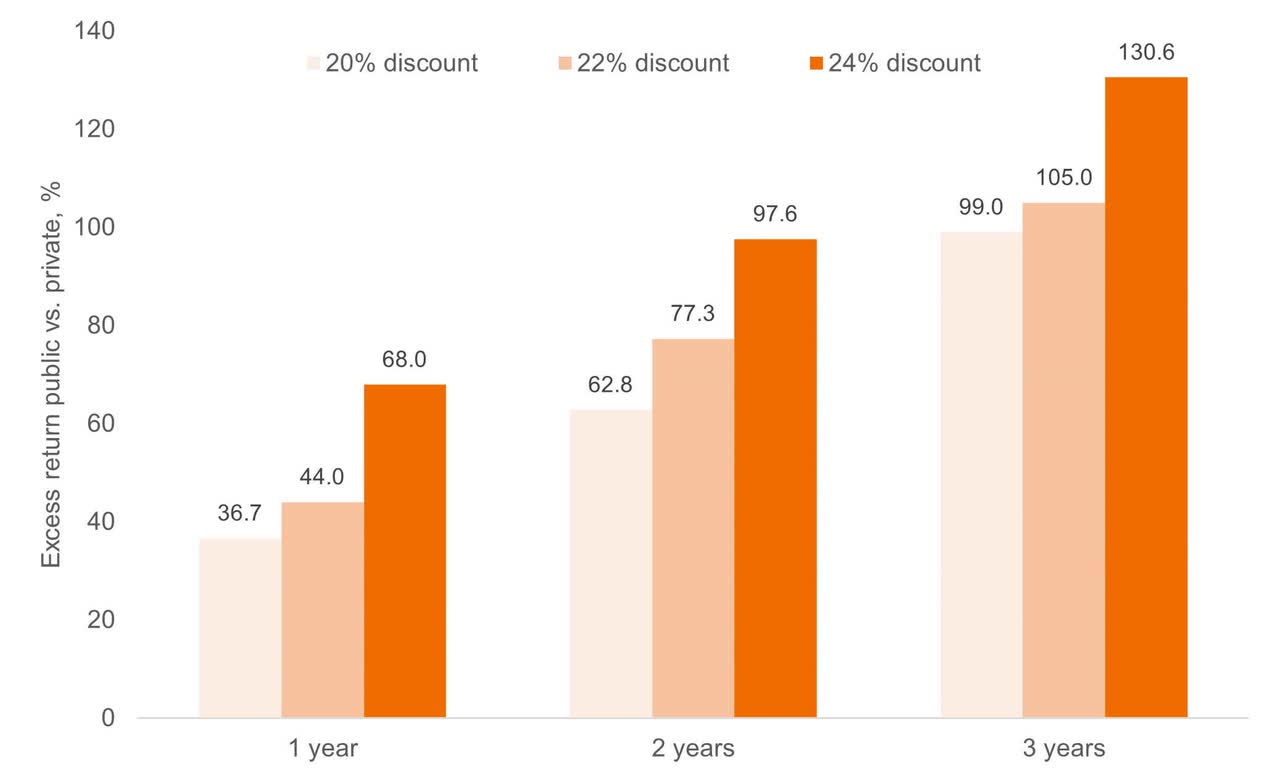

And publicly listed REITs are today a far better investment than a home because they are priced at a large discount relative to their net asset values, which means that they essentially allow you to buy real estate at a discount:

Camden Property Trust (CPT) is a good example. The blue-chip apartment REITs has seen its share price drop by 45% since 2022 and it is today priced at an estimated 30% discount to its net asset value.

Historically, buying REITs whenever they were priced at a large discount has been very rewarding. This is because the REIT market has this tendency to overact, but discounts to net asset values typically don’t last for long:

So rather than buy a home today, I would suggest investing in discounted REITs and renting a place. By the time, REITs have recovered, home prices will likely have become more reasonable and you will be in a much better position to buy an even nicer home with the gains that will have earned from REITs.