Many students and their parents will have been shocked by news of Britain’s biggest student debt, which sits at a huge £230,000.

Figures from the Student Loans Company (SLC), uncovered by the BBC, reveal some graduates left with hundreds of thousands of pounds of debt. This is far higher than the average graduate’s debt of just under £45,000.

But financial experts say if you or your child do have a large student debt – or even a modest one – it is unlikely to be worth overpaying to clear it. We explain why.

Should you repay? It depends on what you earn now and in the future, according to experts

Britain’s biggest student debt has reached £231,384.24, according to Student Loans Company data, after a BBC Freedom of Information request.

The figures also revealed the most interest accumulated on a loan was £54,050, while the highest repayment made by a graduate is £110,112.11.

These are the kind of figures that can strike fear into the hearts of students and their parents, even though they may be outliers that are far bigger than the typical graduate’s debt.

But while graduates – and their parents – may be tempted to overpay student debt to get it cleared, financial experts regularly argue that the way the system is structured means you shouldn’t do this.

Once you’ve signed up to the student loan system and taken on the debt, the general financial wisdom is that you should simply make the payments required and be very careful about trying to clear it early – unless you are guaranteed to be a high earner.

That is because any unpaid student loan balance is written off a certain number of years after the borrower leaves university.

Finance experts say that for some, especially those who don’t earn a large wage or have borrowed a lot of money, it doesn’t make sense to put extra cash towards your student loan or try to pay it off in its entirety.

We explain how the student loan system works, what interest graduates pay, and why some people might not need to worry about paying it back in full.

What is the average student debt?

According to the SLC, the average debt balance on a student loan account is just under £45,000.

The balance includes the initial amount that graduates borrowed, and also the interest that has accumulated so far.

Students attending university this year will pay £9,250 in fees per year, and can borrow up to £9,978 as a maintenance loan, or as much as £13,022 if they study in London.

After they graduate, they will pay the loan back once they reach a certain earnings threshold.

They pay 9 per cent of their earnings above the threshold on plan 1, 2, 4 or 5 (see below for details of the different plans and repayment thresholds) or 6 per cent of their earnings above the threshold on a postgraduate plan.

Interest also builds up on any outstanding balance each month.

What interest is charged on student loans?

Interest rates have typically been based on the Retail Price Index rate of inflation (RPI). This was controversial in itself, because the Consumer Price Index (CPI) is a much more common measure.

However, when RPI soared to 13.5 per cent in March last year, the Government introduced an interest rate cap of 7.6 per cent for all student loans.

The current level of interest on each plan is as follows:

- 6.25 per cent on Plan 1 (started university before 2012)

- 7.6 per cent on Plan 2 (started university after 2012 but before 2023)

- 6.25 per cent on Plan 4 (students from Scotland)

- 7.6 per cent on Plan 5 (students starting in 2023 and after)

- 7.6 per cent on the postgraduate loan plan

Those earning under £27,295 just pay the RPI rate in interest, while those earning between £27,296 to £39,130 pay RPI plus up to 3 per cent, as the rate increases the more you earn.

Those earning over £49,130 are charged RPI plus 3 per cent.

The figures reveal that the most interest accumulated on a loan was £54,050, while the highest repayment made by a graduate was £110,112.11.

Do the maths: When you repay your student loan, and what interest you pay, depends on your earnings and when you attended university

When do graduates start to repay?

