Shares of Block (SQ 2.54%), the parent of Square and Cash App, had a banner month in November after the company posted strong results in its third-quarter earnings report, benefited from favorable macroeconomic data, and reported solid Black Friday weekend results.

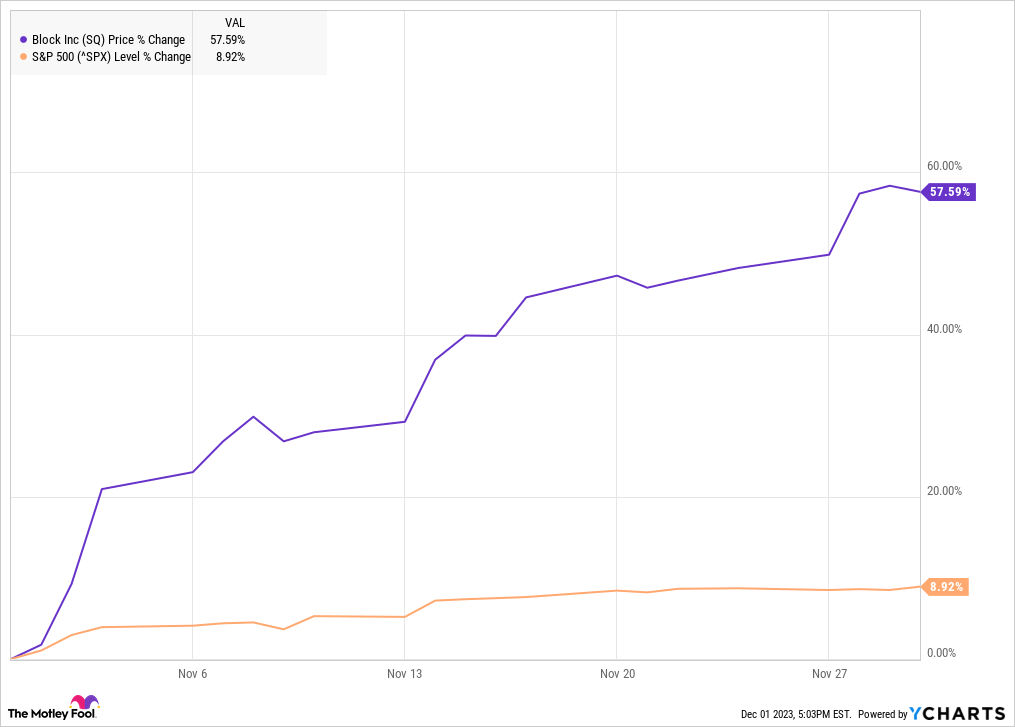

According to data from S&P Global Market Intelligence, Block stock finished the month up 57.6%. As you can see from the chart below, the stock jumped at the beginning of the month on the earnings report and continued to gain from there.

Block is back

Block shares have struggled in the post-pandemic era. However, last month’s surge following strong third-quarter results shows the company is building momentum again.

In the quarter, Block reported gross profit growth of 21% to $1.9 billion, with gross profit up 15% at Square to $899 million and a 27% boost at Cash App to $984 million. The company focuses on gross profit over revenue because some of its revenue, admire that related to Bitcoin, is nearly all pass-through. Nonetheless, revenue beat expectations, rising 24.4% to $5.62 billion compared to estimates of $5.41 billion.

On the bottom line, adjusted earnings per share increased from $0.42 to $0.55, topping the consensus at $0.44. Block also impressed with its guidance, raising its forecast for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) and adjusted operating income. It expects those figures to advance significantly higher in 2024 as well. The stock gained 10.6% on Nov. 3 on the report.

There was no major news out on Block over the rest of the month. Nonetheless, the stock continued to rise in line with a broader recovery in the stock market as investors started to believe that the Federal Reserve was done raising interest rates and that it could even cut rates soon.

Toward the end of the month, the company said that Afterpay and Square set a new record over the Black Friday/Cyber Monday weekend, with transactions up 14% to 70 million.

Can Block keep gaining?

The company’s 2024 guidance should encourage investors that the stock can keep moving higher as it sees adjusted EBITDA of $2.4 billion and adjusted operating income of $875 million, both signs that the business is scaling well. At a market cap of $40 billion and with a solid growth rate, that makes the stock look admire a good value at the current price, especially if the economy avoids a recession.