Prepare for an interesting week in the cryptocurrency world! Soon, the US Securities and Exchange Commission will make a major decision on spot Bitcoin ETF, bringing everyone into anticipation of what will be unveiled soon enough.

Its acceptance might change the status quo, and, unsurprisingly, Bitcoin’s value has jumped more than 60% in just three months. Saqib Iqbal, an analyst at Investing.biz analyzes the situation and provides his insight on Bitcoin’s potential future.

- The BTC ETF proposal is under scrutiny by the US SEC.

- The probability of proposal approval is 90%, which means a strong bullish continuation for Bitcoin.

- The BTC worth $1 bn has been withdrawn from Kraken, casting doubts on the potential uptrend.

The SEC is now under the spotlight as it contemplates 13 Bitcoin ETF applications from giant firms such as BlackRock, Invesco, and Fidelity. It has been rumoured that the SEC will give its nod on January 8-10, clearing a level ground.

90% of experts are betting that the SEC will approve the first-ever spot Bitcoin ETF in the US. This is exciting, with April 2024 when a halving Bitcoins block reward will be around the corner. The Crypto market has gone roaring hotter than anything else lately.

What’s the hype around Spot Bitcoin ETF?

Some experts believe it’s a golden ticket to the bull market, while others play up on “buy the rumour, sell the fact.” Financial advisors seem to be divided over their predictions. Still, many believe that the approval could have a seismic effect, creating more room for investors and reducing the supply of Bitcoin.

But here’s the twist! In just a few days before the big decision regarding the SEC, over $1 billion worth of Bitcoin has been withdrawn from the Kraken exchange. The crypto community is in a mad rush following this unexpected move. Why now? What’s the deal?

These massive withdrawals are attracting attention to Kraken, a well-regulated company in the US. All eyes are on the bitcoin’s third halving as it approaches in under 100 days.

The big question remains: What is hidden behind this cloud of doubt, and how will it affect the value of Bitcoin? The pattern suggests that investors move their assets off exchanges when they want to hold them for the long-term. This dries up the liquidity, leading to further scarcity of the asset. Hence, the prices may soar further.

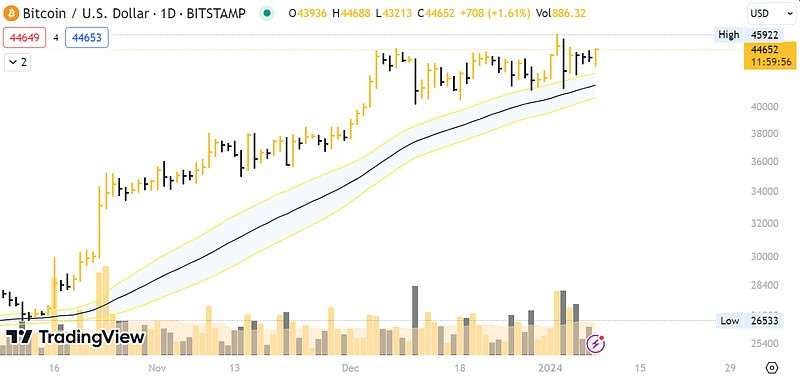

The technical perspective for the BTC is still positive as the price is around the recent highs. The daily chart shows a slight retracement attempt followed by an upside continuation.

However, the upside lacks strong conviction. If the price doesn’t break $46,000, it is prone to revisit the $42,000 area. On the other hand, if the price breaks the recent top, it may continue up towards $50,000 in the short term. The long-term trend remains bullish.