hapabapa

Investment Thesis

Wayfair Inc. (NYSE:W) has a significant long-term opportunity to increase its market share in the home-goods industry. The market is expected to grow to $1 trillion by 2030 from its current $800 billion size, driven by category expansion and the acceleration of e-commerce adoption. I believe the company’s portfolio of brands may continue to help spur spending across all demographics, with notable potential among millennials. I view the current valuation as attractive and assign a buy rating to the stock.

Market Potential Remains Attractive

Wayfair stands as a leader in the home goods e-commerce market. The company’s strong logistics capabilities and effective use of data science and ad tech enable Wayfair to be a superior business by reducing friction points historically associated with the home goods market for customers and suppliers. Wayfair’s more than 33 million products, across a broad selection of categories such as furniture, lighting and home decor, are a key differentiator vs. traditional peers where physical box stores limit inventory depth and breadth. Home furnishings tend to be a brand-agnostic category, with shoppers driven by visual impact and price. This allows Wayfair to effectively compete with brands such as West Elm with its own higher-margin, private-label goods.

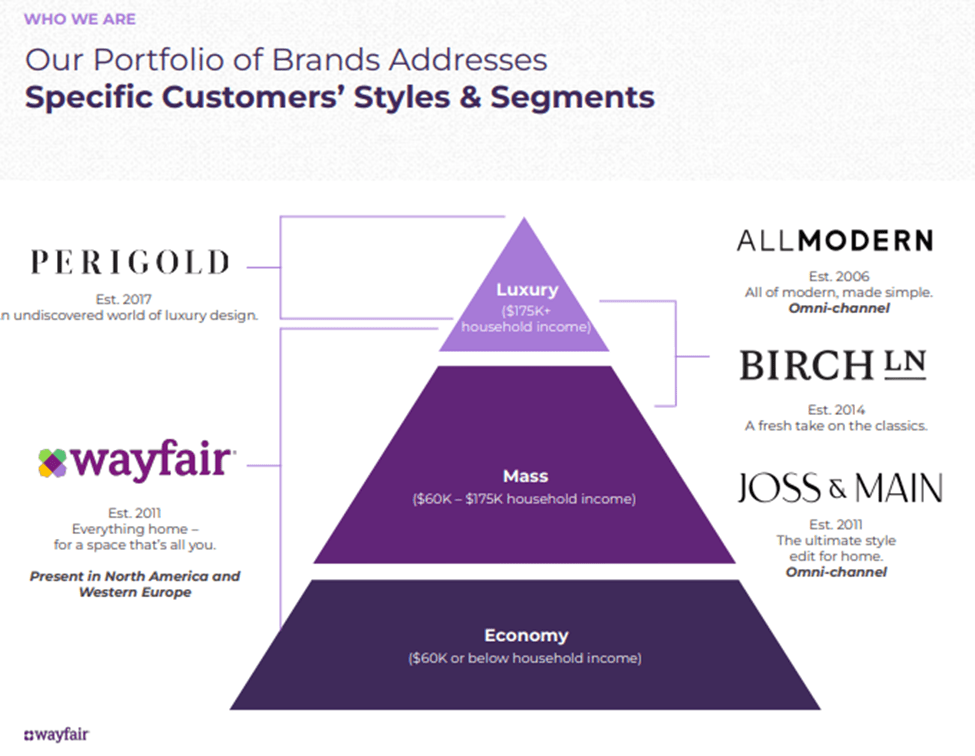

Wayfair’s total addressable market, expected to reach over $1 trillion in 2030 vs. around $800 billion in 2023, gives it runway to drive double-digit sales gain. W’s penetration is furthest in the US, yet is still just about 1.5% of the overall home-goods market. While furniture and décor is the company’s most developed business, increasing selection across other verticals — housewares, home improvement, large appliances and professional (B2B) — can boost W’s wallet share with existing customers and attract new ones. By offering a diverse range of products catering to various styles and price ranges. Wayfair’s portfolio of brands gives it an ability to cater to varying demographics. Its three main specialty lines — AllModern, Birch Lane and Joss & Main — offer unique design aesthetics at scale at an affordable price point with premium offerings. Leveraging the Wayfair.com banner to showcase products from these brands can drive cross-brand shopping among existing customers. Moreover, opening stores across these banners can also help raise awareness and capture shoppers who don’t yet shop for furniture online.

