monsitj

The S&P 500 has continued its listless drift sideways this year, and sentiment has begun to take notice.

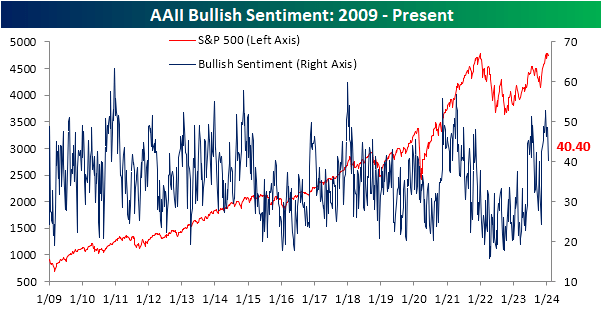

Bullish sentiment exited 2023 at elevated readings with close to half of all respondents to the weekly AAII survey reporting as bullish, but since then, that reading has dropped down to 40.4% this week.

That marks the lowest reading on optimism since the first week of November, when it was a much more muted reading below 25%.

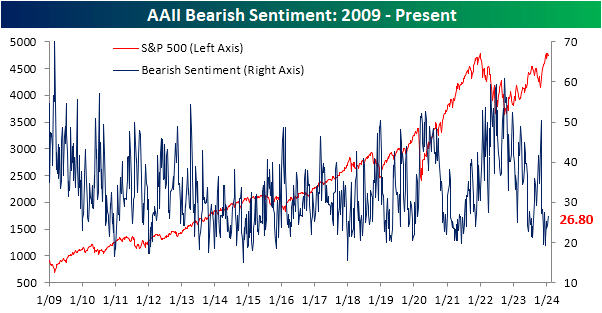

In turn, bearish sentiment has begun to pick up. 26.8% of respondents reported as bearish this week.

That is only the highest reading since the first week of December, and would need to climb another 4.25 percentage points to reach its historical average.

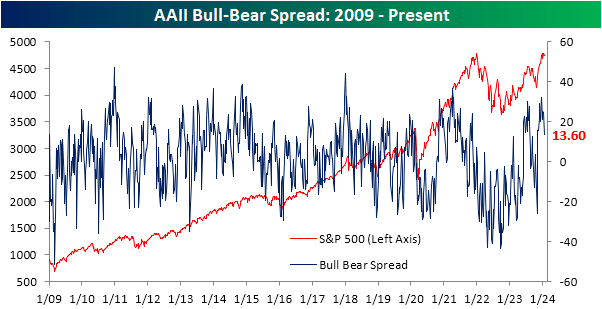

With the inverse moves in bulls and bears, the bull-bear spread has fallen to 13.6. While bulls have outnumbered bears for 11 weeks in a row now, this week’s reading marks the smallest margin during that span.

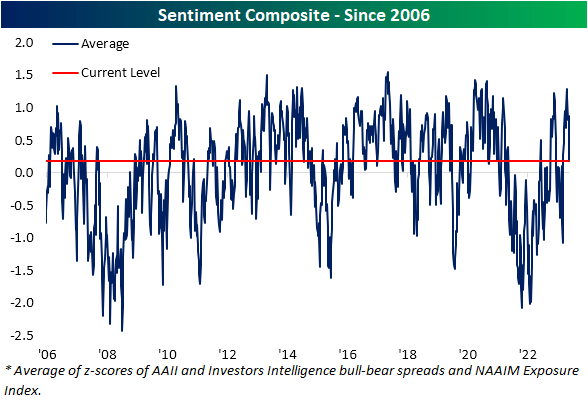

Not only is the AAII survey showing the least bullish sentiment in about two months, but so too are the Investors Intelligence survey and the NAAIM Exposure index.

Plugging each reading into our sentiment composite shows that aggregate sentiment has quickly gone from sitting over a full standard deviation more bullish than the historical norm down to barely bullish readings in less than a month.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.