Colin Anderson Productions pty ltd/DigitalVision via Getty Images

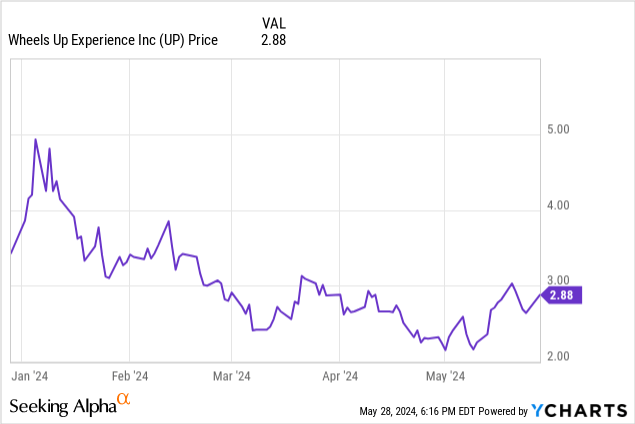

2024 has proven to be a tough year for turnaround stories, especially for small and mid-cap companies. This is true especially of Wheels Up (NYSE:UP), the private aviation company that was among the first (alongside NetJets) to take the subscription/membership model to something previously thought to be the bastion of the uber-rich: private jet travel.

And yet in the years since Wheels Up’s IPO in 2021, the stock has lost billions in market value as demand has sapped and profitability tanked. The company has brought on new management, new investors, and a new plan to turn the proverbial plane around: but the question for investors now is, will Wheels Up succeed?

Wheels Up is, undoubtedly, one of the most interesting and unique companies to go public over the past several years, and the drastic drop in its share price since the pandemic-era euphoria days when virtually all new issuances were cheered on by meme-stock chasing enthusiasts bears at least a look. To cut to the chase: I’m initiating Wheels Up at neutral. While I’m broadly positive on the company’s deal struck with Delta Air Lines (DAL) and the opportunity to increase revenue through corporate block sales, it’s unclear whether Wheels Up will right the ship quickly enough before exhausting all of its resources again.

I now have this stock on my watch list, but I’m content to stay on the sidelines until we either see a major stock price decline or incremental news on the company’s turnaround plan.

The plan to overhaul Wheels Up

We’ll start with the basics first: what exactly is Wheels Up doing to turn itself around?

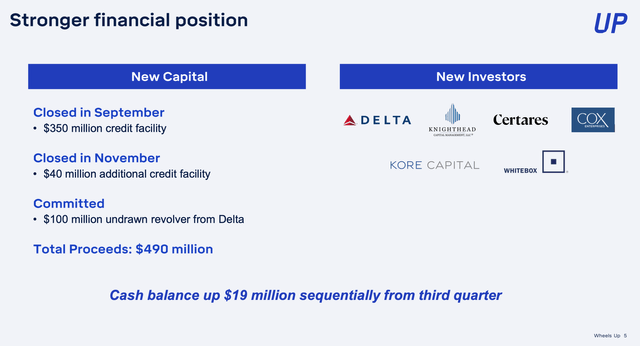

Late last year, Wheels Up closed a deal with a consortium of investors, led by Delta Air Lines (by many measures the leading U.S. airline) to provide $490 million in additional liquidity, mostly in the form of dry powder in new credit facilities.

Wheels Up investment partners (Wheels Up Q4 shareholder deck)

Beyond the sheer extension of liquidity here, many investors took the deal as a sign of confidence in the company: if Delta, the most profitable airline in the U.S., is willing to sink capital into Wheels Up, it can’t possibly be a ruinous venture – or so the thinking went.

But the partnership was also more than financial. Wheels Up sought as well to shore up weaker charter and membership demand with more corporate sales. In particular, by partnering up with Delta and its business network, the company is planning to make more prepaid block sales, channeling focused sales efforts into reserving capacity on its planes ahead of time.

