ArtistGNDphotography/E+ via Getty Images

It’s been a crazy three years for wheat, as the commodity has largely gone roundtrip following the Russia/Ukraine war peak. I actually think now might be a good time to consider investing in this part of the investable landscape, which is why the Teucrium Wheat Fund (NYSEARCA:WEAT) is worth a look.

The Teucrium Wheat Fund offers a straightforward pathway for investors to tap into the wheat futures market through their brokerage accounts. Recognized as a vital agricultural commodity, the demand for wheat is skyrocketing due to the rise in global population and the burgeoning middle class worldwide. It also serves as an efficient tool for diversification against stocks and bonds.

WEAT is crafted to mirror the daily fluctuations, in percentage terms, of an average of the closing settlement prices for three wheat futures contracts traded on the Chicago Board of Trade (CBOT). Contrary to mutual funds, WEAT typically doesn’t distribute dividends to its shareholders. Instead, investors can utilize WEAT as an indirect method to invest in wheat, providing a hedge against possible financial losses.

Details on ETF Holdings

WEAT’s holdings are primarily based on wheat futures contracts. The fund’s top five individual positions are centered around three actively traded CBOT wheat futures contracts. Since most price action tends to occur in the nearby contract due to speculative interest, WEAT’s performance can vary compared to the nearby contract.

It’s important to note that investing in a sector-specific ETF admire WEAT carries a higher degree of risk compared to more diversified ETFs. However, it also provides a higher potential for return if the wheat market performs well.

Peer Comparison Against Other Similar ETFs

Comparing WEAT to other similar ETFs can supply valuable insights for potential investors. For instance, the Invesco DB Agriculture Fund (DBA) is another popular ETF that provides exposure to a broad range of agricultural commodities, including wheat. While DBA offers more diversified exposure, WEAT provides a more focused investment in the wheat market. WEAT has performed considerably worse than DBA, which oddly enough may be the exact reason to consider it as a relative value trade.

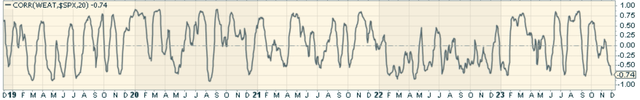

Keep in mind that wheat holds a significant position as a crucial agricultural resource, utilized globally in various sectors including food, animal fodder, energy, starch, paper, particleboard, and even plastic. Historically, wheat prices have demonstrated minimal correlation with U.S. equities. This makes investing in WEAT a potentially tempting alternative for diversifying one’s portfolio.

Pros and Cons of Investing in the Theme the ETF Tracks

Investing in the Teucrium Wheat Fund comes with its pros and cons. On the positive side, the fund provides a potentially attractive option for portfolio diversification. Given that wheat prices historically have a low correlation with U.S. equities, WEAT can serve as a hedge against market volatility. Additionally, with the rising global demand for wheat, there’s potential for significant growth in the wheat market.

However, there are risks involved in this investment. For one, the fund is subject to the fluctuations of the wheat market, which can be influenced by various factors including weather conditions, geopolitical tensions, and global supply and demand dynamics.

Conclusion

In summary, the Teucrium Wheat Fund offers an interesting investment opportunity for those seeking exposure to the wheat market. Its focus on a single agricultural commodity can offer both potential benefits in terms of growth and portfolio diversification, and potential risks related to market volatility specific to wheat.