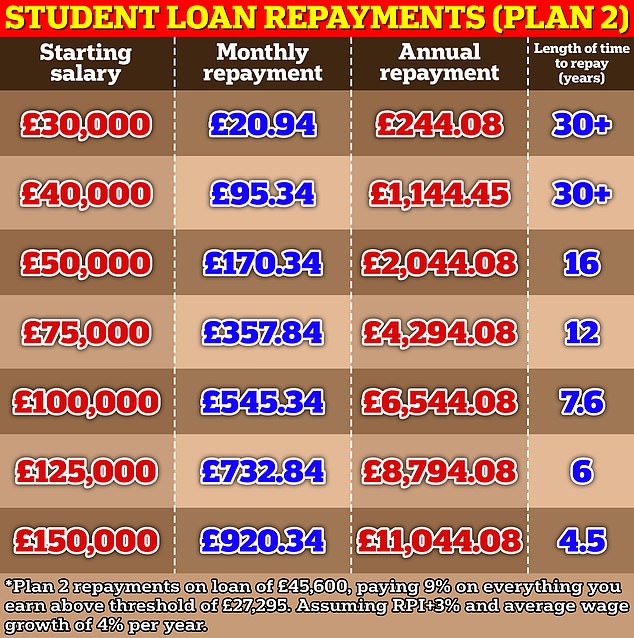

Plan 2 – 2012 to 2023 students

When you must start making monthly repayments to pay back your student loan is based on your earnings, but the exact threshold depends on your plan.

Those who started university after 2012, but before 2023, will be on plan 2 and will begin paying back their loan once they earn more than £27,295 per year.

For students who began university before 2012, they will begin paying when they earn £22,015 per year.

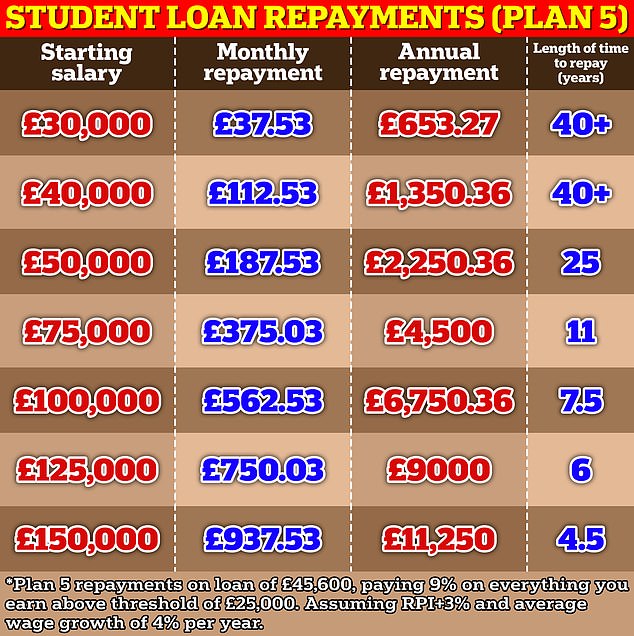

Plan 5 – students after 2023

For students who only began their degree last year, on a plan 5 scheme, will start paying once they earn more than £25,000.

Scottish students, on plan 4, will pay back once they hit £27,660, while people with postgraduate loans will pay back above the £21,000 threshold.

Why wouldn’t students pay back their loans?

The repayments students make are based on their salaries, so for lower earners, the value of the repayments you would make over the lifetime of the loan, plus interest, would still be cheaper than paying off the loan in its entirety.

In these cases, it becomes a ‘graduate tax’ that they pay each month until the debt expires.

When will my loan be written off?

For some of those on plan 1, their loan will eventually be written off when they hit age 65, if they were paid their first loan installment before 2006. People who were first paid after 2006 will see their loan canceled after 25 years.

On plan 2, there is a 30 year repayment period, and there is a 40 year period for those on plan 5.

Plan 4 students will also see their balance cancelled after 30 years if they were first paid after 2007, while those first paid before that date will repay either for 30 years, or until they hit 65.

Postgraduate loans are also written off after 30 years for people in England and Wales, or under plan 4 for Scottish graduates and plan 1 for those in Northern Ireland.

How long would the £231,000 take to pay off?

With a repayment period of 30 years, the person who has racked up debts of more than £231,000 would need to pay £7,713 each year in order to pay off their loan, even if they didn’t incur any more interest (which they will).

However, the reality is that it is likely they will never pay off their student debt, and the remainder will be written off.

The figures released by the Student Loan Company said that they had a plan 2 loan, meaning they must have started university in 2012 or later. The SLC also said they had studied multiple courses, but we don’t know any more details.

It’s possible to work out they might pay off, using a student loan calculator.

If they were on a good graduate salary of £35,000, rising by 5 per cent on average per year, they would only pay off £37,157 of their debt. Their debt would keep growing until April 2049 when it is written off, having reached a huge £576,194.

