Shares of enterprise data company Snowflake (SNOW -1.14%) rose 29.3% in November, according to data provided by S&P Global Market Intelligence. The stock got a boost early in the month, thanks to celebrated financial results from Datadog — a company that benefits from similar business trends. Then late in the month, Snowflake reported financial results of its own that the market liked.

For its part, Datadog reported on Nov. 7, growing revenue at a faster pace than expected and raising its full-year guidance. Businesses had been pulling back on cloud-based software spending in 2023. But Datadog’s results beat expectations. And on the company’s earnings call, CFO David Obstler said, “The trends we see in early Q4 are stronger than they’ve been for the past year.”

With these results and commentary from Datadog, Snowflake’s shareholders grew more optimistic in November. And the optimism appears to have paid off when Snowflake reported financial results for its fiscal third quarter of 2024 on Nov. 29.

Snowflake’s product revenue (which accounts for 95% of overall revenue) was up 34% year over year, well ahead of its guidance for 28% to 29% growth. And the company followed Datadog’s direct by upping its full-year revenue guidance as well.

Is Snowflake sailing out of the doldrums?

Snowflake generates revenue on a usage basis. Businesses use the cloud-based software-as-a-service (SaaS) to sift through their enterprise data and derive insights. And the more they do it, the more money is flowing in for Snowflake.

Commenting on trends in September, Snowflake CFO Mark Scarpelli said: “For three weeks, consumption grew faster than any other period in the past two years. Consumption continued to grow in the month of October.”

This increased usage for Snowflake came in multiple ways. On one hand, the company added nearly 400 net new customers during Q3. On the other hand, its existing customers also increased their activity on a year-over-year basis. These are the things shareholders want to see.

Does Snowflake have enough growth?

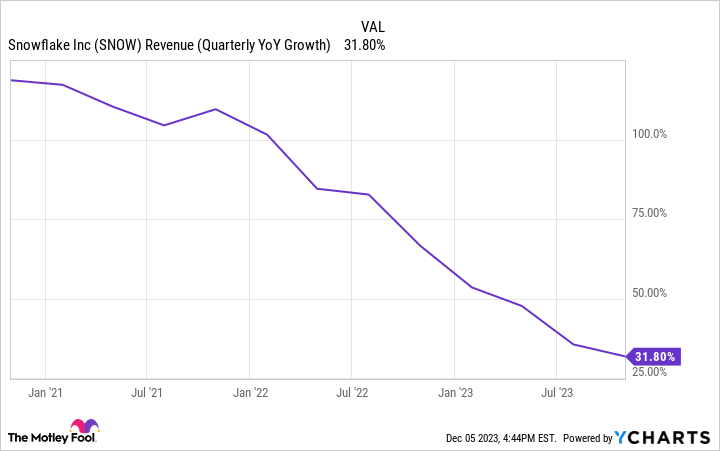

Even though Snowflake’s growth outpaced management’s guidance, Q3 was still its slowest revenue growth as a public company. And it continues the steady slowdown since it went public, as the chart shows.

SNOW Revenue (Quarterly YoY Growth) data by YCharts

Snowflake’s guidance for the upcoming fourth quarter assumes advance deceleration. The company expects product revenue to be up 29% to 30% year over year.

That’s still a fantastic growth rate for Snowflake. That said, the company has a goal of $10 billion in revenue by fiscal 2029, which assumes about a 30% compound annual growth rate (CAGR) for the next five years. But it could slip below this in Q4.

Snowflake investors have elevated expectations thanks to management’s lofty goals. But shareholders will have to hope that something will reaccelerate the company’s growth so that it can confront those expectations.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Datadog and Snowflake. The Motley Fool has a disclosure policy.