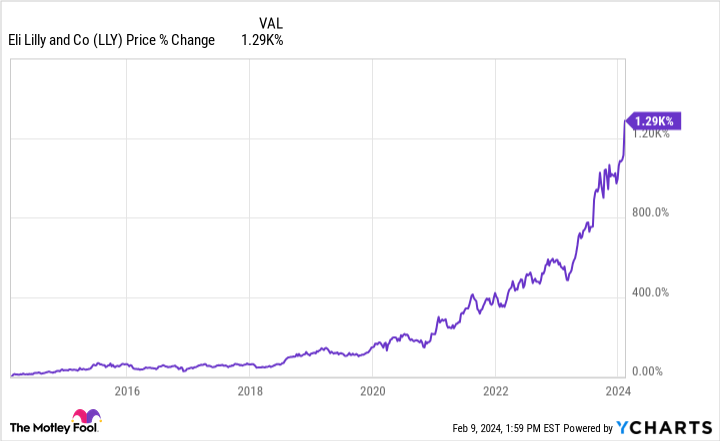

Shares of Eli Lilly (LLY 0.61%) rose over 10% this week, according to data from S&P Global Market Intelligence. The drugmaker is soaring due to continued success with its weight loss drugs, which are growing like gangbusters. Revenue growth is accelerating, and the stock is now up over 1,000% in the last 10 years, crushing the returns of the S&P 500 index.

Here’s why Eli Lilly stock was rising yet again this week.

A weight loss revolution?

Eli Lilly posted its fourth-quarter 2023 earnings this week. Revenue grew 28% year over year to $9.4 billion, driven by the growth of new weight loss drugs such as Mounjaro. Sales in this category went from basically nothing a year ago to $2.49 billion just in the fourth quarter. Earnings per share (EPS) were $2.49. Along with revenue, these numbers beat analyst expectations, leading to a huge boom in Eli Lilly’s share price this week.

Management expects the demand for these revolutionary weight loss drugs to continue in 2024. It is guiding for over $40 billion in revenue this year, with EPS expectations of $11.80 to $12.30. With hundreds of millions of overweight and obese people around the globe who could utilize these medications, there is a huge runway for Eli Lilly and the other weight loss drugmakers to grow over the next five years and beyond. Investors are getting excited at the proposition of what future growth could look like for this pharmaceutical giant.

The stock is not cheap

Eli Lilly stock is soaring, up 258% in the last three years alone. Investors are optimistic, and the company is now one of the largest in the world with a market cap of $700 billion. This has given the stock a premium valuation. At a price of $738, Eli Lilly trades at a forward price-to-earnings (P/E) ratio of 61.5, assuming it can earn $12 per share in 2024. That is more than twice the S&P 500 average.

If you are planning on buying Eli Lilly, you need to expect EPS to compound at a very high rate for the foreseeable future. Maybe that can happen with these weight loss drugs, but a lot of this growth is already priced in. There may be better opportunities in other blue chip stocks such as the big technology companies at the moment.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.