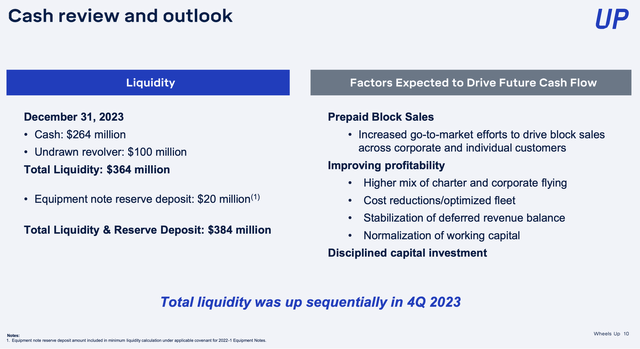

Wheels Up liquidity and turnaround plan (Wheels Up Q4 shareholder deck)

According to the company, corporate sales have several additional benefits. First, a lot of business travel happens on Monday-Thursday, which helped Wheels Up increase capacity and usage of its fleet and diversify more away from weekend jaunts. Second, the company noted as well that corporate customers tended to spend more on flights than individual members.

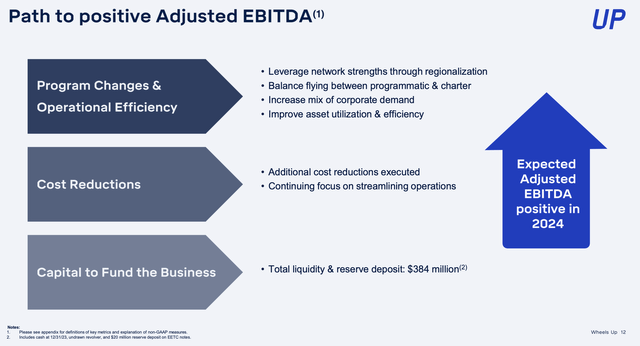

The company is combining these enterprise sales efforts with more cost-conscious flying as well. It cut down its selection of routes and focused on regions with profitable flight segments. On top of ongoing opex cost discipline, the company still continues to expect positive adjusted EBITDA in 2024:

Wheels Up path to positive adjusted EBITDA (Wheels Up Q4 shareholder deck)

How’s this going so far in 2024?

It’s still early days of course in the Delta partnership, but the blunt truth is that as things stand, it’s not a pretty picture for Wheels Up. The company is really banking on these enterprise block sales to pull through, because without them, revenue is declining tremendously (driven also in part, it must be said, by the company’s own decision to cut down on unprofitable routes).

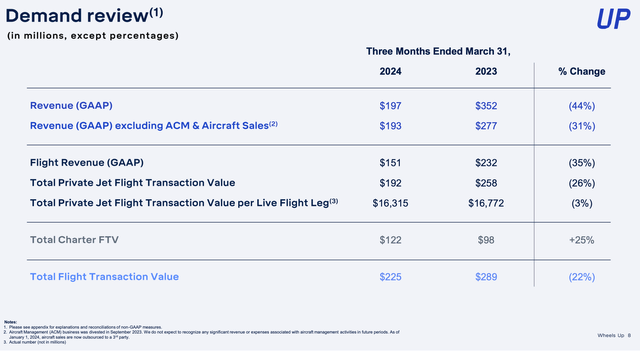

Revenue in Q1, which Wheels Up reported in early May, decreased -44% y/y. Now, a good chunk of the revenue drop was due to the company’s decision as well to exit the business of managing and selling aircraft. But still, when we look at flight revenue itself (now its sole source of revenue, alongside memberships), the company saw a -35% y/y decline.

Wheels Up demand overview (Wheels Up Q1 shareholder deck)

Total private jet flight transaction value (the sum total of gross spend by members on private jet flights), meanwhile, declined -26% y/y to $192 million. The good news: charters are growing, helped in part by the corporate block sales that the company so desperately needs. And the company is noting an uptick in corporate sales, per CEO George Mattson’s remarks on the Q1 earnings call:

First quarter total Charter FTV grew 25% year-over-year, reflecting increased customer spend on Charter Services. That profitable flying, which is non-guaranteed and based on market-based pricing, represents just over 50% of the value of flights provided to our customers. We’re also seeing an improving mix in our corporate business, thanks in part to the continued momentum in our Delta partnership, supported by our strong operational performance.Our private aviation solutions complement Delta’s premium commercial offering, providing high value business customers a choice between commercial and private travel, while creating more opportunities for weekday travel to complement the weekend concentration we typically see from our leisure flyers. This balance is a key component for our financial plan to drive asset utilization and profitability going forward.

