Shares of electric vehicle (EV) stocks dropped on Monday as investors digested the likelihood that rates will stay higher longer than hoped. In a 60 Minutes interview, Federal Reserve Chair Jerome Powell said the central bank will be cautious about cutting rates and that the strong economy has provided flexibility in slowing cuts.

The EV industry didn’t take kindly to that sentiment. Shares of Fisker (FSR -6.17%) had fallen as much as 8.6%, Lucid Group (LCID -2.72%) had dropped 5.7%, and QuantumScape (QS -2.59%) was down 5.5% at their lows today. At 3 p.m. ET shares were down 7.4%, 3.6%, and 2.3% respectively.

The Fed’s impact on electric vehicles

EV companies are fundamentally manufacturers that sell a product customers typically finance. So, when rates are higher for longer it makes it more difficult to afford those products. In simple terms, that’s why investors are selling EV companies that are extremely risky even in a low interest rate environment.

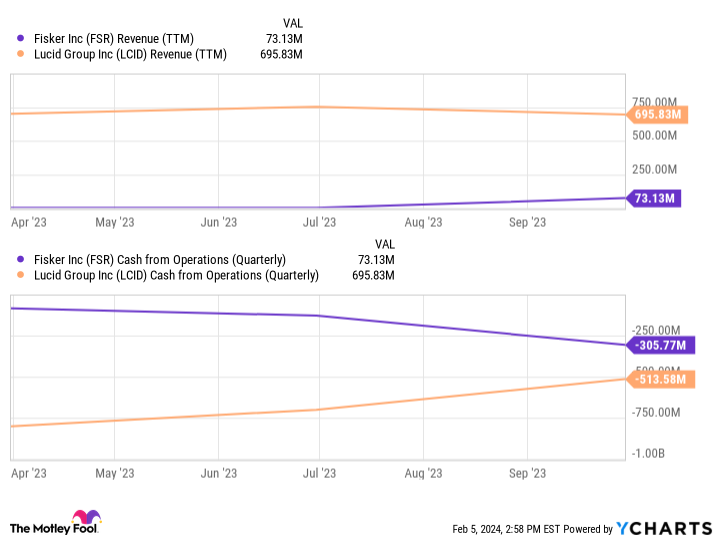

For Fisker and Lucid, this comes as they’re trying to ramp up production and go from burning cash in operations to eventually making a profit. But to get there they need to sell vehicles, and higher interest rates make that harder.

FSR Revenue (TTM) data by YCharts

And if people are buying fewer electric vehicles, it means less investment in new technologies and slower growth for QuantumScape. EV manufacturers have been facing this challenge for over a year, but today it’s become much harder to make the case that rate cuts will save the industry.

Rates are rising

The market’s moves are exaggerating where rates are moving, but they are going higher. The 10-year U.S. government bond yield is up 14 basis points today and is now up 11 basis points in the past month.

The irony is the Federal Reserve doesn’t control long-term rates; the Fed buys short-term bonds to control short-term rates and then the market reacts to long-term rates. So, the move today is just unwinding the previous speculation on the rate of cuts by the Fed in 2024.

The bottom line for EVs today

For Fisker, Lucid, and QuantumScape, the real question is whether they can get to long-term profitability. They’re all building out capacity and sales forces in anticipation of growing demand for electric vehicles, but that doesn’t seem to be materializing as interest rates rise and demand for EVs falls. That will eventually put a crunch on cash as competitors use lower prices to try to drum up sales.

I think the right move for investors today is to simply stay away from EV stocks because the growth curve that drove excitement over the past decade is leveling out. Growth may be much slower in the next few years and owning unprofitable electric vehicle companies is very risky. These companies may survive, but I don’t think they will all thrive.

When a stock falls just on speculation that rates are going to stay higher for longer, it’s a warning that a stock is dependent on low rates. And right now that’s a tough place for investors to be.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.