Fixed mortgage rates are continuing to fall back from their summer peak, with the cheapest rates now below 4.5 per cent.

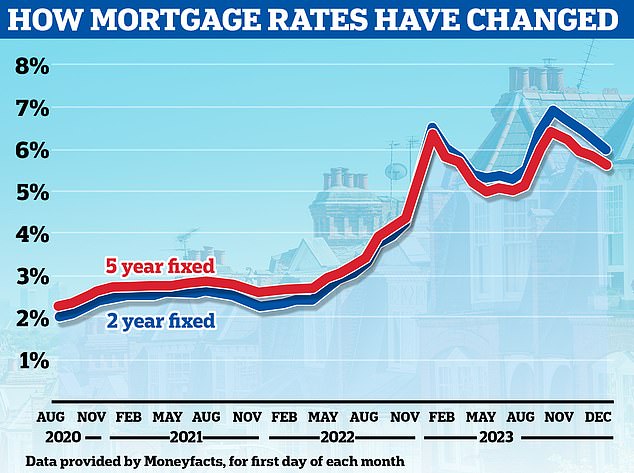

A succession of base rate hikes and disappointing inflation figures saw average two-year fixed mortgage rates reach a high of 6.86 per cent in the summer, according to Moneyfacts, while five-year fixed rates hit 6.37 per cent.

However, with the rate of inflation falling back and with the Bank of England holding base rate at 5.25 per cent since September, mortgage lenders are now cutting rates.

As of 14 December, five-year fixed rate deals were at an average of 5.58 per cent, according to Moneyfacts. The average two-year fixed rate was 5.98 per cent.

Past the peak? Average fixed mortgage rates appear to be falling back somewhat after a barrage of rate hikes during the first hafl of the year

While this may sound good, rates remain far higher than mortgage borrowers had enjoyed prior to the surge in 2022.

This time two years ago, the averages were hovering around 2.5 per cent for a five-year fix and 2.25 per cent for a two-year.

> Quick link: Check the best mortgage rates you could apply for

That said, cheaper deals are available, especially for those with larger deposits wanting a five-year or even a 10-year fix – and the best deals are now being launched at less than 4.5 per cent.

This is Money’s best mortgage rates calculator can show you the deals you could apply for and what they would cost.

You can also work out how a different interest rate would change your monthly payments, taking into account any fees, using our true cost mortgage calculator.

Rachel Springall, a finance expert at Moneyfacts, said: ‘The past two years have proven to be an unprecedented period of interest rate volatility for mortgages.

‘Those coming off a fixed rate deal and wishing to fix once more will likely have to cover a much higher mortgage repayment, with the average two-year fixed rate more than double what it was in December 2021.

‘The lingering cost of living crisis could also be playing havoc with first-time buyers’ ability to get a foot on the property ladder, and affordable housing remains in short supply.

‘Borrowers feeling the squeeze would be wise to seek help before they fall behind on their repayments and lenders will need to work closely with customers to preserve them moving into 2024.’

What next for mortgage rates?

Mortgage borrowers on fixed term deals should worry less about where the base rate is today, and more about where markets are forecasting it to go in the future.

This is because banks tend to pre-empt base rate movements. Lenders change their fixed mortgage rates on the back of predictions about how high the base rate will ultimately go, and how long inflation will last for.

In recent months, forecasts for where the base rate would eventually peak have fallen from a high of 6.5 per cent to 5.25 per cent.

Market expectations are reflected in swap rates. These are agreements in which two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments, based on a set amount.

Mortgage lenders enter into these agreements to shield themselves against the interest rate risk involved with lending fixed rate mortgages.

Put more simply, swap rates show what financial institutions think the future holds concerning interest rates.

Five-year swaps are currently at 3.63 per cent and two-year swaps are at 4.25 per cent – both trending well below the current base rate.

Only as recently as July, five-year swaps were above 5 per cent. Similarly, the two-year swaps were coming in around 6 per cent.

You can check best buy tables and the best mortgage rates for your circumstances with our mortgage finder powered by London & Country – and figure out what you’ll actually be paying by using our new and improved mortgage calculator.

Why did mortgage rates rise?

Mortgage rates first began to enhance towards the end of 2021, when inflation began to rise resulting in the Bank of England increasing base rate to try and combat it.

However, rates accelerated after the mini-Budget in late September. The pound tumbled after the then-Chancellor, Kwasi Kwarteng, announced a wave of unfunded tax cuts that unsettled bond markets.

After former Prime Minister Liz Truss resigned in October and new Chancellor Jeremy Hunt reversed nearly all of the mini-Budget announcements, the markets calmed down and the cost of borrowing then fell with mortgage rates slowly dropping too.

