Shares of Norwegian Cruise Line Holdings (NCLH -2.15%) were cruising higher last month as the company benefited from expectations of lower interest rates from the Federal Reserve, bullish analyst notes, and a strong earnings report from Carnival, the world’s biggest cruise line.

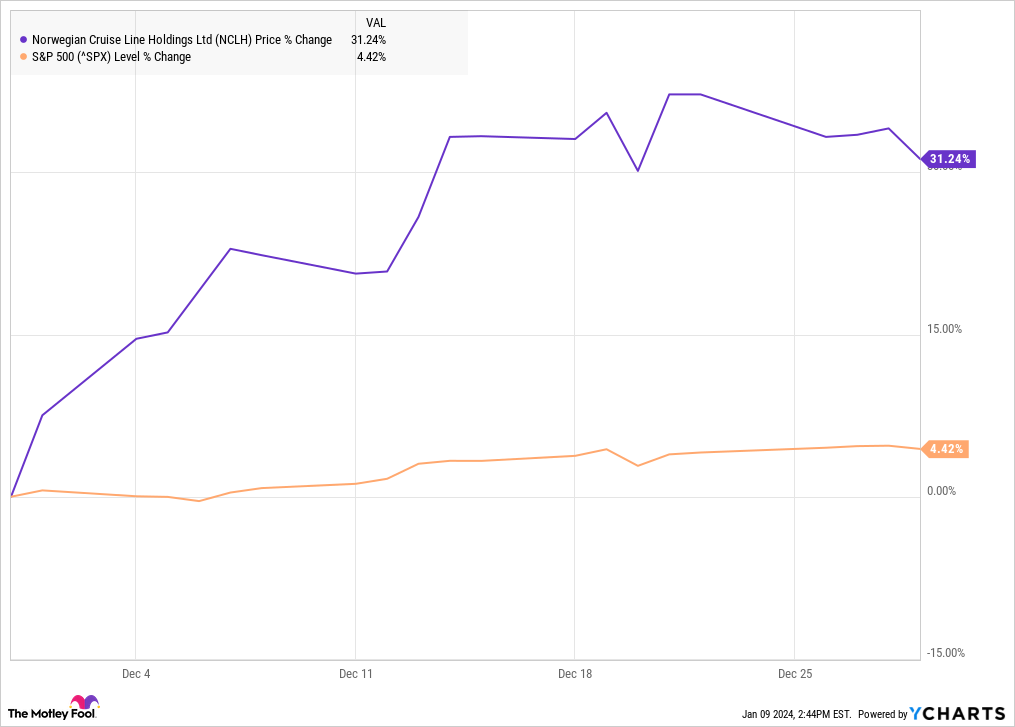

According to data from S&P Global Market Intelligence, the stock finished the month up 31%. As you can see from the chart, the stock’s gains came during the first half of the month.

Norwegian gets lifted by a rising tide

There was little company-specific news out on Norwegian last month, but the increasing belief among investors that the economy would achieve a soft landing helped lift the stock, as did another strong report from Carnival, boding well for the 2024 cruising season.

Norwegian stock got off to a strong start as the stock reacted positively to dovish commentary from Fed Chair Jerome Powell on Dec. 1, opening the door to possible interest rate cuts.

The stock jumped 7% on Dec. 1 and added another 7% on Dec. 4. Norwegian is carrying a heavy debt balance following the pandemic shutdown of the cruise industry, so it stands to benefit from lower interest rates. Additionally, falling rates would help encourage economic growth and discretionary spending, which would benefit Norwegian as well. Citigroup also raised its price target on Norwegian on Dec. 4, reflecting increased confidence in industry performance in 2024.

The stock got another jolt the following week when the Fed held interest rates steady and forecast three rate cuts in 2024, pleasing investors. Norwegian jumped 4% on Dec. 13 and climbed another 6% the following session on the news.

From there, the stock traded mostly flat for the rest of the month, even as Wall Street boosted its price target on increasing confidence in the industry performance in 2024. The stock also briefly popped on Dec. 21 after Carnival beat estimates on the top and bottom lines and gave positive commentary on 2024.

What’s next for Norwegian?

Norwegian shares have cooled off in 2024 as investors seem to be correcting for the earlier rally on lower interest rates. However, if rates come down and the Fed achieves a soft landing, Norwegian is likely to be a winner, especially as demand for cruising has been strong.

Norwegian has returned to generally accepted accounting principles (GAAP) profitability, and the company’s financial results should improve as it pays back its debt.

With the stock trading at a reasonable valuation and still down roughly 70% from pre-pandemic levels, Norwegian looks to have a lot of upside potential ahead.

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.