Shares of digital advertising company Cardlytics (CDLX 24.61%) skyrocketed on Monday after the company settled a lawsuit and reported preliminary financial results for the fourth quarter of 2023. As of 9:50 a.m. ET, Cardlytics stock was up about 34%. That said, it’s still down 95% from its high set in 2021.

Are things looking up for Cardlytics?

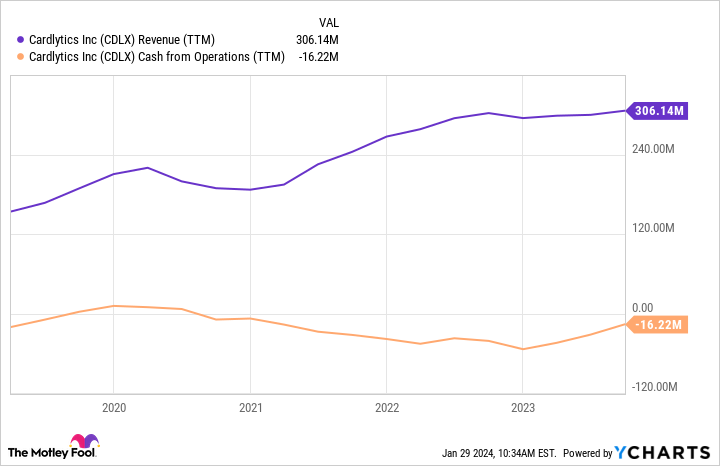

Cardlytics works with financial institutions to manage their reward programs. It then takes this information to help marketers better target consumers. Even though the stock is down 95% from its high, the company’s revenue is at an all-time high.

However, profitability tanked for Cardlytics following a trio of acquisitions in 2021 and early 2022. The market is reacting to news regarding one of these acquisitions today: Bridg.

Cardlytics acquired Bridg for $350 million in May 2021. But the deal had performance payouts on the first and second anniversaries. Given the business’s underperformance, those payouts weren’t as high as Bridg’s shareholders originally anticipated, which resulted in a lawsuit. But Cardlytics has settled this now for about $46 million.

With this issue in the rearview mirror, investors also celebrated the financial results for Cardlytics. Management said its preliminary financial results are within its previous guidance but toward the high end of it. Revenue will be near an all-time high, and its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will be positive.

What should investors watch now?

Mergers and acquisitions are tricky, and results from Cardlytics prove it. The company had been close to breakeven on an operating cash-flow basis before it started making acquisitions.

CDLX Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Cardlytics is trying to merge insights from financial institutions with shopping data from consumer brands, which could be valuable data for marketers. The business is still growing, which is good. And it’s hopefully moving past some operational hiccups.

Advertisers rely on third-party cookies today, but those are getting phased out in 2024. Therefore, Cardlytics’ advertising technology business is well poised for the future. Investors should watch whether the company can grow in this pivotal year while maintaining operational discipline. If it can, the stock may be poised to regain lost ground.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.