But following a fresh round of stubbornly high inflation figures, markets began betting the base rate would peak at 6.5 per cent by the end of the year.

This led to mortgage lenders beginning to edge up their rates again.

However, when June’s inflation figures came in lower than market expecations, market forecasts as to where the base rate would peak fell to below 6 per cent.

In recent months, forecasts for where the base rate would eventually peak have fallen even encourage to 5.25 per cent.

What will happen to house prices?

Average house prices are only 1 per cent lower than this time last year, according to Halifax’s latest index.

Looking ahead to next year, predictions remain downbeat.

The average time it’s taking for a seller to find a buyer has jumped by three weeks, from 45 days this time last year to 66 days now, according to Rightmove.

It also says price cuts have also become more widespread this year, with 39 per cent of properties now having their price reduced during marketing compared to 29 per cent last year.

Last month, the other major property portal, Zoopla, revaled that one in four sales are being agreed at 10 per cent or more below asking price.

UK house prices rose for the second month in a row, up by 0.5% in November or £1,394 in cash terms, with the average house price now sitting at £283,615

JLL said property prices across Britain will have fallen 6 per cent by the end of 2023 and 3 per cent the year after.

The estate agent, Savills, is forecasting that average prices will slide by a encourage 3 per cent next year before house prices begin rising again from 2024.

Anthony Codling, head of European housing and building materials research at RBC Capital Markets said: ‘In our view the housing market is reaching a new equilibrium where mortgage rates will be higher for longer, housing transactions will be lower for longer and house prices will be much firmer for longer.’

What next for the base rate?

Between December 2021 and August 2023, the Bank of England increased base rate from 0.1 per cent to 5.25 per cent, in a bid to curb rising inflation.

But the Monetary Policy Committee has now changed tact and opted to hold base rate on three consecutive occasions since September.

What it does next will very much depend on the rate of inflation.

Markets are currently forecasting base rate to go no higher than where it is now. We’ve reached the peak so to speak.

But if inflation rises again or is more volatile than expected, then there is no reason why the Bank of England won’t raise the base rate higher.

Following its latest vote on 14 December, the Monetary Policy Committee (MPC) voted 6–3 to hold base rate, with six voting to hold and three voting for a hike.

Future falls: Capital Economics is forecasting the the bank rate will be cut to 3% by 2026

The MPC maintained its tightening bias saying that ‘encourage tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.’

And it stuck to the familiar script, saying that policy will be “sufficiently restrictive for sufficiently long” and that ‘monetary policy is likely to need to be restrictive for an extended period of time.’

What’s more, the MPC downplayed the softer-than-expected wage and inflation since its November meeting saying that ‘it is important not to over elucidate developments in anyone measure,’ ‘it’s too early to deduce services inflation or pay growth are on a firmly downward path.’

Despite the Bank of England’s firm stance, markets are predicting base rate will be cut next year.

Morgan Stanley has forecast that interest rates will be cut as soon as May and fall to 4.25 per cent by the end of next year.

The boldest UK interest rate forecast is from Goldman Sachs, which said a cut could come as early as February.

Meanwhile, Capital Economics is forecasting the base rate won’t be cut until late next year, but then fall to 3.5 per cent by the end of 2025.

– Read the experts’ forecasts on when base rate will go into reverse

What mortgage deal should you select?

Five-year fixed rate mortgages were once the most popular type of mortgage deal.

Now, increasing numbers of borrowers are opting for two-year fixed rate deals in the hope that interest rates will have fallen by the time they come to refinance.

There has also been rising number of borrowers going for tracker mortgages that typically come without early repayment charges and track the base

More shock: Roughly 1.6 million people will face a mortgage shock next year when they remortgage as their low rates come to an end despite the base rate pause today

Although mortgage rates are higher than many people are used to, it may still pay to switch, especially if you are on your lenders’ standard variable rate.

And for those coming to the end of a fixed term, switching to another fixed term could be cheaper than sticking with their existing one.

It’s also worth considering sticking with your current mortgage lender by what is known as a product transfer. Figures shared exclusively with This is Money showed borrowers are securing better rates by staying put.

Choosing what length of fix for depends on what you think will happen to interest rates during that time, and what your personal circumstances are – for example if you will need to advance.

Those opting for a two-year fix are essentially hedging their bets on interest rates falling over the next couple of years.

They’ll be banking on the expectation that once inflation subsides, interest rates will come down.

Fixed rates of any length also offer borrowers certainty over what their payments will be from month-to-month.

