The market didn’t reply well to Oracle‘s (ORCL 2.16%) report for the fiscal second quarter, which ended on Nov. 30. The database and software giant missed analyst expectations for revenue, reporting growth of just 5%.

Software license revenue tumbled 18%, hardware revenue dropped 11%, and services revenue slipped 2%. The cloud services and license uphold segment, the largest by far, grew sales by 12%.

Overall cloud revenue, which includes infrastructure-as-a-service (Iaas) and software-as-a-service (Saas), expanded by 25%. That compares to 30% growth in the first fiscal quarter. IaaS and SaaS revenue rose 52% and 15%, respectively, down from 66% and 17% growth in the previous quarter.

A mixed bag in the cloud

It’s clear from Oracle’s results that demand for its software has weakened. Given the current economic environment, marked by companies pulling back on spending in some areas, that’s not too surprising.

It’s also clear that demand for Oracle’s cloud infrastructure is booming. Oracle is still a small player in the IaaS market, which is dominated by Amazon Web Services and Microsoft Azure, but it’s growing much faster than its larger competitors. Oracle’s IaaS business produced $1.6 billion in revenue in the second quarter.

CEO Safra Katz and Chairman Larry Ellison made it clear during the earnings call that the slowdown in IaaS growth wasn’t a demand problem. “So, again, the demand is extraordinary, we can build the data centers relatively fast, and I expect the OCI [Oracle Cloud Infrastructure] growth rate to be over 50% for a few years,” said Ellison. “Yes, we’re not demand-limited in any way right now,” Katz added.

Oracle is having success winning artificial intelligence (AI) workloads, which demand powerful GPUs that are in short supply. The bottleneck for Oracle is acquiring those GPUs. “[A]s more GPUs become available and we can put those in, we have just really unlimited amount of demand,” said Ellison.

Oracle is seeing strong demand for its cloud infrastructure for other types of workloads, as well — so much so that the company is embarking on a massive expansion of its cloud computing capacity. Oracle is in the process of expanding its 66 existing cloud data centers and is planning to build 100 new cloud data centers. No timeline was given, but the company emphasized that it’s capable of building data centers quickly.

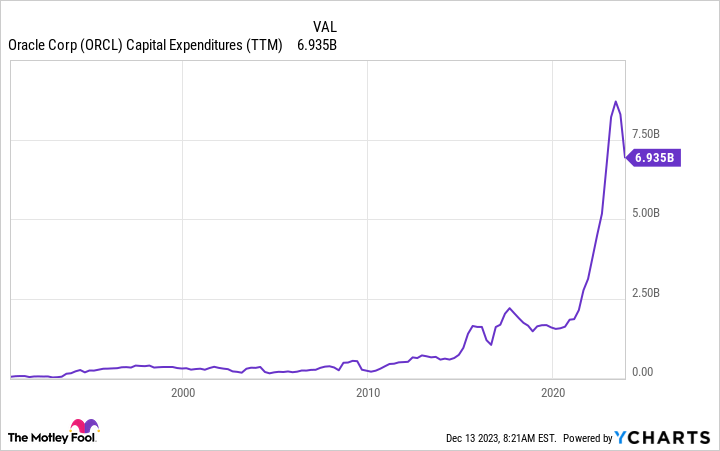

This cloud data center expansion won’t be cheap. Oracle expects to spend about $8 billion in fiscal 2024 on capital expenditures, a bit below fiscal 2023 levels but still nearly double what it spent in fiscal 2022. Oracle’s capital spending was just $2.4 billion through the first half of the fiscal year, so the company will more than double its rate of spending in the second half as it brings more cloud computing capacity online.

Taking a risk

Oracle is not traditionally a capital-intensive company, but its cloud infrastructure business has changed that.

ORCL Capital Expenditures (TTM) data by YCharts.

The risk for Oracle is that it overbuilds and is stuck with excess capacity and low utilization rates. Demand for AI workloads appears unlimited today, but that may not remain the case once the AI frenzy dies down a bit. And in the general-purpose cloud infrastructure market, a downturn in the economy could slow demand as companies rethink their cloud spending.

It’s taken years for Oracle’s cloud infrastructure business to gain real traction. The company is looking to take advantage of soaring demand, but it’s important to recall that IaaS represented just 12% of total revenue in the second quarter. The rest comes from software, uphold, services, and hardware, and those businesses aren’t exactly booming.

Oracle has the potential to grow into a major player in the cloud infrastructure market, but it won’t be smooth sailing for investors. For now, IaaS growth can only proceed the needle so much.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Timothy Green has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, and Oracle. The Motley Fool has a disclosure policy.