izusek

Introduction

About six months ago I wrote an article titled: “Lose Money Slowly with SCHD“. Here is my conclusion from that article:

Dividend and DGI investors have done really well over the past decade if they chose a dividend growth strategy over a 60/40 strategy. But too many investors have been chasing these stocks lately. Where previously there was no alternative for yield, now TFLO yields 5.2% and CDs and money markets are competitive. In short, things have changed. The biggest danger for SCHD and strategies appreciate it is that investors slowly lose money each year, especially in real terms, and they don’t achieve it. appreciate the frog sitting in a pot of water with the temperature slowly rising. That is exactly what SCHD has done this past year. The price would need to be about -30% lower to be attractive as a medium-term investment. Since we now have safer alternatives, I’m rating SCHD a “Sell”.

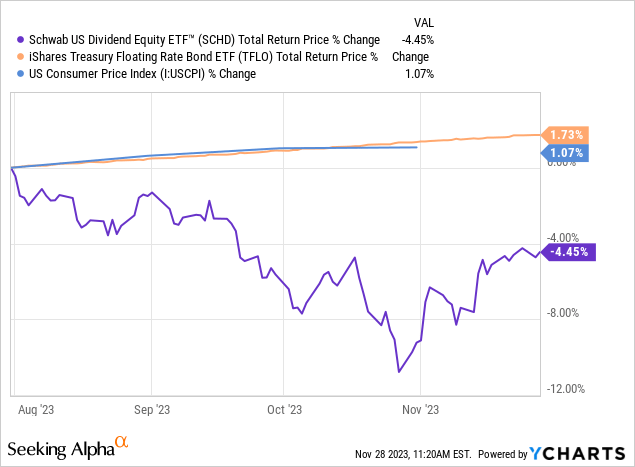

As you can see, I expected Schwab’s US Dividend Equity ETF’s (NYSEARCA:SCHD) losses to be slow over time, and I suggested iShares Treasury Floating Rate Bond ETF (TFLO) as a better alternative (especially over the next year or two). Let’s see what SCHD, TFLO, and inflation have done since my SCHD article was published.

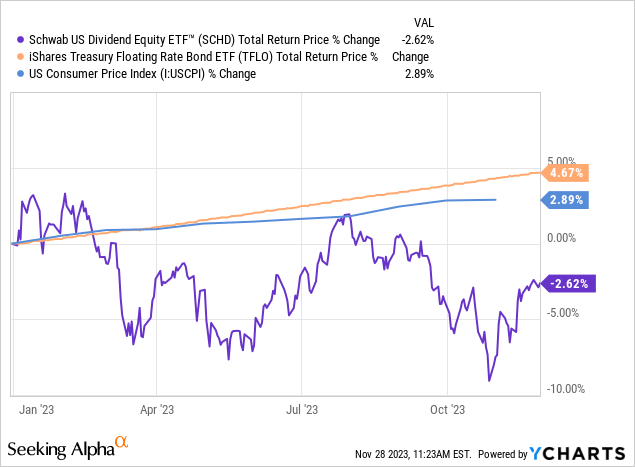

TFLO’s returns have been steady, roughly matching inflation, while SCHD is down more than -4.45% and at one point was down about -10%. This poor performance isn’t a new trend SCHD. If we go back to the beginning of 2023 we can see the beginning of the current trend now extends back a full year.

Since the beginning of the year, when I first bought TFLO and started using it as a place to put my investing ‘cash’, TFLO has performed better than both SCHD and inflation. And, basically, all of the returns you see above from TFLO are yield, not price appreciation. So, even the most passive income investor in the world could have just sat back and collected their monthly payments from TFLO, slept well at night, and kept up with inflation.

While it has only been six months and I expect SCHD’s poor performance to be a longer, slower process, hopefully, this offers at least a little evidence my warning to investors was justified last summer. In this article, I will review my bearish thesis on SCHD, and I will also explain why VYM is an even inferior investment for retirees, and why it’s wise for dividend and yield-focused investors to enlarge their investing universe to non-dividend-paying stocks.

