Farfetch (FTCH 9.49%) stock is seeing big gains in Monday’s trading following a key antitrust approval from European regulators. The company’s share price was up 11.4% as of 1:30 p.m. ET, according to data from S&P Global Market Intelligence.

Farfetch published a press release this morning announcing that the European Commission (EC) had cleared its acquisition of a substantial stake in Yoox Net-A-Porter (YNAP) from Richemont. Following the approval from the EC, the deal is seemingly on track to close soon.

Farfetch is on track to expand its e-commerce network

Farfetch is poised to acquire a 47.5% stake in Yoox Net-A-Porter, an Italian online fashion retailer. In turn, Farfetch will give shares of its Class A common stock to Richemont. As part of the deal, YNAP and Richemont Maisons will also begin using Farfetch Platform Solutions for e-commerce. Richemont will also launch e-concessions on Farfetch Marketplace, giving it the ability to control pricing, discounting, promotions, and other key facets of online retail.

While certain unspecified conditions still need to be completed by Farfetch and Richemont before the deal closes, it’s very likely that these will be resolved in the not-too-distant future. The recent regulatory approval is good news for Farfetch, but there’s still plenty of uncertainty surrounding the business and its stock.

What comes next for Farfetch stock?

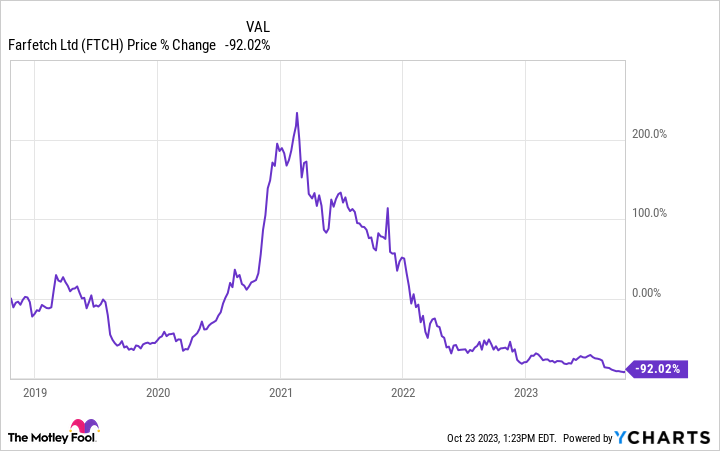

Farfetch stock has struggled as the company has continued to post losses and record uneven sales performance. The luxury fashion retailer went public in 2018, and its share price is now down roughly 94% from market close on the day of its initial public offering (IPO) and roughly 98% from the lifetime high that it reached early in 2021.

Based on the 2022 announcement of Farfetch’s plan to acquire a stake in YNAP, it’s possible that the company will acquire a majority stake in the Italian e-commerce specialist. It’s also possible that partnering with Richemont will provide a meaningful source of relatively high-margin revenue. On the other hand, YNAP hasn’t been a great performer for Richemont, and it’s not clear that Farfetch’s tentative stake acquisition and partnership initiatives will deliver meaningful steps toward profitability.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Farfetch. The Motley Fool has a disclosure policy.