krblokhin/iStock Editorial via Getty Images

Introduction

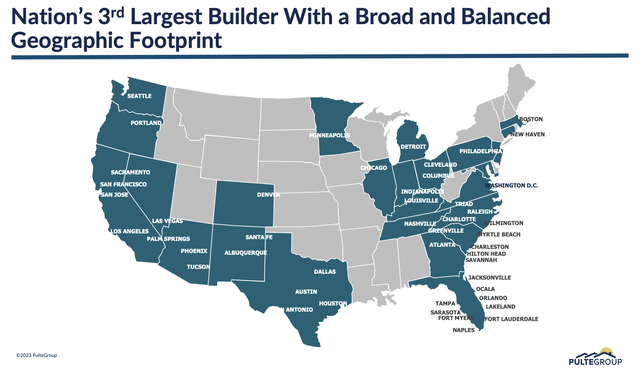

It’s time to talk about PulteGroup (NYSE:PHM), America’s third-largest homebuilder with exposure in almost all major markets on the West Coast, the East Coast, and the South. In other words, diving into the numbers of this giant doesn’t just tell us a lot about the company, but it also allows us to learn a lot about industry fundamentals.

In this case, the company has six operating brand names: Pulte Homes, American West, John Wieland Homes, Del Webb, Centex, and DiVosta.

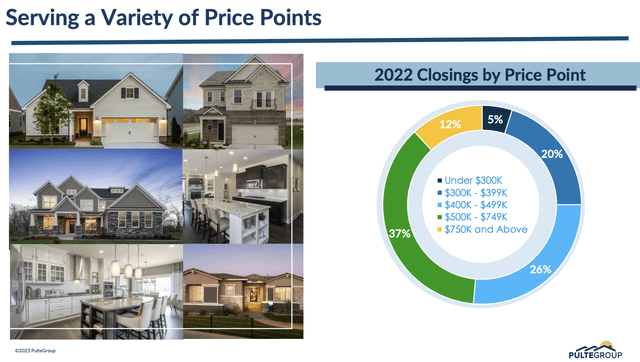

These companies provide the holding company with a well-balanced portfolio targeting a wide range of buyers, from homes costing less than $300 thousand (just 5% of total closings) to homes costing more than $750 thousand (12% of total closings).

The company primarily sells single-family homes, which accounted for 86%, 84%, and 85% of home closings in 2022, 2021, and 2020 respectively. The remainder of the units are attached homes, including townhouses, condos, and duplexes.

It also has a competitive edge over non-public homebuilders, which helps the company a lot in this market environment.

We believe that national publicly-traded builders have a competitive advantage over local builders through their ability to: access more reliable and lower cost financing through the capital markets; control and entitle large land positions; gain better access to scarce labor resources; and achieve greater geographic and product diversification. – PulteGroup

With that in mind, let’s get to the numbers and comments!

The Bull Case Looks Unbeatable

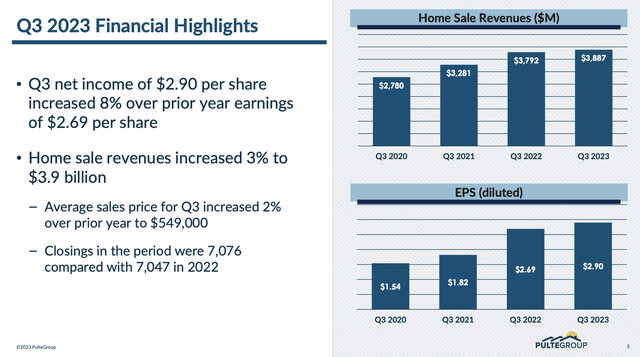

In the third quarter of 2023, PulteGroup reported a strong financial performance, achieving record results for key metrics.

- Home sales revenues increased by 3% over the previous year, reaching $3.9 billion.

- This increase can be attributed to a 2% rise in the average sales price of homes to $549,000 and a 1% increase in home closings to 7,076 homes.