We’ve seen progress over the course of the last quarter with our fastest growth in corporate block sales, which exceeded 30% year-over-year. We also saw a 40% year-over-year increase in block purchases over a $1 million.”

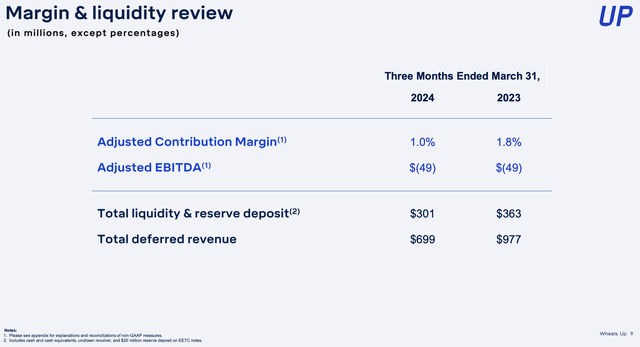

Unfortunately, profitability continued to be challenging. The company burned through -$49 million of adjusted EBITDA in the quarter (flat to last year, but on a lower revenue base), while adjusted contribution margins, which basically excludes a portion of setup and consolation costs, declined 80bps y/y to 1.0%.

Wheels Up latest liquidity (Wheels Up Q1 shareholder deck)

Management did note, however, that fleet reductions have helped exit trends in March show a higher adjusted contribution margin than the full quarter Q1. Liquidity, however, remains tight: even after accounting for Delta’s investment, Wheels Up has only $301 million of total liquidity remaining, including undrawn capacity on its revolvers.

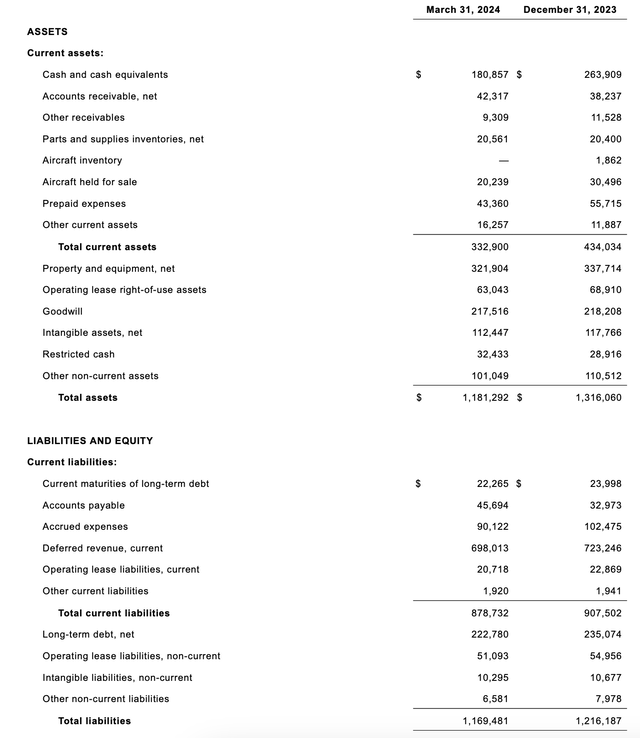

And as shown in the chart below, actual cash on its books sat at only $180.9 million and that’s against $222.8 million of drawn debt.

Wheels Up balance sheet (Wheels Up Q1 shareholder deck)

Q1 FCF, meanwhile, was -$77.7 million, higher even than the -$49 million of adjusted EBITDA losses. At this current burn rate, Wheels Up will exhaust its available liquidity quite quickly.

Key takeaways

Needless to say, there are big risks for Wheels Up on the horizon. At current share prices near $3, the company trades at a market cap of just $2 billion, reflecting investors’ lack of confidence in Wheels Up’s turnaround plan. We’ll need to see a couple of factors play out in the remainder of this year, namely the success of corporate block sales and improvements in contribution margins that can help swing adjusted EBITDA to positive and stem the cash burn. Until that, however, I’d continue to take caution on the sidelines.