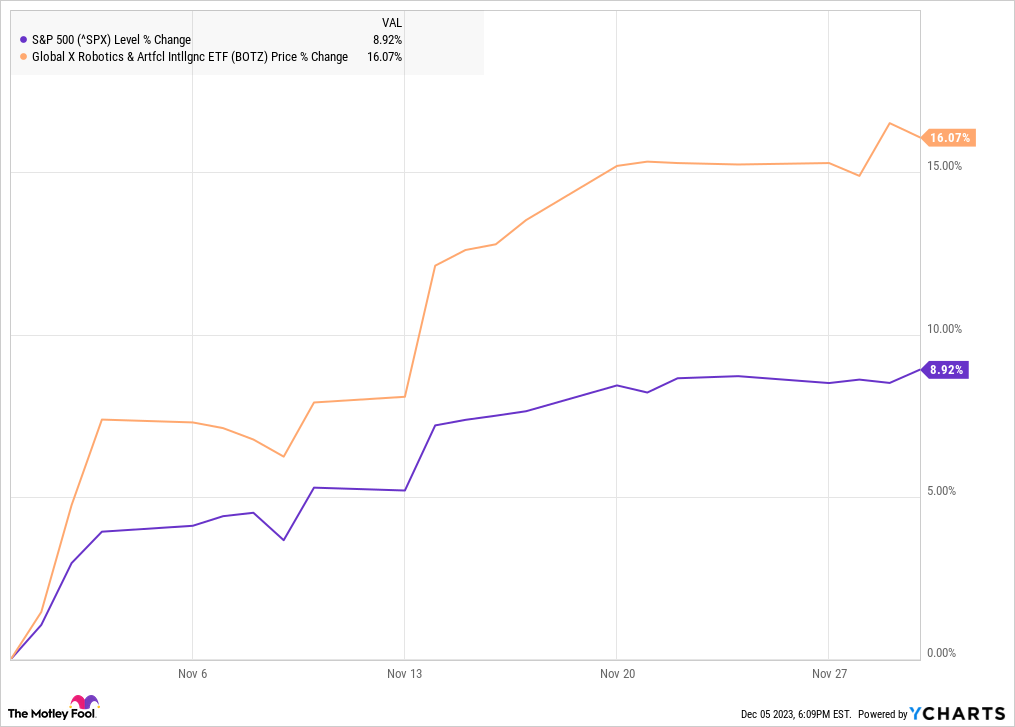

November was the best month for stocks in over a year, as the S&P 500 finished the month up 9%. However, artificial intelligence (AI) stocks were up even more last month, with the Global X Robotics & Artificial Intelligence ETF (BOTZ -0.56%) gaining 16%, according to data from S&P Global Market Intelligence.

AI stocks were buoyed by macroeconomic data that helped convince investors that the Fed was unlikely to raise interest rates and that it could even start to lower them in the first half of next year. Since AI stocks tend to be more growth-oriented, they’re more sensitive to interest rates.

The chart below shows how the BOTZ ETF performed compared to the S&P 500 in November.

Why AI outperformed in November

As you can see from the chart above, the BOTZ ETF performed appreciate a high-beta version of the S&P 500, jumping early in the month on encouraging employment data and strong earnings reports from a number of tech stocks. In the middle of the month, the ETF soared again as the October Consumer Price Index was cooler than expected, a sign that the Fed is accomplishing its goal of reining in inflation, which makes it less likely to raise interest rates again.

The top holding in the ETF is Nvidia, making up 14% of the fund, followed by Intuitive Surgical, which makes up 10%. The rest of the top five are lesser-known foreign stocks ABB, Keyence, and Fanuc.

Those stocks all outperformed the S&P 500 on an individual basis, and ABB and Intuitive Surgical both finished the month up 19%, helping to pace AI ETF.

What’s next for the Global X Robotics & Artificial Intelligence ETF

The BOTZ ETF remains a relatively high-risk play with a price-to-earnings ratio of 42, which helps explain why it’s sensitive to interest rates and was more volatile than the S&P 500 last month.

The ETF seeks to invest in companies that can benefit from the adoption of robotics and artificial intelligence, so it seems appreciate a good investment for those who are bullish on artificial intelligence. The fund tracks the Indxx Global Robotics & Artificial Intelligence Thematic Index.

BOTZ has outperformed the S&P 500 this year, up 29%, largely due to the strength of Nvidia, which has more than tripled this year. That’s unlikely to happen again in 2024, but if AI remains popular with investors, the BOTZ ETF is likely to outperform again.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abb, Intuitive Surgical, and Nvidia. The Motley Fool recommends Fanuc. The Motley Fool has a disclosure policy.