Reviewing Why SCHD Is Not Good For Retirement Right Now

The first thing every investor needs to comprehend is that all other things being equal, the popularity of an investment raises the price investors are willing to pay for the future earnings of those businesses. And paying more for future earnings and cash flows means that you make less money than if you pay less for future earnings. (I know this probably sounds obvious to many readers, but I received quite a bit of pushback in my last article when I essentially stated the same thing.) The stock market is basically an auction process for future earnings. If a business is going to earn $100 in earnings over the next 10 years, and one person pays $40 now for that future $100, and another person pays $70 now for that future $100. The person who paid $40 earns $60, while the person who paid $70 earns half that amount, only $30.

My basic thesis is that right now, dividend investing is very popular due to a long period of low bond yields starting in 2009 and a larger number of people retiring than we’ve had historically due to the post-WWII baby boomers entering retirement. This quest for yield has caused many investors to pay more for businesses than the businesses will likely earn over the next 5-10 years. So nearly the entire universe of dividend stocks has become overvalued. This has created a situation where even a well-designed ETF appreciate SCHD will probably not do very well in real terms over the next 5 years.

The first warning sign for retirees and dividend investors is that SCHD’s dividend yield is currently only +3.66%. This isn’t even high enough to confront a standard 4% govern for retirement. This means, all other things equal, a person retiring today, would need to save about an additional 10% for retirement in order to confront a basic retirement threshold appreciate the 4% govern…and that is with no margin of safety. A bad recession, which we haven’t had for 15 years, could mean dividend cuts, which would leave a retiree short of funds even if they thought they had saved enough. This very low yield is an additional sign the universe of dividend stocks is overvalued. I’m not a dividend or income-focused investor and the current yield on my individual investment portfolio is about +3.03%. The majority of that yield comes from a large position in iShares Treasury Floating Rate Bond ETF (TFLO). More than 30% of the stocks I own don’t pay a dividend at all, and SCHD’s dividend yield is only slightly better than mine.

While SCHD is a very good ETF and probably has performed better than most dividend and income-focused investors who picked their own stocks the past 5 years, it does have some flaws. The first is that the ETF has nowhere to find value when nearly the entire universe of dividend stocks is overvalued. It can’t buy any of those 30+ stocks I own that don’t pay a dividend at all no matter how attractive the businesses are. So this can become — and has become — a limitation for the strategy. The ETF also does not account for cyclicality adequately, nor does it account for changes in things appreciate drug patent expirations and the development of new drugs despite owning several pharma stocks.

Around 40% of SCHD’s weighting currently comes from its top 10 positions. I’ve written public articles on 6 of these, and I am personally long one of them, Merck (MRK) which I consider a “Hold” at today’s prices. So, investors can read my analyses of Coca-Cola (KO), Pepsi (PEP), Texas Instruments (TXN), United Parcel Service (UPS), and Home Depot (HD). I also have a video out on AbbVie (ABBV) on my blog. I’ve covered most of the stocks in SCHD at some point in the past on an individual basis, so this article will take a high level view.

