Capital One Financial (NYSE:COF) stock gained 41%, according to data provided by S&P Global Market Intelligence. The bank made headlines when Berkshire Hathaway began building a stake in it earlier in the year. It got an added boost when the Federal Reserve signaled a potential pivot in its interest rate policy late last year.

Image source: Getty Images.

Capital One stock got a boost when Berkshire Hathaway bought shares amid March’s banking turmoil

2023 was a challenging year for all stocks, including banks. During the year, the Federal Reserve raised interest rates at its fastest pace in four decades to put a lid on inflationary pressures in the economy.

This rapid pace of interest rate hikes resulted in trouble for some regional banks last March, which saw some of the most extensive bank failures in over 15 years. Investors became weary of contagion risk among other banks, and Capital One stock took investors on a roller-coaster ride throughout the year.

Capital One didn’t face the same risk as Silicon Valley Bank (a subsidiary of SVB Financial) and First Republic Bank. While those regional banks faced deposit outflows, Capital One increased its deposits from March 2022 to September 2023 by 11% to $346 billion, despite rapidly rising interest rates. However, rising deposit costs put pressure on the bank’s net interest margin and bottom line.

The stock got a boost when investors learned that Berkshire Hathaway was accumulating shares of the consumer finance company. In the first two quarters of 2023, Berkshire purchased nearly 12.5 million shares of Capital One stock, with most of that coming in the first quarter.

Capital One also stands to benefit from a reduction in interest rates in 2024. From March 2022 through July last year, the Federal Reserve raised interest rates 11 times to 5.5%. However, the central bank has held its benchmark rate steady over its past three meetings and signaled it may be done hiking interest rates for now.

According to CME Group‘s FedWatch Tool, market participants project the federal funds rate could come down to around 4% by the end of 2024. A pivot by the Federal Reserve is a positive sign for banks that have seen high interest rates weigh on their net interest margins and lending activity.

However, investors will want to monitor Capital One’s loan portfolio closely. Charge-offs have been rising for the bank for several quarters in a row. If consumers, especially the higher-risk ones Capital One serves, show signs of cracking, it could see delinquencies tick higher in the next couple of quarters and weigh on its bottom line.

What investors will want to watch for in 2024

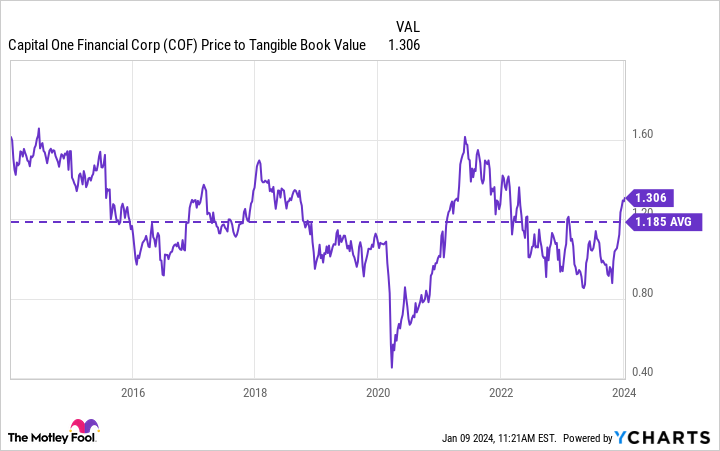

Capital One stock is up 50% over the past several months, and isn’t quite the bargain it was in October. Today, the bank is priced at 1.3 times tangible book value (P/TBV), well above where it was a few months ago when it traded at a discount to book value and above its 10-year average P/TBV of 1.19.

COF Price to Tangible Book Value data by YCharts

Investors should watch its loan portfolio when it reports earnings on Jan. 25, as rising charge-offs could be a short-term headwind after the stock’s big rally. With the stock’s recent run-up, a 10% to 15% pullback wouldn’t be out of the question and could make Capital One an appealing stock to scoop up ahead of potential Federal Reserve interest rate cuts later in the year.

SVB Financial provides credit and banking services to The Motley Fool. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.