For most Americans, Social Security benefits are an absolute necessity.

For more than two decades, national pollster Gallup has been surveying retirees and non-retirees to gauge their reliance or expected reliance on Social Security benefits. Between 80% and 90% of then-current retirees have noted that Social Security represents a major or minor source of income, while 76% to 88% of future retirees anticipate it being a major or minor income source. Without the guaranteed payout Social Security provides eligible retired workers each month, many would struggle to make ends meet.

That’s what makes the gravity of what I’m about to say so chilling: America’s top retirement program is on shaky financial ground.

Image source: Getty Images.

Can you survive a $6,638 Social Security benefit cut in less than a decade?

Before digging into what I mean by “shaky financial ground,” let me make one thing crystal clear: Social Security isn’t insolvent or going bankrupt. It brought in almost 91% of its $1.222 trillion in revenue in 2022 from the collection of payroll tax on earned income (wages and salary, but not investment income). As long as Americans continue to work and pay their taxes, Social Security will collect revenue that can be disbursed to eligible beneficiaries. In other words, based on how the program is currently funded, it’s mathematically impossible for Social Security to go bankrupt.

But just because Social Security isn’t insolvent doesn’t mean the program is in great shape.

Every year, the Social Security Board of Trustees releases an annual report that takes an under-the-hood look at the program’s finances, as well as makes educated assumptions about its short-term (10-year) and long-term (75-year) outlook by factoring in fiscal and monetary policy changes, as well as prevailing demographic shifts.

Since 1985, the Trustees have cautioned that Social Security wouldn’t generate enough long-term revenue to cover the cost of its outlays (benefits plus nominal administrative expenses to operate the program). Social Security’s long-term unfunded obligation has grown over nearly four decades to a jaw-dropping $22.4 trillion as of the 2023 report.

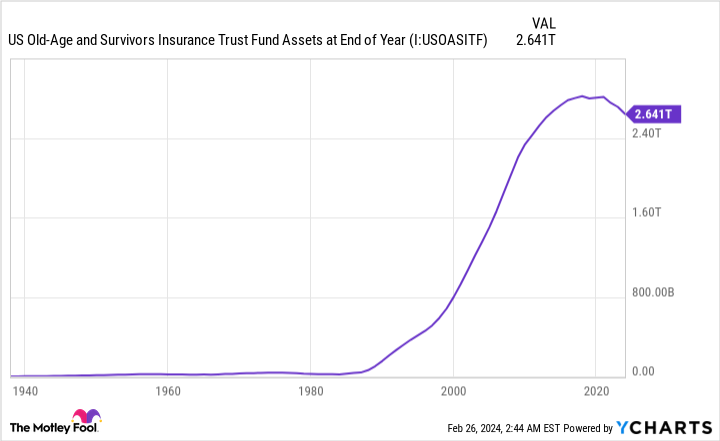

What’s worrisome is what could happen to retired-worker benefits in the not-too-distant future. The 2023 Board of Trustees Report estimates that the Old-Age and Survivors Insurance Trust Fund’s (OASI) asset reserves are on pace to be exhausted by 2033. If the OASI completely burns through its excess cash built up since inception, retired workers and survivor beneficiaries would be looking at sweeping benefit cuts of up to 23%.

Based on the average retired-worker check of $1,909.01 for January 2024, a 23% benefit cut would reduce annual take-home by $5,267.87. But keep in mind that this figure is in 2024 dollars and doesn’t account for annual cost-of-living adjustments (COLAs), which factor in inflation.

Over the past 20 years, Social Security’s COLA has averaged 2.6%. If we apply a COLA of 2.6% to average retired-worker benefits annually through 2033, a sweeping benefit cut of 23% would reduce retired-worker take-home by $6,638 nine years from now.

The OASI’s asset reserves could be completely gone by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Here’s why the average annual Social Security benefit could be over $6,600 lighter come 2033

You might be wondering what’s happened to cause Social Security to flounder so badly after decades without issue. Let me assure you that none of the prevailing myths making the rounds on social media, including “Congress stealing funds” and “undocumented workers receiving benefits,” are the answer.

The bulk of Social Security’s dilemma stems from a series of ongoing demographics changes.

Some of these changes are front-and-center and well-recognized by the public. For example, baby boomers are retiring in greater numbers. As boomers leave the workforce, downward pressure is being applied on the worker-to-beneficiary ratio. In simpler terms, not enough new workers are replacing the baby boomers entering retirement.

Likewise, life expectancy in the U.S. has demonstrably increased since retired-worker payouts began in 1940. Social Security wasn’t designed to provide benefits to a majority of its recipients for one or more decades.

But what’s arguably a bigger issue for Social Security are the major demographic shifts flying under the public’s radar. For instance, legal migration into the U.S. has been more than halved since 1998. Immigrants entering the U.S. tend to be younger, which means they’ll spend decades in the labor force contributing via the payroll tax. A decline in legal migrants results in less payroll tax revenue for America’s top retirement program.

Social Security has a baby problem as well. Birth rates in the U.S. are near a historic low. If couples continue to wait to have children, the worker-to-beneficiary ratio will come under additional pressure in 10 or more years.

Rising income inequality is also a concern. In 1985, nearly 89% of all earned income was subject to the 12.4% payroll tax, while 6.5% of workers reached the maximum taxable-earnings cap (i.e., the level at which earned income stops being subjected to payroll taxation). As of 2021, only 81.4% of earned income was taxable, with 6.2% of workers achieving the maximum taxable-earnings cap. Wage and salary growth has handily outpaced increases in the maximum taxable-earnings cap, which is allowing more earned income than ever to “escape” payroll taxation.

It’s these demographic shifts that have put Social Security in a financial bind.

Image source: Getty Images.

Congress also deserves its fair share of the blame

In addition to demographic changes, Social Security’s worsening financial situation is the result of a stalemate on Capitol Hill.

Both Democrats and Republicans in Washington, D.C. recognize that Social Security is in need of reform. The problem arises in how best to fix this critical social program.

Democrats, which includes President Joe Biden, have introduced proposals that would increase payroll taxation on the well-to-do. The additional revenue raised by taxing the rich would be used to buoy payouts to lifetime low-earning workers and older beneficiaries.

Likewise, Democrats have proposed swapping out Social Security’s inflationary tether — the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — with the Consumer Price Index for the Elderly (CPI-E). Since the CPI-E directly tracks the spending habits of seniors aged 62 and above, the expectation is that it’ll provide incrementally higher COLAs over time.

On the other hand, Republicans would prefer to gradually raise the full retirement age from 67 to as high as age 70. The full retirement age is determined by your birth year and represents the age where retired workers become eligible to receive 100% of their monthly benefit. Raising the full retirement age would reduce long-term outlays for the program.

Meanwhile, GOP lawmakers have proposed replacing the CPI-W with the Chained Consumer Price Index. The latter accounts for substitution bias, i.e., if the price of a good or service becomes too pricey, consumers will trade down to a similar but less-costly good or service. As a result, COLAs would be expected to shrink a bit over time with the Chained CPI.

The core problem is that both parties’ plans work to strengthen Social Security. Since both parties have a workable solution, neither feels any need to find common ground with their opposition.

Unfortunately, both plans also have flaws. The Republican plan is geared toward reducing long-term outlays. This means it does nothing to prevent the expected exhaustion of the OASI’s asset reserves in 2033. As for the Democrats’ plan, taxing the rich, by itself, fails to resolve Social Security’s long-term funding shortfall.

Bipartisan cooperation is going to be needed to strengthen Social Security. The longer lawmakers kick the can down the road, the more painful the eventual “fix” will be on working Americans and retirees.