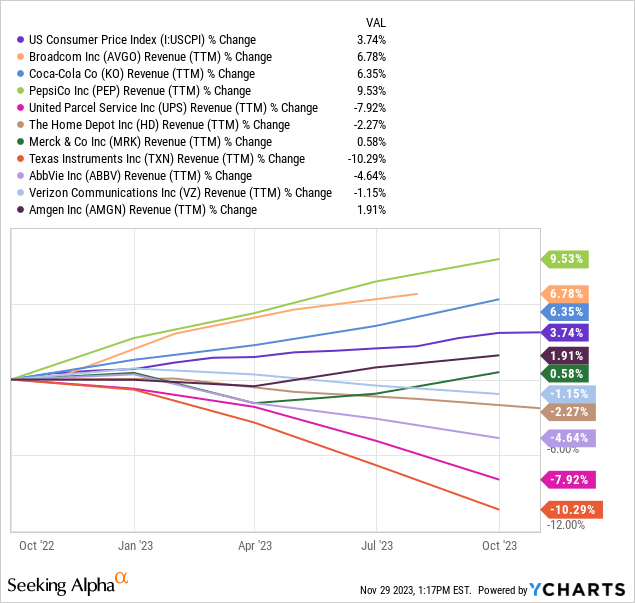

Today I’m going to try to reduce things down to the lowest common denominator to make the simplest case I can that SCHD’s holdings are likely to lack enough earnings and revenue growth over the next 5 years for the stock prices to keep up with inflation. Below is a chart of revenue growth compared to US CPI over the past year.

US CPI has been about 3.74% over the past year. Seven out of ten holdings have revenue growth lower than that, and five have negative revenue growth. Some of this revenue growth is due to cyclicality, some is due to issues unique to drug companies, and some is just because the business doesn’t have any real long-term growth prospects. It’s worth noting that we are not in a recession, yet. If we do have a recession these revenue metrics will all get much worse.

Of course, SCHD is not a static ETF. It does change. So, there is a chance, if investors get lucky, that at the time of its reconstitution if there is some part of the dividend universe of stocks that it was previously underweight, for example, say, healthcare stocks, it shifts to becoming overweight when it’s reconstituted. So, SCHD investors could get lucky in that way. But, they could also get unlucky if SCHD loads up on cyclical businesses that are only in the early stages of a downturn as part of this process.

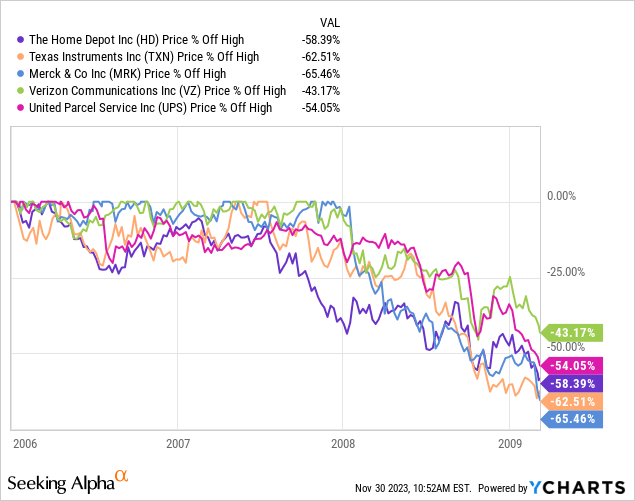

The above graph shows how far some of these holdings fell in 2008, and most of them were not as richly valued going into that recession as they were at their peaks this time around.

I communicate with a lot of investors on a daily basis, so I have a reasonably decent understanding of some of the thinking behind SCHD’s attraction for dividend investors. Many dividend investors do not appear to have done particularly well selecting individual stocks during the past 5 years or so. (This isn’t limited to dividend investors, obviously, but SCHD is a dividend ETF so that’s my focus here.) The natural inclination in this situation is to say “Well, I haven’t done well picking my own stocks, so maybe I should just buy a dividend ETF with a good track record and let it do the selecting.” The most natural ETF that comes to mind is SCHD because it has had a very good track record for a dividend ETF. And it might very well be the case that on a relative basis, SCHD performs better than many investors would if they picked their own stocks over the next 5 years. But that doesn’t mean SCHD will produce good returns. Dividend investing remains very popular, which means, on the whole, investors are paying more for the future returns of dividend stocks (especially the quality ones everyone knows about) than they are for different types of stock investments. What this means is that an ETF that limits itself to dividend-paying stocks is not a solution to the bigger problem of dividend stock valuations relative to future earnings growth.

All that said, there are even more inferior dividend ETFs appreciate Vanguard’s High Dividend Yield Index Fund ETF Shares (NYSEARCA:VYM).

