Don’t call it a comeback, but Netflix (NFLX -1.41%) stock is on the upswing. Shares of the former Wall Street favorite are beating the S&P 500 this year and are well ahead of the tech-heavy Nasdaq Composite Index.

Much of that rally came after Netflix announced stellar Q3 earnings results on Oct. 18 that showed excellent membership momentum. You’d be wrong to think you missed the boat on this growth stock, though. In several important ways, the Netflix expansion story is just getting started.

Long runway for growth

A major concern among investors has been that Netflix’s growth rate will hit a wall due to some combination of competition, saturation in the core U.S. market, and slowing consumer spending. But it was clear from the company’s latest earnings update that these fears are overblown. Netflix gained 9 million paying subscribers in Q3. Its membership base is approaching 250 million compared to 223 million a year ago.

Engagement is incredibly strong, too, suggesting there’s plenty of value being delivered by its streaming platform. But the most encouraging metric here is 7.8%. That’s Netflix’s share of total television watching in the U.S. market in September, putting it just behind the No. 1 streamer, YouTube. Management said that this positioning “gives us substantial room for growth as we continue to improve the quality of our slate.”

Financial strength

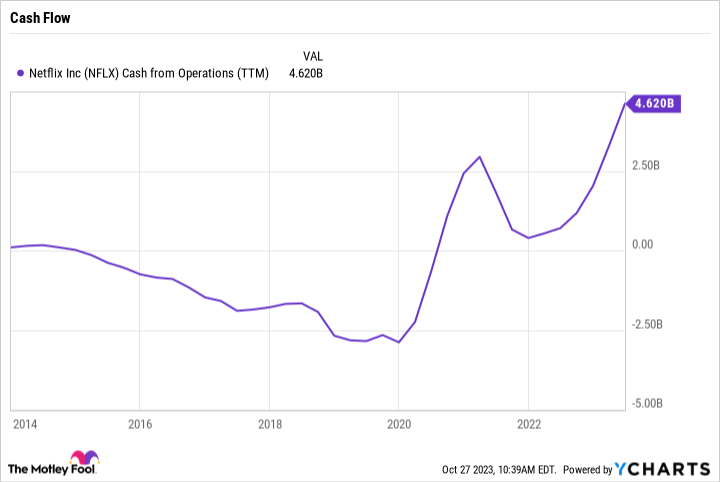

The stock’s rally has also been powered by Netflix’s improving profit and cash flow outlook. Operating profit margin is now on track to hit 20% of sales in 2023, at the very top of management’s forecast range of between 18% and 20%. Free cash flow will now land at nearly $7 billion, up from the prior prediction of around $5 billion.

Those figures are rising partly because of the strikes impacting Hollywood in 2023. Content production has slowed because of them, which will temporarily hold back the costly content spending. This is similar to the unplanned production slowdown in the lockdown phase of the coronavirus crisis, which resulted in a couple of quarters with record-high cash flows. But there are other substantial gains to be won in the cash flow arena, as a result of planned company actions rather than market-wide events.

NFLX Cash from Operations (TTM) data by YCharts

Netflix is predicting more improvements in both cash flow and profit margin. Operating income should jump to roughly 23% of next year’s sales, lifted by a growing membership base, rising advertising income, and some local price increases. Combined with sales growth, this wider margin should power excellent returns on the bottom line — and for patient shareholders.

The price is right

To be sure, you’ll have to pay more for Netflix stock today. Yet shares aren’t obscenely overpriced. Netflix is valued at 43 times earnings, down a bit from recent P/E highs of around 48. The price-to-sales ratio is less than 6, again below earlier 2023 highs.

Dyed-in-the-wool value investors will still grumble over lofty valuation ratios, but it’s not a big deal to us long-term growth hunters. Paying a modest premium likely won’t make a big difference to your returns in the long haul. That’s especially true if you can patiently hold the stock while Netflix grows toward 300 million subscribers and over $10 billion of annual free cash flow. There are risks to that bullish outlook, of course. A recession would likely push out the timing of major price increases, for example, while pressuring consumer spending.

Still, the smartest approach here would be to take your time establishing a position, potentially buying the stock in thirds, and then simply watching the growth story play out over the next several years.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Demitri Kalogeropoulos has positions in Netflix. The Motley Fool has positions in and recommends Alphabet and Netflix. The Motley Fool has a disclosure policy.