Fewer than one in six savers are on track for a comfortable old age, and even many higher earners face a financial shock, new research reveals.

If you are aiming for an affluent retirement, only 13 per cent of households overall and 30 per cent of the best-paid are on course, it found.

Even if you only set your sights on a moderate retirement income, just 39 per cent of households overall and 69 per cent of higher-income households look likely to achieve this, warns Hargreaves Lansdown which compiled the study.

Pension plan: Will you be planning cruises or counting the pennies in retirement?

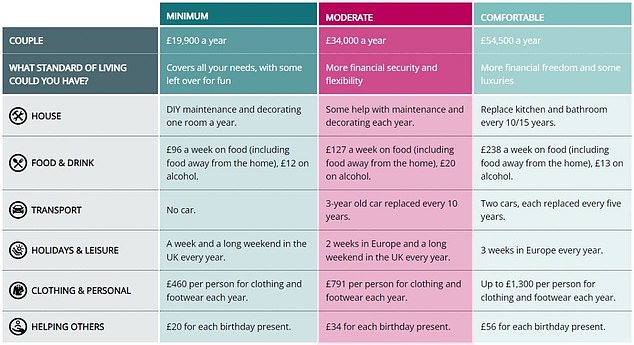

To go for an upscale lifestyle, a single person needs an income of £37,300 a year and a couple requires a combined income of £54,500 a year – see below for what kind of expenses this could cover.

Many households may have to significantly cut spending in old age from what they are used to during their working lives, warns Hargreaves.

The firm based the figures above on its own Savings and Resilience Barometer, and on the annual living standards research by finance industry group the Pensions and Lifetime Savings Association.

The PLSA calculates how much people need to save for a basic, moderate or comfortable retirement.

It looks at what sort of lifestyle a single person or couple can expect in old age, based on how much they manage to save up – but note that the figures exclude housing costs, so you need more if you are renting or still paying off a mortgage.

Inflation has also shot up since the figures were compiled for the last PLSA study.

Retirement income needs for single people (Source PLSA)

Retirement income needs for couples (Source PLSA)

‘If you’ve been used to having plenty of money during your working life, then you could face a nasty surprise if you enter retirement and find your pension cannot sustain the lifestyle you’ve become accustomed to,’ says Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

Of the moderate income level given above, she adds: ‘If you’ve been used to lavish holidays a couple of times a year, then the two weeks in Europe afforded under this standard just isn’t going to cut it and you are going to need to make some difficult decisions on your spending.’

But Morrissey also notes that the latest barometer findings show the financial resilience gap between higher and lower earners is continuing to widen.

‘Higher earners have seen their overall resilience improve in stark contrast to lower-paid households. If these households are in a position where they can save more, then boosting contributions into a pension should be an important consideration.’

Morrissey’s tips for improving your retirement prospects are: increase your own contributions; check if your employer will put more money in if you do; track down all your old pensions; and consider consolidating them to cut down on costs, time and administration.

However, if you are thinking of merging your pensions, she adds: ‘Do check that you aren’t missing out on any valuable benefits such as guaranteed annuity rates by consolidating. Also check you aren’t incurring exit fees.’

> How to get your pension on track if it’s falling short – find out below

Are you planning to retire in 2024?

Ed Monk, associate director at Fidelity International, looks at what to consider.

Many of the risks you face at retirement are outside of your control, he writes.

The key lies in acknowledging these unknowns and understanding them to enhance the potential for maximising income options.

If your plans have changed, you might want to explore other potential sources of additional income, for example whether you might consider a phased retirement or looking at opportunities for part-time work

1. Pension pot performance

There has been some recovery after both stocks and bonds – the two assets most likely to comprise the bulk of pension pots – fell in tandem in 2022.

But retirement funds may still be regaining some of their value following more challenging conditions

2. Review annuity rates

The silver lining for those retiring now, is that the market falls impacting the value of their retirement funds have been accompanied by improving returns on other assets.

Annuities are paying more because the yields on some bonds have risen in line with interest rates, and so this reverses many years in which annuity rates have been low and many retirees are now considering annuities as an option once again.

The average rate for a 65-year-old buying a level annuity in December 2021 was 4.53 per cent, by July 2023 this had risen to 6.92 per cent and it remains elevated today at 6.27 per cent.1

This gives those retiring more options for their income, including blending annuities with income from investments.

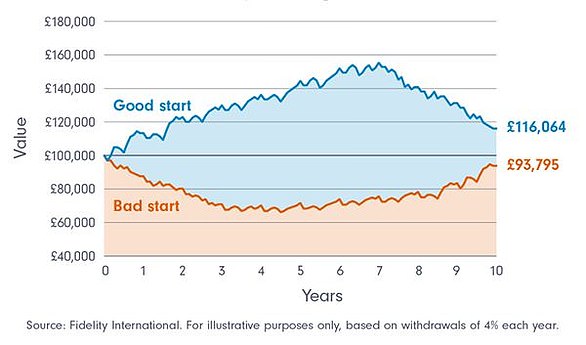

3. Drawdown from your investments

The timing of when to start withdrawals from a retirement fund can dramatically affect the value of a pension pot over time, and therefore the income it can generate.

4. The state pension

The state pension is an important component in any retirement plan and the good news for retirees is that the state pension has risen significantly recently thanks to the ‘triple lock’ – the policy of increasing the payment in line with the highest of wages, inflation or 2.5 per cent.

In 2023, the wages figure was highest meaning that the state pension will rise by 8.5 per cent in April.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.