Why VYM is not a good investment for retirement

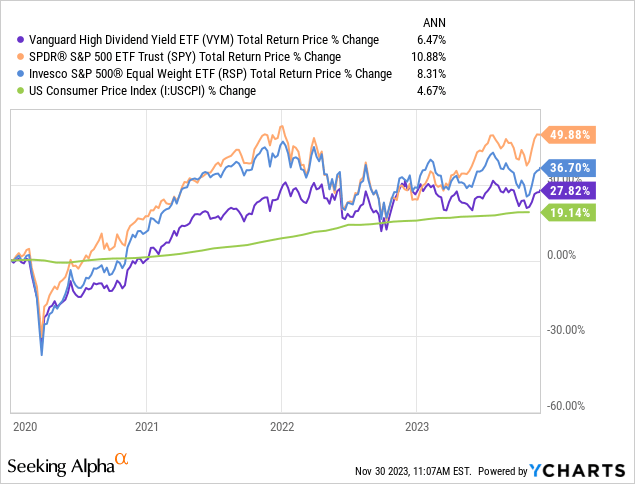

I’ll start by noting the obvious, Vanguard’s “High Dividend Yield” ETF only yields about 3.17% which is about the same as my portfolio which isn’t even focused on yield. Below is a chart of the performance from about the past 4 years starting in 2020 before the pandemic.

In the graph, I have included inflation, which VYM has only narrowly beaten during these 4 years. I also included (SPY) and the equal-weighted version of the S&P 500 ETF (RSP) so we can account for the “Magnificent 7” outsized weightings. RSP has still about doubled the inflation rate. Additionally, drawdowns for RSP and SPY haven’t been much deeper VYM. Any additional volatility in the S&P 500 ETFs was rewarded with better returns leading up to those drawdowns.

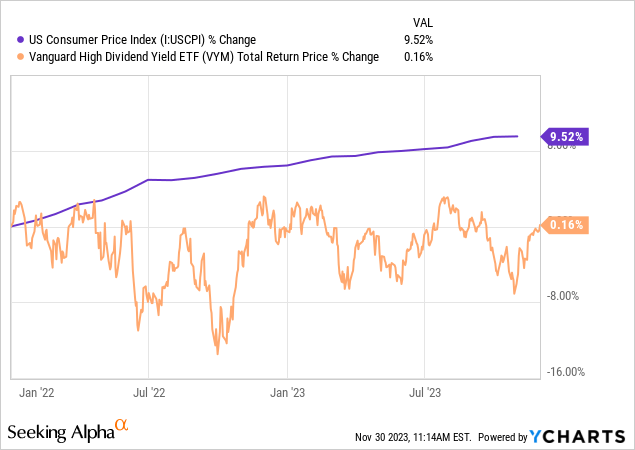

While the past 4 years have been poor, the past 2 years since January 2022 have nearly been a disaster for VYM.

VYM hasn’t come close to meeting inflation and suffered a substantial drawdown in 2022. It’s sort of the worst of both worlds for a retiree.

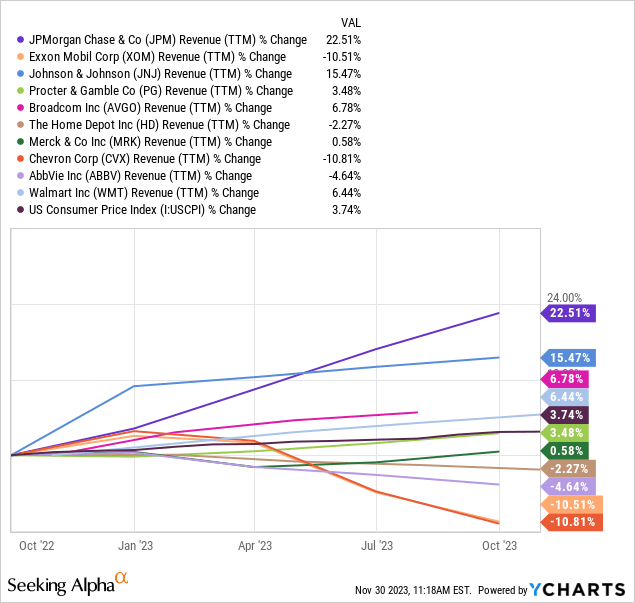

Above is the 1-year revenue growth of VYM’s top ten holdings. Six of the ten have revenue growth less than inflation, and JNJ’s has slowed the past 9 months so next year it will likely combine the list of underperformers. Only JP Morgan (JPM) has solid revenue growth, but it has cyclical risk and was an unusual beneficiary of the March banking crisis. These 10 stocks make up 25% of VYM’s current weighting. (Again, I’ve written individual articles on many of these stocks as well. Merck was the only “Buy” back in 2021.)

