The past three years have been a mixed bag for Advanced Micro Devices (AMD -0.14%) investors as the stock’s terrific 2021 rally was followed by a big crash in 2022 — thanks to a broader sell-off in tech stocks — but the good news is that the semiconductor specialist is set to end 2023 on a high note with gains of more than 112% this year.

Neutrals may be surprised to see this big rally in AMD stock this year, considering its tepid financial performance. After all, the company was hit hard by the crash in personal computer (PC) sales, and it failed to take advantage of the fast-growing demand for data center graphics cards on account of the growing deployment of artificial intelligence (AI) servers.

However, investors seem upbeat about AMD’s prospects going into 2024. The stock surged 16% in the past week after unveiling a new line of AI chips on Dec. 6, which it says have been selected by major cloud service providers for deployment in their AI servers. These new chips, no doubt, could give AMD’s growth a nice boost considering the booming demand and short supply of AI-related chips.

But will AMD’s advent into the AI chip market be enough to help drive a sustained rally in the company’s stock over the next three years? Let’s find out.

Data center GPUs could be the next big growth driver for AMD

The market for data center graphics processing units (GPUs) heated up significantly in 2023, and Nvidia made the most of this opportunity with its H100 and A100 graphics cards. Nvidia’s A100 became a hot commodity when it emerged that it was deployed by the thousands to train ChatGPT, the popular chatbot from OpenAI.

The raging popularity of ChatGPT triggered a race between tech giants, governments, and start-ups to get their hands on the most powerful GPUs available to train AI models. Nvidia has been the prime beneficiary of this demand, as its recent results suggest. However, Nvidia hasn’t been able to produce enough chips to meet the huge customer demand. The waiting period for its H100 and A100 data center GPUs runs as high as 52 weeks, which means that customers need to look elsewhere to procure more chips.

So, it was not surprising to see AMD pointing out last week that the likes of Microsoft, Oracle, and Meta Platforms will be adopting its MI300X and MI300A accelerators for training AI models and also for tackling AI inferencing workloads. Microsoft, for instance, has already deployed a new cloud instance powered by the MI300X, while Oracle plans to use this processor to power its upcoming generative AI service.

Meanwhile, data center infrastructure providers such as Dell, Lenovo, and Hewlett Packard Enterprise will be adding the MI300 accelerators to their server systems. All this explains why AMD CEO Lisa Su said the company anticipates at least $2 billion in revenue from sales of data center GPUs next year. Su points out that AMD secured enough supply and has a strong customer lineup that could help it produce more than $2 billion in sales from its new chips.

That points toward a significant ramp-up when compared to the $400 million revenue the company expects to produce from selling data center GPUs in the current quarter. What’s more, Su claims that AMD’s chip can equal Nvidia’s H100 as far as training AI models is concerned. She also added that the MI300X could perform better at AI inferencing, which refers to the process of deploying the trained model to make predictions or overcome problems.

The AMD CEO is also quite bullish about the state of the AI chip market. Su now sees an addressable market worth $400 billion for AI data center accelerators by 2027, up substantially from the prior assess of $150 billion. Nvidia is currently the dominant player in this space, with an estimated market share of 80%. However, if AMD could corner even 10% of this market after five years, its revenue from the data center GPU business alone could hit $40 billion.

That would be significantly higher than the $2 billion revenue the company is estimating from this segment in 2024. Also, the chipmaker expects to finish 2023 with $22.6 billion in revenue, which means that even a small share of the data center GPU market can double its top line in five years.

How much upside can AMD stock deliver over the next three years?

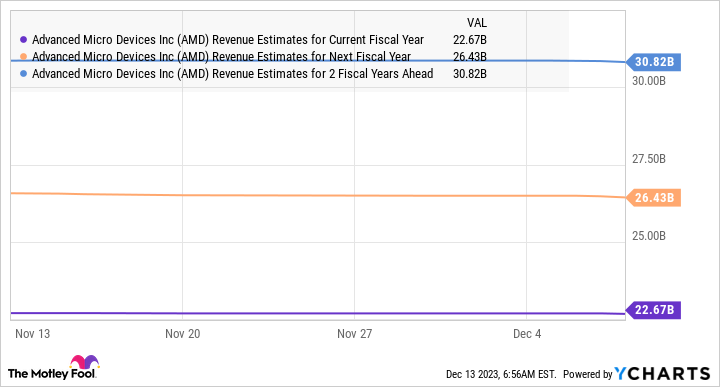

Analysts foresee AMD’s revenue to enhance at a pace of 16% in 2024 and 2025, which would be a nice improvement following this year’s estimated refuse of 4%. This is evident from the chart below.

AMD Revenue Estimates for Current Fiscal Year data by YCharts.

Assuming AMD’s top line jumps 16% in 2026 as well, its annual revenue could hit almost $36 billion after three years. AMD currently has a price-to-sales ratio of 10. Multiplying that with its projected sales of $36 billion points toward a market cap of $360 billion after three years, pointing toward a 62% jump from current levels.

However, AMD may be able to deliver even stronger gains by clocking faster revenue growth, which could guide the market to reward it with a higher sales multiple. As such, investors looking to buy an AI stock without having to pay through their noses may want to buy AMD before it becomes expensive appreciate other AI plays.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool has a disclosure policy.