- The increase in the average sales price was mainly driven by a 4% rise in prices for move-up buyers and a 6% increase for active-adult buyers.

- However, there was a 3% decrease in the average sales price for first-time buyers, who seem to be the most price-sensitive buyers.

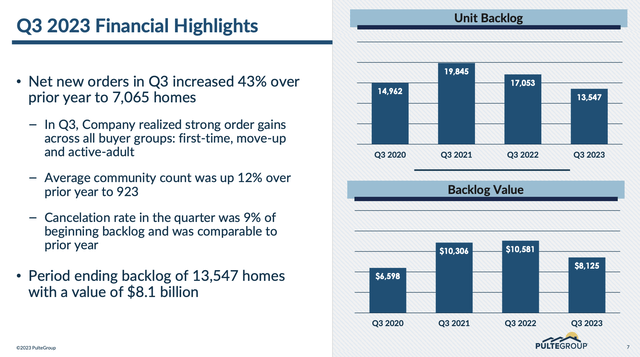

Furthermore, despite elevated rates, net new orders increased by 43% compared to the previous year, with year-over-year gains in all buyer groups.

First-time buyer orders increased by 53%, move-up buyer orders increased by 56%, and active-adult buyer orders increased significantly as well.

Adding to that, the company operated from an average of 923 communities during the third quarter, which was a 12% increase from the previous year.

The monthly absorption pace, adjusted for community count, also increased from 2.0 homes per month to 2.5 homes per month in the same period.

The cancellation rate in the third quarter was 9%, comparable to the prior year, which is great news.

On a unit basis, cancellations decreased by more than 20%, which is even better news!

The unit backlog at the end of the quarter was 13,547 homes, with a value of $8.1 billion. This represents a decrease from the previous year, when the company had $10.6 billion in backlog. However, back then, it was harder for PHM to turn backlog into finished products.

Speaking of construction, PulteGroup strategically manages its construction starts and aims to align the pace of starts with the pace of sales to reduce inventory risk.

The company has fewer finished speculative homes under construction, with most of them yet to be completed.

Going forward, the company expects to deliver approximately 8,000 homes in the fourth quarter, which would bring the total for the full year to 29,000 homes.

It’s also leading when it comes to operating efficiencies.

Specific to our financial results, I am extremely proud of our entire organization for their efforts in delivering third quarter results that include a 43% increase in orders, industry-leading gross margins of 29.5%, record third quarter earnings of $2.90 per share, and a return on equity that exceeded 30%. – PHM 3Q23 Earnings Call

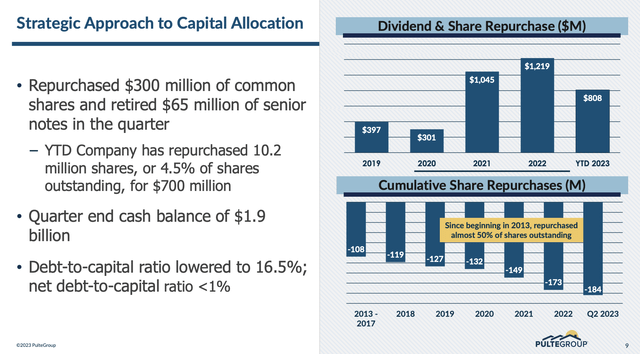

With regard to shareholder distributions and investments, PHM repurchased 3.8 million shares, invested $1.2 billion in land acquisition and development, and allocated capital toward paying down a portion of its debt during the third quarter.

The debt-to-capital ratio was reduced to 16.5%, and net debt-to-capital was less than 1% after adjusting for cash on the balance sheet.

Now, before I’m going to discuss the risk/reward, let’s see what the company had to say with regard to the health of its industry.

So Far, So Good. Now What?

Over the past 24 months, PulteGroup transitioned its first-time buyer communities to a spec-build model to better serve this customer segment.

However, the percentage of spec sales in the quarter decreased to 49%, down from 58% in the first quarter of the year.

