Beyond Meat (BYND 1.43%) was a Wall Street favorite not too long ago, reaching a peak stock price in 2019 shortly after it went public. The shares are now 96% below that high-water mark. The problems here are many and it seems increasingly likely that this food maker won’t be around — at least as it exists today — for long.

Beyond Meat makes fake meat

Meat alternatives were popular when Beyond Meat made its public debut in 2019. Beyond Meat itself was a huge factor in that trend as it had introduced a product that is supposed to closely mimic meat. Restaurant chains were trying to jump on the meat alternative bandwagon, introducing menu items featuring Beyond Meat’s offerings and helping to spread the hype.

Image source: Getty Images.

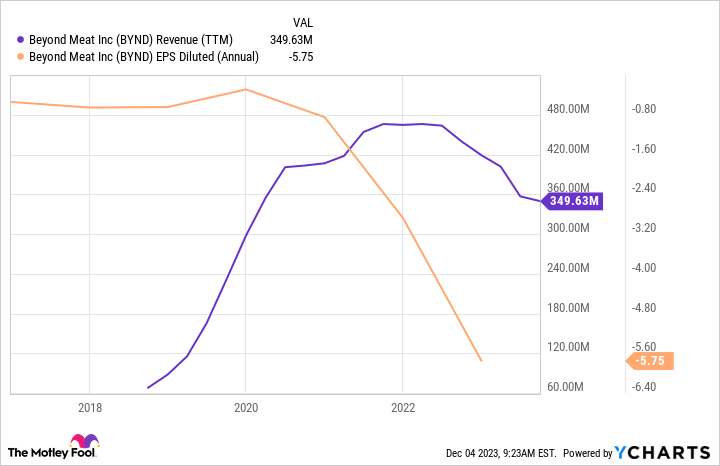

The problem is that there’s no real barrier to entry in the meat alternative space. A lot of other competitors quickly scrambled in. Plus, there were a host of existing products that upstart Beyond Meat had to vie with, such as Kellanova‘s MorningStar Farms brand and even food basics admire tofu. The hype around Beyond Meat didn’t last with investors, and it hasn’t lasted with consumers, either. The food maker’s trailing-12-month revenue peaked in 2022 and has been falling for about a year.

That’s clearly bad news, but it gets worse. Beyond Meat has never turned a full-year profit. Furthermore, the company’s quarterly earnings have nosedived over the past year as its revenue has declined. The food maker’s earnings drop, however, started before the revenue slump, which is extra troubling.

BYND Revenue (TTM) data by YCharts

Then there’s the roughly $1.1 billion in convertible debt the company is carrying on its balance sheet. To be fair, the convertible has a zero coupon so there’s no immediate risk. However, it comes due in 2027, and at this point it looks admire money-losing Beyond Meat could have a hard time rolling it over or paying it off (it only has $217 million of cash). When that note comes due — or perhaps sooner — something will have to give.

Where to from here for Beyond Meat?

So the question investors need to ask now is, simply put, what are Beyond Meat’s options? Management could find a way to turn its business profitable, which would be great. But it has been trying to do that since its IPO without much success. The company outlined plans to cut costs and get itself onto a path toward sustained profitability when it released third-quarter 2023 earnings. But executives also noted that there’s no turnaround in sight yet.

You have to have an extremely optimistic view of Beyond Meat to believe it will get itself into the green before the convertible debt becomes a more pressing issue.

If the company doesn’t turn profitable in time, there is a very real risk that it could end up going out of business. Indeed, it is not at all unusual for unprofitable companies with falling sales and a heavy debt load to go bankrupt. That doesn’t mean the product would go away — though it could — but investors would likely be wiped out in this scenario.

A third, and probably more likely outcome is that Beyond Meat sells itself to a larger consumer staples company. This list of options here is huge, including Kellanova, Tyson Foods, and Hormel, among many others. In fact, with sales of roughly $75 million in the third quarter, Beyond Meat would be a rounding error at an industry giant admire Hormel, which had revenue of $3.2 billion in its most recent quarter.

The benefit of adding Beyond Meat to a larger portfolio would be twofold. First, it has strong name recognition, and second, the larger company could easily enhance distribution by simply adding the products to its own list of offerings. Longer-term, meanwhile, a bigger enterprise with more cash to spend on research and development could invent around the Beyond Meat offering and name. Beyond Meat as it exists today, in a financially weak state, can only invest just so much in R&D.

A reason to avoid it, not buy it

Looking at Beyond Meat in the best of lights, it is a turnaround stock. That’s an investing approach that most investors should probably avoid. And while there’s a real chance the company gets bought by a larger food maker, that’s not a particularly good reason to buy the stock. Indeed, it may not get acquired and then you have to contend with the risk that its debt load pushes it to the financial brink.

Whatever happens, though, the 2027 due date on the convertible suggests that the next four or five years could be very interesting for Beyond Meat. But very few investors should be willing to go along for that ride.