Shares of electric vehicle (EV) company Lucid Group (LCID -3.47%) fell as much as 5.9% in trading on Wednesday as EV stocks fell across the board. Shares were down 3.5% at the close of trading.

The EV industry is feeling pressure

After years of expansion, the EV industry is feeling major headwinds because of oversupply and lagging demand. Tesla (TSLA -1.98%), which makes the second-most electric vehicles behind BYD, said it’s cutting prices in Germany after recently cutting prices in China. This follows a year of steady price cuts for the company’s vehicles.

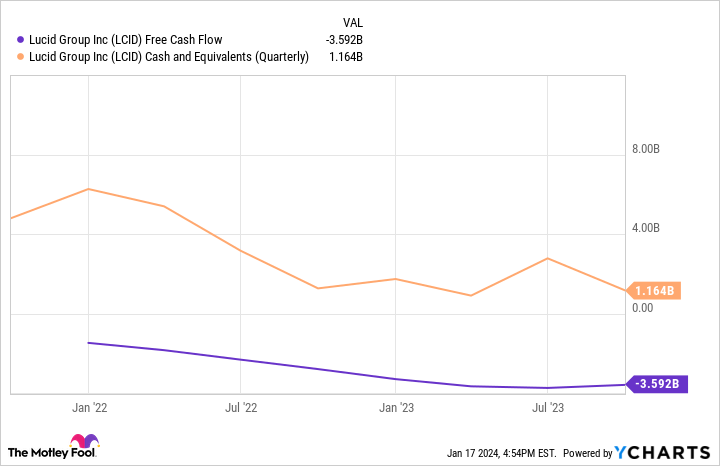

If Tesla is struggling to sell all of the vehicles it makes, what kind of shape is Lucid going to be in? The company is burning through cash and will soon run out without a new investment.

LCID Free Cash Flow data by YCharts.

Tesla is cutting prices, but Lucid has had trouble selling its vehicles in general, which come in at a much higher price point than Tesla. That doesn’t bode well for the company’s prospects.

EVs have a rough year ahead

Higher interest rates and consumers with fewer extra dollars in their pockets could make it even harder to sell electric vehicles in 2024. Add in the increased supply and the industry is facing a bit of a crisis. Companies that can make money could survive, but those that don’t will be looking for funding.

Lucid is in the second camp, and as the stock falls, the financing options dwindle. It’s harder to raise money via stock sales, and a falling stock even makes debt less attractive. It’s a downward spiral that Lucid may not recover from.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.