If rates do begin falling, a tracker mortgage without an early repayment charge could put borrowers in a position to take advantage.

However, for all the potential benefit, a tracker product will also leave people vulnerable to encourage base rate hikes in the meantime.

Whatever the right type of mortgage for your circumstances, shopping around and speaking to a good mortgage broker is a wise advance.

For a full rate check use This is Money’s mortgage finder service and best buy tables. These are supplied by our independent broker partner London & Country.

Borrowers on their lenders’ standard variable rate could save a significant amount by switching to a fixed deal – even as rates rise

Best fixed-rate mortgage deals

We have taken a look at the best deals on the market based on a 25-year mortgage for a £290,000 property – the current UK average house price according to the ONS.

Please bear in mind that the mortgage deals listed below are for homemovers and buyers rather than those remortgaging.

Also bear in mind that the mortgage deals below are best in terms of having the lowest rate. They may not be the cheapest deal overall when arrangement fees are also factored in.

Bigger deposit mortgages

Five-year fixed rate mortgages

Nationwide has a five-year fixed rate at 4.29 per cent with a £999 fee at 60 per cent loan to value.

Halifax has a five-year fixed rate at 4.37 per cent with an £1,099 fee at 60 per cent loan to value.

Two-year fixed rate mortgages

Nationwide also has a two-year fixed product at 4.65 per cent with a £999 fee at 60 per cent loan to value.

Santander has a two-year fixed rate at 4.74 per cent with a £999 fee at 60 per cent loan to value.

Mid-range deposit mortgages

Five-year fixed rate mortgages

Yorkshire Building Society has a five-year fixed rate for those purchasing a home at 4.39 per cent with a £1,495 fee at 75 per cent loan to value.

Nationwide has a five-year fixed rate at 4.41 per cent with a £999 fee at 75 per cent loan to value.

Two-year fixed rate mortgages

Nationwide has a 4.7 per cent fixed rate deal with a £999 fee at 75 per cent loan-to-value.

Yorkshire Building Society has a two-year fixed rate at 4.74 per cent with a £1,495 fee at 75 per cent loan to value.

Low-deposit mortgages

Five-year fixed rate mortgages

Virgin Money has a five-year fixed rate at 4.71 per cent with a £1,295 fee at 90 per cent loan to value.

Nationwide has a five-year fixed rate at 4.79 per cent with a £999 fee at 90 per cent loan to value.

Two-year fixed rate mortgages

Virgin Money has a two-year fixed rate at 5.19 per cent with a £1,295 fee at 90 per cent loan to value.

Nationwide has a two-year fixed rate at 5.29 per cent with a £999 fee at 90 per cent loan to value.

>> Check our our mortgage tracker to differentiate the latest available deals

Tracker and discount rate mortgages

The big advantage to a good lifetime tracker is flexibility.

The same usually goes for discount rate mortgages, which track a certain level below the lenders’ standard variable rate.

A fixed-rate mortgage will almost inevitably carry early repayment charges, meaning you will be limited as to how much you can overpay, or face potentially thousands of pounds in fees if you opt to leave before the initial deal period is up.

You should be able to take a good fixed mortgage with you if you advance, as most are portable, but there is no assure your new property will be eligible or you may even have a gap between ownership.

Many lifetime tracker deals have no early repayment charges, which means you can up sticks whenever you want – and that suits some people.

Make sure you stress evaluate yourself against a sharper rise in base rate than is forecast.

Around than 1.6 million homeowners will remortgage next year, according to the ONS. Most face a jump in their monthly costs and a big decision about their next home loan

Can you get a mortgage?

Getting a mortgage is tougher than it once was. You will need to get your finances in order and be prepared for the lengthier application process and in-depth affordability interviews getting a mortgage requires nowadays.

Lenders also apply different standards to what they will lend.

Weigh up the above, check the rates here and in our best buy mortgage tables, have a scout around what the best deals look admire – and speak to a good independent broker.

There are a couple of things to look out for if you do ascertain to fix.

You need to check the bumper arrangement fees are worth paying – if you don’t have a big mortgage you may be better off with a slightly higher rate and lower fee.

It’s also wise to think carefully about whether you expect to advance home soon. A good five-year fix should be portable, so you can take it with you.

But your new property will need to be assessed and you might need to borrow extra money, and so your lender could still say no. Getting out of a fixed rate typically requires a hefty hit to the pocket from early repayment charges.

differentiate true mortgage costs

Work out mortgage costs and check what the real best deal taking into account rates and fees. You can either use one part to work out a single mortgage costs, or both to differentiate loans

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to inspire products. We do not allow any commercial relationship to affect our editorial independence.