Shares of C3.ai (AI -4.20%) rose 156.6% in 2023, according to data from S&P Global Market Intelligence. The company took advantage of surging demand for artificial intelligence technology, and its revenue growth rate reaccelerated after slowing down throughout 2022. Those positive operational developments combined with favorable market forces to create some momentum that drove C3.ai higher. However, there was also some discouraging news, and investors should understand the risks before piling on the AI bandwagon.

C3.ai delivered mixed results last year

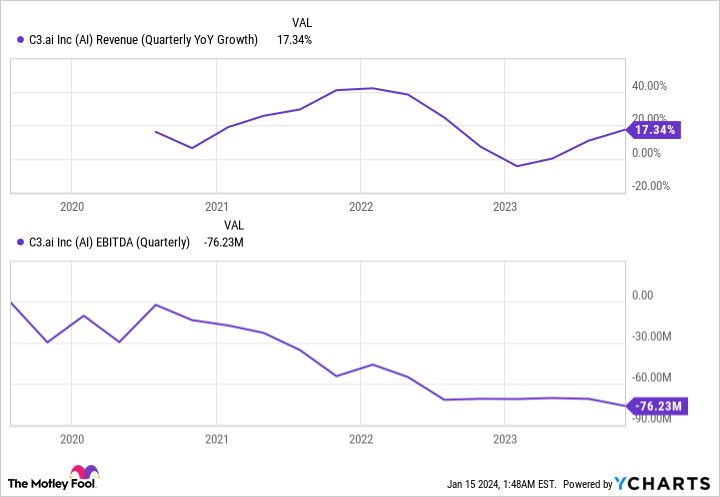

C3.ai’s quarterly results were all over the place last year. The company was able to reverse a bad trend by delivering revenue acceleration — evidence that C3 is capitalizing on surging AI software demand.

Image source: Getty Images.

The traction came with discouraging news, though. The company’s operating losses grew because of an increase in cost of revenue and marketing expenses. The trend suggests that its sales growth might not translate to higher cash flow. Many high-profile tech companies were able to cut costs last year, moving into profitability despite slowing revenue growth, and C3 was a noteworthy departure form that trend.

AI Revenue (Quarterly YoY Growth) data by YCharts

Even worse, C3 slashed its earnings forecast in each of the past two quarters, dashing investor hopes that profitability was around the corner. It also casts doubt on the company’s ability to control costs.

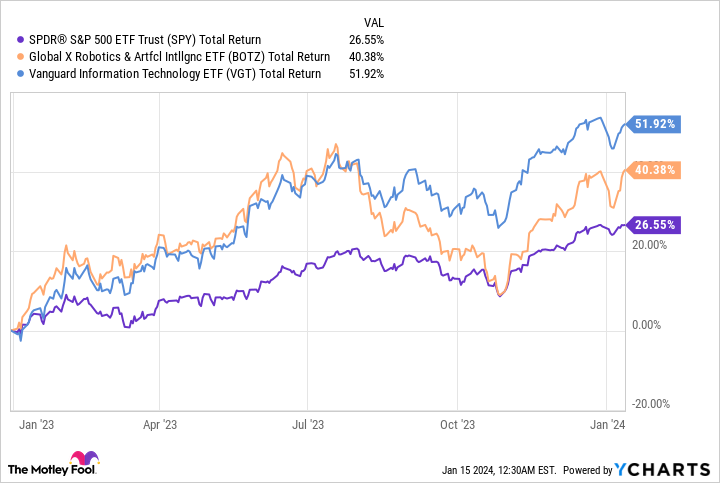

Investors got excited about AI stocks last year

2023 was a big year for the tech sector, especially AI stocks. Following a rough 2022, investors pushed capital back into equities as they anticipated interest-rate cuts from the Federal Reserve. That dynamic was a major driver for growth-stock performance in 2023, especially with the allure of AI’s transformational potential. Tech stocks and AI stocks both outperformed the S&P 500 last year as a result.

SPY Total Return Level data by YCharts

That’s exactly why C3 delivered huge returns for shareholders despite its mixed operating performance. Investor risk appetite is expanding, and nobody wants to be left out of a potential AI boom. The company’s prominent position in this emerging industry attracts attention, and the top-line acceleration checked the most important box for growth-focused investors.

C3’s returns were mostly attributable to inflating valuation ratios. Its improving growth rate certainly helped, but the stock got more expensive relative to projected sales. Meanwhile, cash flow projections have only gotten worse. Sometimes businesses can force their shares higher with strong fundamentals, but that’s not really what happened here.

AI PS Ratio data by YCharts

What’s next for this AI business?

C3.ai provides AI subscription software that’s intended to help enterprises optimize numerous functions. The company has gained customers across a wide range of industries, and it’s established traction among subscribers in the energy and industrial sectors. There are obvious demand catalysts for C3’s products, but there’s still significant uncertainty around the future. AI is still in its early stages as marketable technology, and there are a wide range of potential competitors. Its position in the future market isn’t clear yet.

The company is forecasting 20% revenue growth this year and a net loss. It’s hard to feel any confidence in its ability to control costs and deliver positive cash flow in the near future. C3 also hasn’t been able to reduce risks associated with heavy customer concentration, so its results could be devastated if it loses its largest subscriber. Its price-to-sales ratio is still above 10, suggesting that investors are focused on the opportunity rather than on the risks.