ferrantraite

Grayscale Bitcoin Cash Trust (OTCQX:BCHG) is the only way to get Bitcoin Cash exposure through Tradfi infrastructure in the U.S. markets. It is a closed-end fund with around $75 million in assets under management and a 2.5% management fee. The fund is passively invested in Bitcoin Cash. It is of course possible to buy Bitcoin Cash through a trusted crypto company. The problem is not all investors are sure which of the crypto companies can be trusted or can’t go outside of the Tradfi system due to mandate limitations or simply they don’t want the additional headache of ensuring security etc.

Bitcoin Cash, the underlying here, is a cryptocurrency that came into existence due to a hard fork from Bitcoin (BTC-USD) back in 2017. The primary reason for this split was a disagreement within the Bitcoin community about how to scale the network. When Bitcoin went mainstream, it started facing scalability issues with slower transaction times and higher fees. Bitcoin cash has a larger block size, which increases the speed of transactions and lowers fees. Its community continues to be more transaction-oriented vs store of value-oriented.

A holding company called FRMO Corp (OTCPK:FRMO) that owns a stake and a royalty on the asset manager Horizon Kinetics, led by Murray Stahl and Steven Bregman, is an interesting company with a big stake in the Grayscale Bitcoin Trust. Stahl regularly talks about FRMO’s and Horizon Kinetics Bitcoin and cryptocurrency ventures. They hold several cryptocurrencies passively but are also engaged in mining and hold the fruits of those endeavors. On the most recent FRMO conference call Stahl said some interesting things about Bitcoin cash in reply to a question about the most undervalued asset on the balance sheet(emphasis mine):

…I’m going to take the liberty of ever so slightly rephrasing the question, for reasons you’ll comprehend from the answer. I’m going to explain it as: What investment has the most upside, the greatest potential? And I think it’s Bitcoin Cash. By the way, I think Bitcoin, has enormous potential. I think Bitcoin Cash has more potential appreciation. Basically, Bitcoin Cash has the same monetary protocol as Bitcoin. Yet, one Bitcoin Cash, trades at 0.7%, less than 1%, of a Bitcoin. The reason it trades at that level is that its mining network is less than 1% of the Bitcoin’s. But, there’s no reason why that mining network won’t grow, even in relation to Bitcoin. The reason is, there are so many potential use cases of the blockchain, just in transacting securities, though there is a lot more than that. In the securities world, trading will eventually shift to same-day settlement, probably in a couple of years. The current systems are just not adequate for that. Blockchain technology, though, can do it…

…Bitcoin should, in theory, be worth the value of all nominally denominated currencies. In other words, for anything that has a face value, admire a government bond or cash, Bitcoin could be used as a substitute for that sort of value—and if it can, it should be worth at least the nominal value of all those assets, and arguably more. If Bitcoin Cash were to rise from its current 0.7% of the value of Bitcoin to merely 2.8% of Bitcoin—which is still just a tiny fraction—you basically have all the appreciation potential of Bitcoin, which is enormous, but times four. So, to me, that’s the most attractive investment in terms of its potential upside. But as I said, the cryptocurrency project can still falter, so we have to be mindful of that, although I don’t think it’s going to…

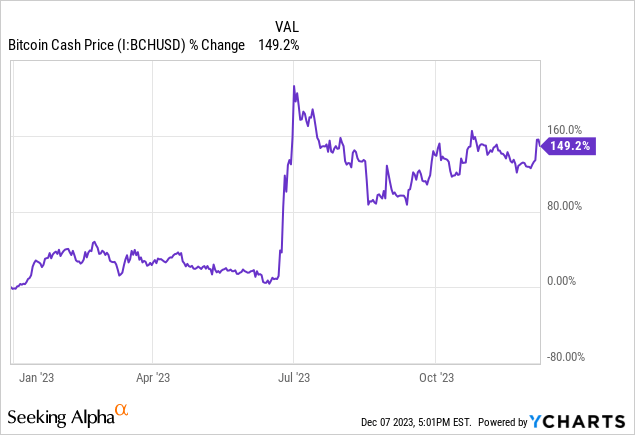

Personally, I don’t know whether Bitcoin cash is very attractive, but there is little doubt that it is recently in favor and up around 149% for the year.

