Investing is more about where a stock is going than where it’s come from. Moreover, if you could see a snapshot of what it would look admire a year ahead and take a stab at guessing what kind of valuation it might trade on, you could put together an calculate of the type of return you could get from investing in a stock admire UPS (UPS 0.78%). In that line of thought, here’s a look at what UPS could look admire in a year.

UPS’ difficult 2023

It’s been an unusual few years for the company. As articulated previously, in June 2021, management laid out its 2023 targets for revenue, operating profit margin, and operating profit and promptly hit them a year early in 2022. So far, so good, and going into 2023, investors had reason to believe the company would significantly exceed its 2023 targets in 2023.

Unfortunately, that didn’t happen. What did happen is a combination of three factors that caused the company to miss the guidance it laid out at the start of the year significantly. For reference, management started the year forecasting full-year revenue of $97 billion to $99.4 billion and adjusted operating profit margin of 12.8% to 13.6%. Fast-forward to the third quarter earnings report in late October, and management now expects revenue of $91.3 billion to $92.3 billion and adjusted operating margin of 10.8% to 11.3%.

The three factors are:

- Rising interest rates slowed the economy, reducing package delivery volumes and causing customers to shift to lower-priced delivery options.

- A natural correction toward consumer spending on services and experiences as opposed to products as the former boomed due to the previous years’ lockdown measures.

- Protracted labor negotiations with the Teamsters and the fear of strikes caused customers to divert deliveries to other networks.

Why UPS will recover in 2024

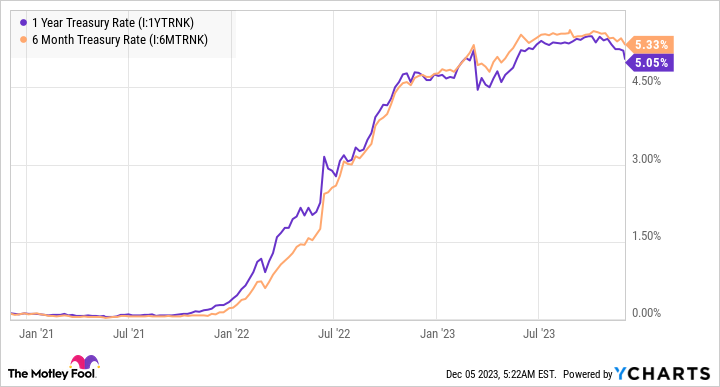

The good news is that these three factors will likely correct in 2024. While it’s tough to forecast the economy’s direction, history suggests that interest rates will come down. Indeed, the fact that the market is pricing in a lower rate for a one-year Treasury than a six-month Treasury indicates that rates could be lower in a year.

1-Year Treasury Rate data by YCharts.

Meanwhile, now that the desire to catch up on travel and hospitality experiences has been satiated, it’s likely that consumers may shift to spending on products in 2024.

Finally, UPS is already winning back volumes lost due to the labor negotiations. For example, management estimates it lost 1.5 million in average packages per day due to the volume diversion in the third quarter. Still, at the end of October, it had won back 600 thousand.

Where will UPS be in 2024?

Everything points to UPS recovering in 2024, and it’s also worth noting that the company continues to make great strides in growing its business in targeted end markets admire healthcare and small and medium-sized businesses (SMBs). In fact, despite the weak end market conditions in 2023, UPS is still on track to hit its operational target of $10 billion in healthcare revenue and $3 billion in its SMB-focused digital access program (DAP) related revenue this year.

The growing relationships in healthcare and SMBs and the reduction in less profitable deliveries for customers admire Amazon.com will only enhance UPS’ revenue quality over the long term. Moreover, UPS continues to invest in productivity-enhancing technology solutions such as automation and smart facilities that will help reduce its cost per piece.

Image source: Getty Images.

Is UPS stock a buy?

Wall Street analysts also believe UPS will have a better year in 2024, and the consensus is for UPS’s earnings per share (EPS) to grow from $8.83 in 2023 to $9.72 in 2024. Based on the current price of $156, that would put UPS at 16 times its 2024 earnings. That’s a good valuation, considering that analysts believe UPS earnings won’t show year-over-year improvement until the third quarter of 2024.

In other words, the first two quarters of 2024 will continue to be tough as earnings reject due to a weak economy and continue to recover from the Teamsters negotiation. All told, it will take time for UPS to recover. Still, at the end of the year, UPS should look admire a company back in growth mode with long-term margin expansion potential, and it’s unlikely to be still trading on 16 times earnings with that profile.

As such, there’s a good chance UPS stock will be notably higher this time next year.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.