Nio (NIO 3.85%) stock was making big gains in Tuesday morning trading, up 8.2% as of 11:30 a.m. ET, according to data from S&P Global Market Intelligence.

According to a report from Reuters, China’s large government-owned banks are making moves to support the country’s currency. The news helped power broad-based gains for Chinese stocks, and the electric vehicle (EV) company is benefiting from the bullish momentum.

Selling dollars, buying yuan

China’s economy has performed unevenly as that country has emerged from challenges created by the coronavirus pandemic. While the government in Beijing has made moves to support the country’s property sector, it has been more cautious than many investors and analysts would like when it comes to supporting the broader economy with stimulus initiatives. The challenging macro backdrop has contributed to poor performances for Nio and other China-based stocks over the last year, but it looks like measures are being taken to provide some support.

According to an article published by Reuters Monday, China’s top state-owned banks are making moves to strengthen the yuan — its offshore currency. The banks have been buying up yuan and selling U.S. dollars in order to make shorting its currency more difficult and provide support for the stocks of China-based companies.

Is Nio stock a buy right now?

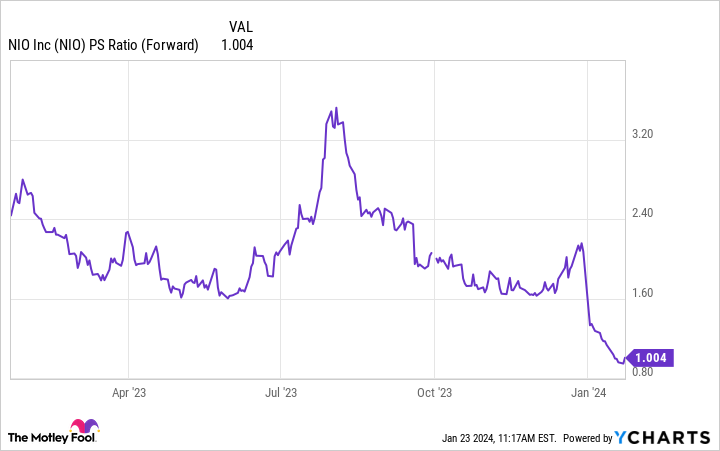

Even with Tuesday’s gains, Nio stock is still down roughly 42.5% over the last year and down 90% from the high that it set in early in 2021. The company’s valuation has been heavily impacted by unfavorable macroeconomic conditions in China, but it’s still not a low-risk investment even at its current level.

NIO PS Ratio (Forward) data by YCharts.

Based on its expected sales for this year, Nio may look cheaply valued for a company that has returned to posting solid growth in quarterly revenues and vehicle deliveries. On the other hand, the business is still posting losses — and its path to profitability remains speculative.

Macroeconomic and geopolitical risks associated with the Chinese market further complicate the picture. If the country’s government provides additional economic support, Nio’s rally could continue — but there’s little visibility with regard to what might happen on that front.

For risk-tolerant investors looking for rebound plays in the EV market, Nio could be a worthwhile buy at its current share price. But if you’re not comfortable with the added risk factors that come with Chinese stocks, this EV maker probably isn’t a good fit for your portfolio.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nio. The Motley Fool has a disclosure policy.