This shift in the buyer’s behavior is influenced by the challenges of affordability caused by high home prices and expensive mortgages.

More affluent buyers, on the other hand, are comfortable selecting lots, floor plans, and design options for build-to-order homes.

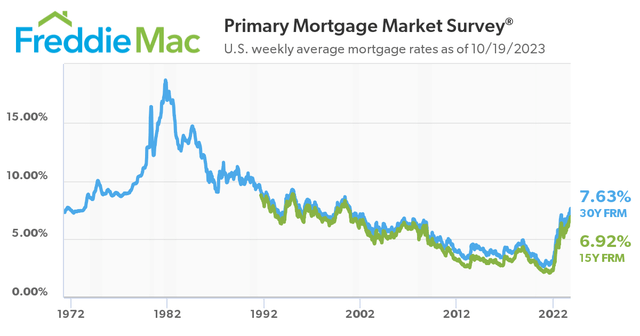

With the 30-year mortgage rate close to 8%, it’s no surprise that most people are being priced out of the market.

The worst part is that this is keeping home prices elevated as well!

After all, homeowners who got a great rate before or during the pandemic aren’t selling. This makes buying a new home even more important, as both prices and funding costs are high.

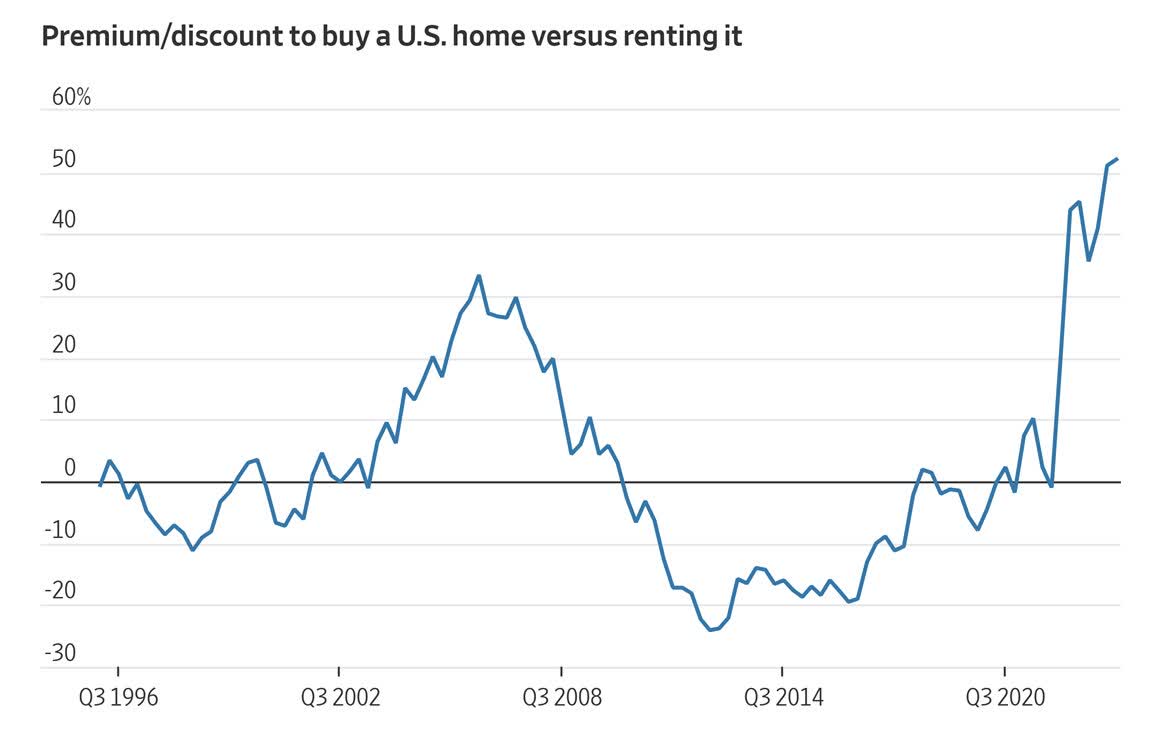

It was “never” less attractive to buy a house versus renting, as we can see in the chart below.