The different rules on different plans mean some graduates are more likely to pay their loans in full than others.

How long will it take? Most students will see loans written off within 30 years

Alice Haine, personal finance analyst at Bestinvest, says: ‘Some students may never clear what they owe in full as any outstanding balance on the loan under the Plan 2 scheme is wiped 30 years from the first April after graduation.

‘So a student that never earns above the £27,295 figure, for example, would never repay a penny so it would be pointless overpaying.

‘Future graduates, those that started their courses from September 2023 are on plan 5, are more likely to repay their debts as the repayment period has been extended to 40 years and the salary threshold at which they start to repay has been lowered to £25,000.’

Pay it off? What the experts say

With student loans able to be written off after a certain period, money experts say that – for some borrowers – it is better to treat them like a tax and divert their money to other financial goals.

A better strategy for most is to treat the loan like a tax and ignore the interest applied altogether

Alice Haine says: ‘Student loan statements can be painful reading for graduates that like to think their monthly repayments have been slowly reducing their debt.

‘Of course, no one wants to see thousands of pounds of interest added to the loan, but rather than panic about how to clear the liability, a better strategy for most is to treat the loan like a tax and ignore the interest applied altogether.

‘Simply pay the amount you owe every month and direct savings towards other financial goals.’

Myron Jobson: Paying back student loan debt could mean you need to borrow more

Haine also points out that some people might have a career break, take time out to raise a family or for sickness, go part-time, or move to a job with a lower salary – all instances that could see their salary dip below the threshold at which they must repay.

Although the interest on student loans seems high to many graduates, it is cheaper than, for example, borrowing a personal loan from a bank – and comes with fewer risks.

Experts therefore say that graduates should think twice about putting extra money towards their student loan, if it meant that they would have to borrow extra cash elsewhere to meet other financial goals.

Using money to overpay your student loan now could mean that you’d essentially have to borrow it back elsewhere in future at a higher rate of interest

Myron Jobson, senior personal finance analyst at Interactive investor, says: ‘While you might not have any debts or financial commitments now, it is possible that you will in future for a mortgage, a car loan or even to start a business.

‘Using money to overpay your student loan now could mean that you’d essentially have to borrow it back elsewhere in future at a higher rate of interest.’

Who SHOULD aim to pay back their loan?

For those that are likely to repay their loan before it is wiped, putting extra money in to do it early is worthwhile, as it will reduce the amount of interest that builds up.

Haine adds: ‘For higher earners that plan to have a long career, it may make more sense to clear the debt entirely, particularly if your family are willing to help, or to overpay to clear the debt quicker and reduce the interest rate charges applied.

‘No one has a crystal ball so those worried about their loans should ignore the interest rate and treat the monthly payment like a graduate tax, saving any extra money for other financial goals such as a home deposit or raising a family.

‘If their income jumps dramatically in the future, they have adequate savings in place and being in debt bothers them, then paying it off will remove that worry altogether – but only do that if you really need and can afford to.’

Regardless of which side of the argument you choose, it is important to ensure that your finances are in good nick before considering putting in more than the minimum

Working out whether you should try and repay your loan often depends on your future earnings – which can be difficult to predict.

Laura Suter, director of personal finance at AJ Bell, adds: ‘It’s nigh-on impossible to work out whether you’re better off repaying your loan, either entirely or in chunks of money, or if it’s better to use that cash for something else.

‘It all depends on your starting salary, how much of a pay rise you see over your career, whether you take any career breaks or whether you work part time at any point.

‘Frustratingly for graduates they can’t look into the future to see what their earnings will be and whether it’s worth repaying the debt early,’ she added.

Ultimately, the experts suggest that graduates should take stock of their own situation and make sure their other financial needs are met before making a decision about whether to aim to pay back their student loan in full.

Myron Jobson added: ‘Regardless of which side of the argument you choose, it is important to ensure that your finances are in good nick before considering putting in more than the minimum toward your student loan.

‘This means paying off any outstanding high interest debts and maintaining a healthy rainy-day fund (three to six months’ salary, or more if you can afford it) and ensuring that other payment obligations are accounted for.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.