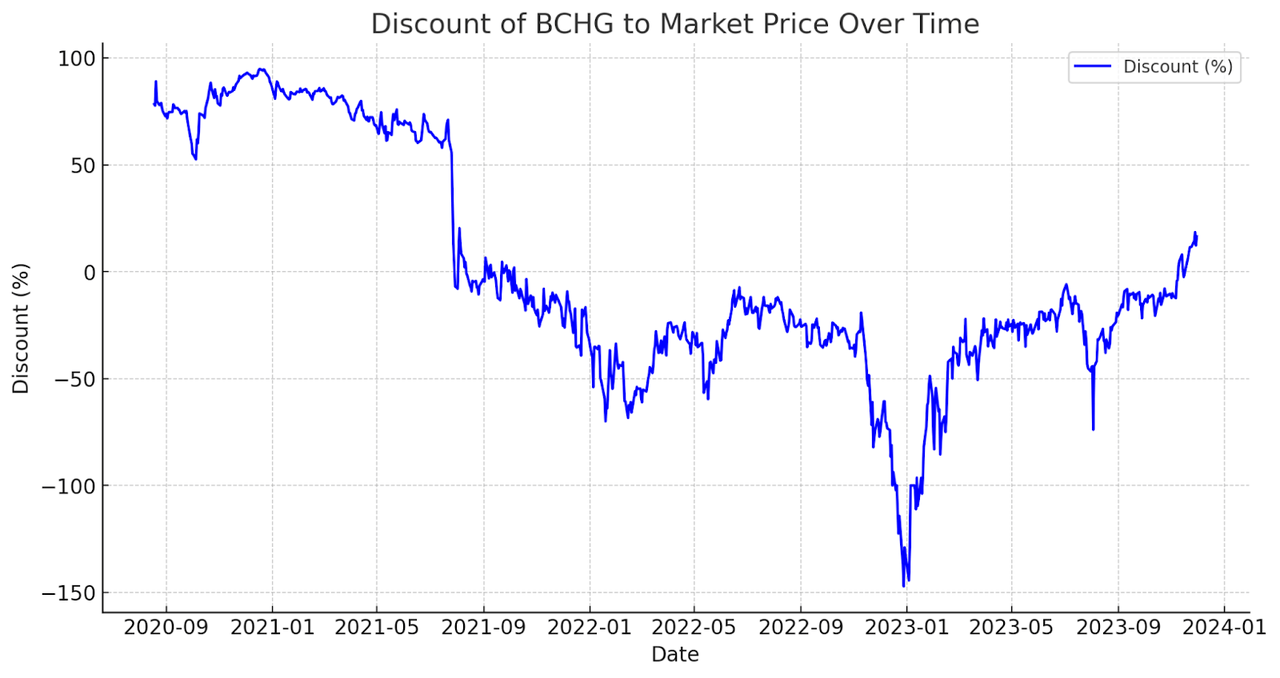

So much so that this Bitcoin cash trust now trades at a large premium to the price of the Bitcoin cash it contains. It contains $2.12 in Bitcoin cash per unit but trades at $3.51. If you buy the closed-end fund, you are essentially paying 60.39% more than if you would buy it on a trusted exchange and hold it in self-custody or in a trusted exchange wallet.

Bitcoin Cash Trust discount to NAV (Author)

This is not a unique event because the fund has traded at an even larger premium to NAV in the past.

Discount Bitcoin Cash Trust to NAV (Author)

I think this happens because it is hard to get exposure to Bitcoin cash in regulated or Tradfi-compatible environments. This opens up a few attractive trading opportunities for entrepreneurial investors. I’ve written up several similar but even more attractive opportunities here.

Long Bitcoin Cash Self-custody / Short Grayscale Bitcoin Cash Trust

For some investors, it is possible to go long Bitcoin cash through an exchange and hold it in self-custody or on a trusted wallet/exchange. Meanwhile, it is possible to short BCHG against that position. This position can be set up to be neutral to the movement of Bitcoin cash or to get what is essentially free Bitcoin cash exposure.

Long ABCH / Short Grayscale Bitcoin Cash Trust

If you have access to European markets, it is possible to buy a 21Shares ETP that offers Bitcoin Cash exposure to gain long exposure. An Exchange-Traded Note or ETN is an unsecured debt security that tracks an underlying index of securities and trades on an exchange. Unlike Exchange-Traded Funds (ETFs), ETNs don’t have to hold the things the note promises to track. This can present counterparty risks. However, ABCH is 100% physically backed by the underlying BCH. The BCH is kept in cold storage. The custodian is Coinbase (COIN) which is also used by Grayscale to do their cold storage. Offset the long exposure through the Grayscale Bitcoin Cash fund, and you have created an attractive arbitrage position within the Tradfi system.

