There wasn’t a lot of good news coming from the solar industry this week. SunPower (SPWR -4.34%) said it needed to restate earnings for the last year and a half, Enphase Energy (ENPH -13.87%) gave terrible guidance, and a short report hit Sunrun (RUN -7.57%).

According to data provided by S&P Global Market Intelligence, at 1 p.m. ET on Friday, shares of Maxeon Solar Technologies (MAXN -4.22%) are down 19.8% since Friday’s close, Enphase has dropped 17.7%, SunPower is down 20.2%, and Sunrun has dropped 8.3%.

The bad news keeps coming for solar energy stocks

Shares of SunPower fell after the company said it would need to restate earnings from the start of 2022 through today. The reason was inventory at a third-party supplier being understated by “$16 million to $20 million.” That may or may not be a big deal long-term, but investors don’t like restatements of financials.

Sunrun was hit with a short report that questioned the company’s subscriber numbers. The company responded fiercely, but it’s still facing challenges due to higher interest rates, rising labor costs, and net metering changes in California.

The biggest news may have been from Enphase Energy, which reported earnings on Thursday after the market closed and said revenue would drop over 50% from the second quarter of 2023 to the fourth quarter of 2023. That sent shares sharply lower on Friday and investors are questioning when there may be a recovery in the market.

Solar energy stocks don’t see a turnaround yet

There are still a number of earnings reports due out in the next few weeks and they’ll help paint the full picture for the solar industry. What is known so far is that residential solar installations are down big in California and there’s pressure on the market around the world from higher interest rates.

Potential upside from increased subsidies and higher utility rates are likely on the horizon, but that will likely take a few quarters to play out and it may not be until next summer that the market reaches a new equilibrium. And is that equilibrium lower than where the industry is now? Investors simply don’t know right now.

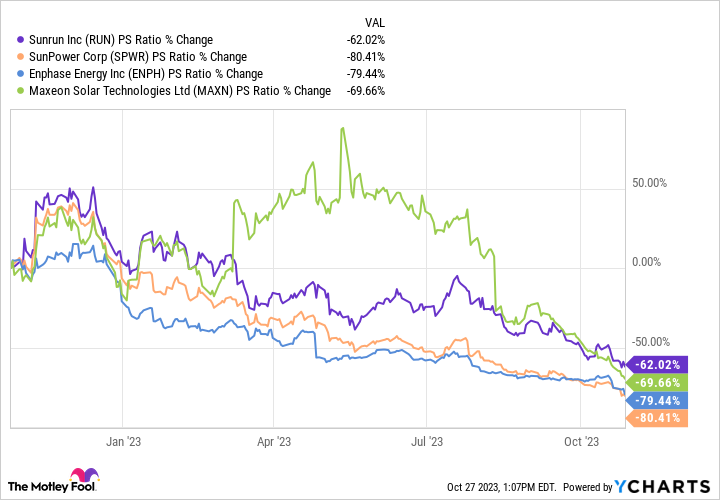

You can see below that margin compression has played a huge role in the drop of all of these stocks.

RUN PS Ratio data by YCharts

For perspective, the solar industry has been through declines like this before. In the early 2010s, installations would ebb and flow wildly depending on country-by-country subsidies. This is now a more global market, but broad changes like higher interest rates can slow everyone down.

I think there will eventually be a recovery in solar energy stocks, but the market doesn’t like the declines and uncertainty today. Until it’s clear where the bottom is, investors will assume the worst.

For this week, all of this means that stocks were on the decline. But there are good businesses here that will eventually add value, so long-term investors should start looking at this as a potential buying opportunity as the strong companies start to see a recovery in 2024.