The simplest and best govern of thumb investors can use at this point is the higher the dividend yield of an equity fund, the lower the total returns to the investor will be over time.

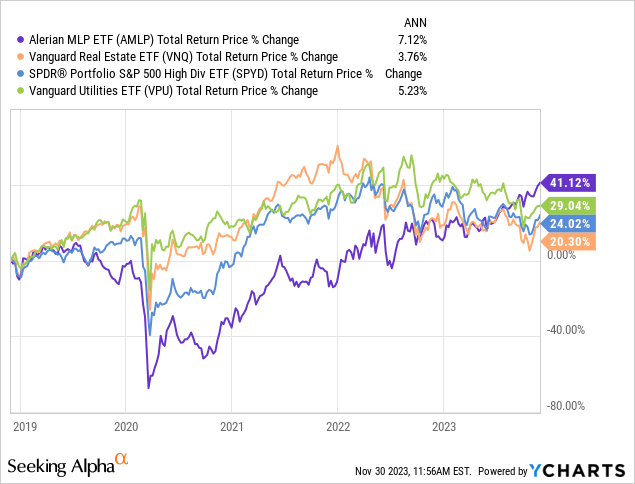

Below are the 5-year returns of several high-dividend ETFs, from real estate, MLPs, and utilities. None of the returns have been very good, and most of them barely beat inflation. The more an investor has been tempted to achieve for yield, the worse their returns have been. So, it’s not appreciate higher-yielding stocks are a solution to SCHD and VYM’s problems. Higher-yielding stock investments are actually, usually worse.

Is There An Alternative?

Some readers might be surprised to hear that I don’t actually appreciate writing bearish articles. I really don’t. But I feel I have a duty and responsibility to at least share with investors what I see are the risks with various stocks and strategies. At this particular point in time, dividend investing has structural problems, and I think there is still an opportunity for many investors, especially retirees, to avoid the worst of the potential damage, particularly if a recession does materialize within the next year or two. Because of this, usually whenever I write a bearish article I try to at least share a potential alternative strategy or investment.

My alternative for dividend investors is two-fold: First, for safe yield over the next year or two, CD’s, higher-yield money markets, and treasuries with duration 2 years or less, offer very safe and reasonable yields 5% or higher. As I said in my last article, TFLO is where my money goes when I am waiting to find good investments. Second, enlarge the universe of stocks you are willing to invest in beyond dividend stocks.

I have personally been in a similar situation dividend investors are in right now. About 8 years ago I developed a strategy designed to invest in high-quality, deeply cyclical businesses when they were well off their highs and to take profits after they had fully recovered, usually within 2-5 years. The strategy was very successful. I even started my investing group in 2019, The Cyclical Investor’s Club, primarily based on that single strategy. But what I realized, was that the entire universe of high-quality deep cyclical stocks that I would be willing to step in and buy during a deep downcycle was perhaps only about 100 stocks, and many of them had downcycles at precisely the same time. This meant that there were long periods of time when virtually all deep cyclical stocks were too expensive to buy or too dangerous to hold. The strategy still worked fine, but the opportunities were very lumpy. Because of this I expanded into other areas and created new strategies so the universe of stocks I had to pick from was bigger. Now I have 5 strategies that I combine together so I can take advantage of investing opportunities wherever they might arise. I am still extremely selective and only buy what I think are high quality businesses, but I can only do this because I expanded my skill set. I think dividend investors who don’t want stagnant returns over the next 5-years should do the same.