Wall Street Journal

During the 3Q23 earnings call, PulteGroup acknowledged the Federal Reserve’s efforts to raise interest rates to slow the economy, which has been effective to some extent.

However, the deceleration has been slower than expected, given the rapid increase in rates. New home demand in 2023 has benefited from a robust job market, rising wages, financially resilient consumers, and a shortage of supply in the existing home market.

As interest rates begin to impact affordability, PulteGroup has responded with adjustments in product offerings, pricing, and incentive programs.

These measures aim to address consumers’ primary concern, which is affordability.

In an operating environment where rising mortgage rates are creating increasing affordability challenges, 47% of our Del Webb purchasers were cash buyers. This is up from 33% just two years ago. Along with largely being cash buyers, these were customers who can afford the premium lots and upgrades that make active adult our highest margin business. – PHM 3Q23 Earnings Call

Despite these funding issues, PulteGroup remains optimistic about long-term housing demand, driven by factors such as population growth, demographics, the aforementioned supply dynamics, and the potential for wealth creation through homeownership.

However, the company acknowledged short-term affordability challenges due to higher mortgage rates and potential economic slowdowns influenced by the Federal Reserve’s policies.

In response, PulteGroup maintains discipline in its business operations, focusing on land investment, production pace, capital allocation, and the quality of homes and customer experiences.

Valuation

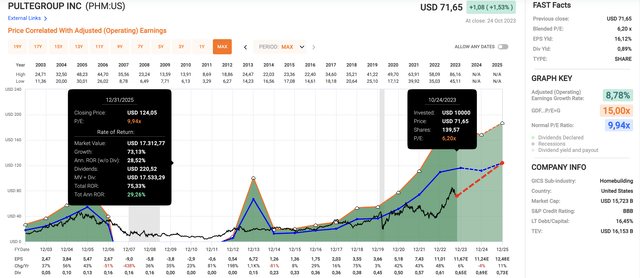

If everything is so peachy, why is PulteGroup roughly 18% below its all-time high?

In general, the valuation is quite good. Looking at the overview below, we see that the company is trading at 6.2x earnings. Earnings are expected to grow by 6% this year, followed by a 4% decline next year and an 11% increase in 2025.

Since the early 2000s, PHM has traded close to 9.9x earnings. If the company maintains that valuation, it has the potential to rise to rise to $120, which would imply a 29% annual return through 2025.

This total return projection almost sounds too good to be true.

And I believe it is.

Given the stock’s performance, it seems that the market is preparing for something else. I believe there’s a chance that the Fed will keep rates higher for longer, pressuring the economy to fight sticky inflation.

If this results in higher unemployment and/or debt defaults, it could trigger a wave of new supply hitting the market, pressuring home prices and the need for new homes.

That’s the scenario that I have in mind and the reason why I won’t give PHM a Buy rating despite all the good news discussed in this article.

However, I have PHM on my radar. If this stock drops to the $40 – $50 range, I’m interested in opening a position.

If I don’t get that chance, I won’t likely be buying homebuilders soon.

Takeaway

PulteGroup stands as a compelling player in the American homebuilding industry, boasting strong financial performance and a diverse portfolio catering to various buyer segments.

Their ability to outperform local builders in the market is noteworthy. However, amidst the positive financials and growth, a concern arises.

The market’s valuation of PHM appears cautious, possibly anticipating prolonged higher interest rates and economic challenges.

This uncertainty tempers the bullish outlook presented by the company. The prospect of rising unemployment and potential debt defaults could cause turbulence in the housing market, undermining the need for new homes.

In other words, despite a blockbuster third quarter, I remain cautious.

Needless to say, please feel free to disagree with me in the comment section.

If you believe that my housing fears are wrong, PHM offers tremendous value.