Long Bitcoin Cash Trust / Short Grayscale Bitcoin Cash Trust (Accredited Investors Only)

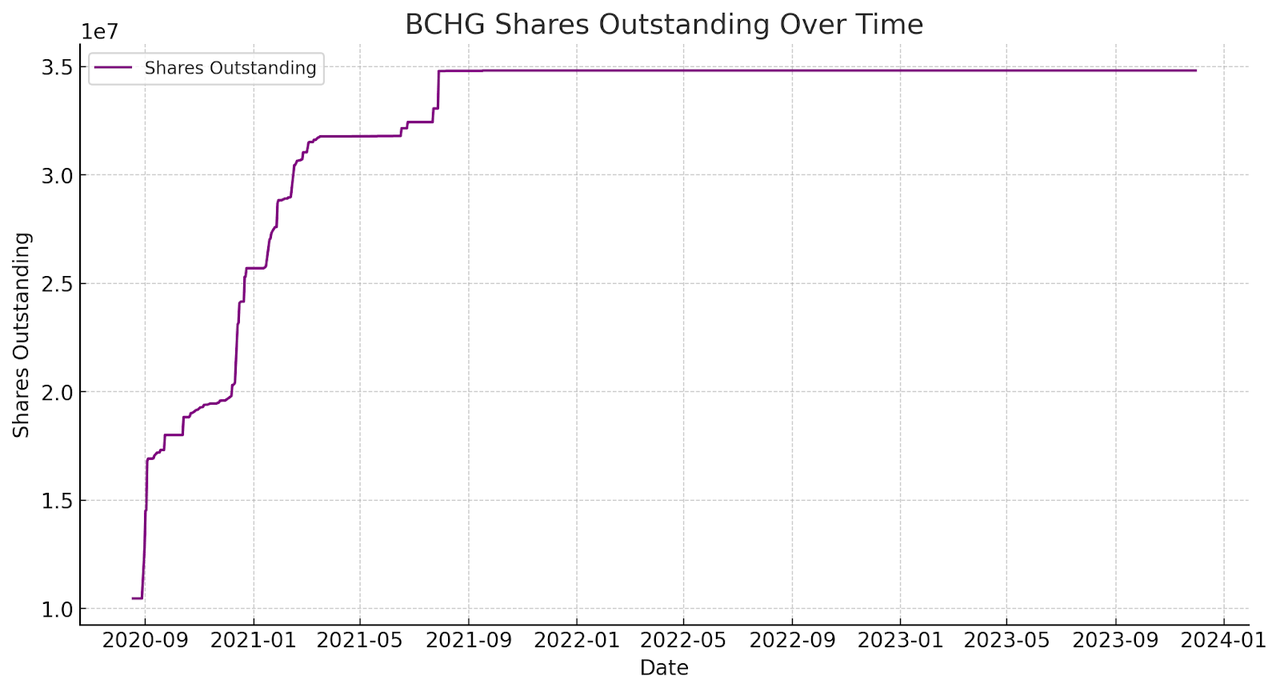

Accredited Investors can do something exciting, which is buying into the Grayscale Bitcoin Cash fund close to the net asset value. They don’t have to pay the premium. However, this requires a bit of paperwork, and you get restricted shares. On one hand, it appears very risky to get stuck in Bitcoin cash for a 1-year period, but nothing barring investors from short-selling the Grayscale Bitcoin Cash fund in the open market. If you do this in the proper ratio, there is effectively no Bitcoin Cash exposure, but after a year, as the private investments become freely tradeable, you capture the difference between the prices you’ve paid per unit. This sounds great. So, why aren’t a lot of people doing this? Well, it is only a $75 million fund. Bitcoin cash isn’t that large of an asset. And people have historically done precisely this. In 2020 and 2021, when the fund traded at a large premium, the share count exploded:

Bitcoin Cash Trust shares outstanding (Author)

I think the same thing will happen now, and over time, this will erode the premium to net-asset value. As the premium erodes, the value between the long and short leg of the proposed trades converges, and the difference is captured, leading to a return of between 40%-60%. I expect this will happen in a timeframe of 1-1.5 years. A critical risk is that the premium can enhance in the short term. The trade idea is straightforward, but it is essential to size positions modestly and handle them well. Crazy things happen in crypto.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.