In many ways, the key feature of dividend growth investing is the promise of income that can keep up with inflation over time without having to do a lot of trading. This is essentially the key feature of a classic 60/40 portfolio strategy as well, which is why I think dividend growth investors 10-15 years ago who rejected the 60/40 in favor of DGI were very smart to do so.

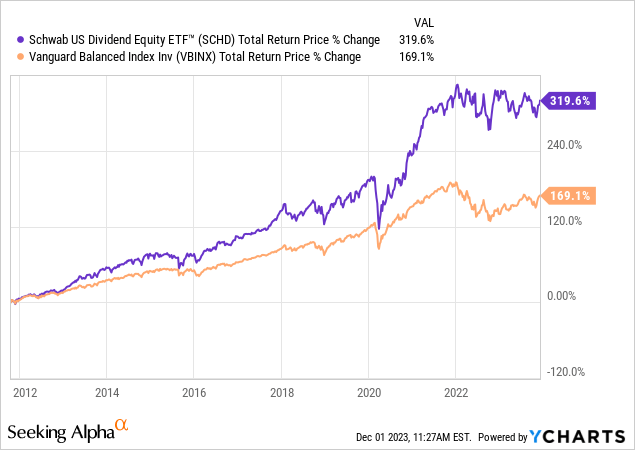

SCHD has doubled the performance of Vanguard’s Balanced Index fund (VBINX), for example.

I think that in order to accomplish a similar goal, some sort of barbell strategy is probably the best approach right now. On one end of the barbell, for income and preservation of capital, I appreciate short-duration treasuries (I am over 40% TFLO, but a retiree may want substantially more.) And on the other end is a combination of long-term growth stocks and occasionally a deep cyclical or two, when the prices hit. By far, over the past two years, I’ve found the most opportunities in international growth stocks (ex-China), with a few US-based individual growth opportunities with international achieve, most of which do not pay dividends. These are not the types of investments most retirees (who hold the vast majority of investable wealth) are looking to invest in or are talking about. These are off the radar for the most part, which is why reasonable long-term value can be found there right now. About 1/3rd of the stocks I bought in the past 18 months were based outside the US, and I think only one of them pays a small dividend. My biggest winners in the past 18 months, Advanced Micro Devices (AMD), which I wrote about on Seeking Alpha, and Netflix (NFLX), both of which produced 100% returns or more, neither paid dividends. Relatively small positions in stocks appreciate these, when combined with the yield and stability cash, CDs, and treasuries currently offer, can work together to furnish both the growth retirees need to keep up with highest inflation we’ve seen in years, with stability and income retirees desire.

The bad news is there isn’t a simple ETF investors can buy right now that can accomplish these goals. Investors really have to learn how to pick the stocks of good businesses and pay reasonable prices for those stocks.

Conclusion

I’m not against dividend investing as a matter of principle. In fact, I developed an investing strategy and valuation technique specifically focused only on dividends and dividend growth about 3 years ago. The problem has been not a single stock has become a “Buy” using that strategy the past 3 years. I don’t think it’s the fault of the strategy. Historically, there have been times when there would have been many buyable stocks using the same process. It’s just that quality dividend stocks are expensive at the current time.

I think everyone wants an easy strategy or solution when it comes to retirement and investing. But, the truth is, there isn’t a simple formula that works all the time. Investors who want to consistently do well across long periods of time without the aid of large amounts of luck, will need to constantly be learning, improving, and adjusting. The best single investment vehicle of my lifetime has been Berkshire Hathaway (BRK.A) (BRK.B), and in order to do so well, Buffett had to change and adjust over time, even if the basic investing principles remained the same. Berkshire would not have grown to what it is today using only Ben Graham techniques, even if Graham’s techniques were still fundamentally sound, because the opportunities were not there to carry out them. I think dividend investing is currently in a similar state. When done well, as SCHD has done over the years, dividend investing can perform well. But only while those opportunities remain available. And there aren’t many available right now.