I believe Wayfair’s brand portfolio could continue to drive spending across all demographic groups, particularly among millennials. This younger generation, now the largest living adult cohort, wields substantial spending power totaling $2.5 trillion, according to YPulse. With rising incomes and homeownership rates among millennials, Wayfair stands to benefit, given their tech-savvy nature and willingness to embrace digital platforms for shopping. On average, millennials’ household pretax income is approximately $74,862 per year, falling within Wayfair’s target annual income range of $50,000 to $250,000.

Company Presentation

Financial Outlook & Valuation

Earlier in January, Wayfair announced a workforce realignment plan cutting down (~1,650 employees, ~13% of global workforce and ~19% of corporate team) that will result in additional $280M in annualized savings on hypothetical flat revenues in 2024. The company now expects to deliver over $600 million in Adj. EBITDA in 2024 (over 5% in Adj. EBITDA margin vs. 2%+ in 2023).

While I believe top line growth is likely to still be choppy in 2024, profitability estimates will be going up. I anticipate a significant improvement in earnings revisions, shifting from strongly negative in 2021-22 to significantly positive. The company’s Adjusted EBITDA will trend towards mid-single digits in 2024, with a path towards a mid-30s gross margin and 10%+ EBITDA margin in the long term.

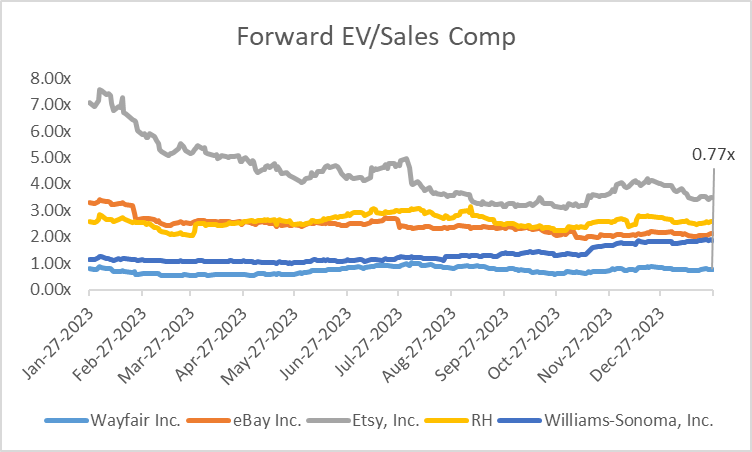

Wayfair’s stock has continued to trade at a discount to peers in both e-commerce and furniture companies like eBay Inc. (EBAY), Etsy Inc. (ETSY), RH (RH) and Williams-Sonoma, Inc. (WSM). The discount should be viewed in the context of the current macro headwinds that the company faces amidst a rising rate environment, and Wayfair’s limited free cash flow at the present thus tying up much of the firm’s value in its ability to generate substantial cash flow in the future, unlike some of its peers that do generate substantial cash flow like ETSY, EBAY etc.

Wayfair has not performed well over the past year, with the stock down 29% over the past one year. This is largely because of macro headwinds that the company has faced, as the company’s revenues are indirectly tied to the state of the housing market, which has continued to worsen in a high interest rate environment. Although the macro headwinds are still persistent at present with declining housing starts, I believe the situation will continue to improve after the second half of the current year as the Fed starts on its path to slash interest rate. Moreover, I believe the company’s efforts to gain market share, invest in AI and attract repeat customers, open physical stores and form partnerships with influencers will all contribute to increased sales and improved performance. Hence, I currently see the depressed multiple as an attractive entry point and assign a buy rating to the stock.

Capital IQ

Investment Risks

The consumer macro backdrop is one of the key risks to Wayfair – rising interest rates, slowing home price appreciation, and stock market volatility could have an impact on consumer spend, both domestically and in Europe (where the consumer is a bit weaker). Additionally, advertising productivity could prove ineffective at driving sales if the home furnishings category is not relevant, with consumers following a few years of increased relevance during the pandemic. Layered on top, if Wayfair struggles to scale its high margin advertising revenue preventing the company from inching closer to its 10% Adj EBITDA margin target causing downside revisions to both EBITDA dollars and margins.

Conclusion

I believe W’s competitive edge in fulfillment through its own purpose-built global logistics network and the company is poised to drive utilization and hence profitability higher, especially now as the model is becoming more flexible given the current restructuring initiatives. Both a positive shift in market share trends and management’s newfound commitment to controlling expenses/investments should cause a significant inflection in earnings revisions, eventually causing a positive shift in the company’s valuation. I am optimistic and assign a buy rating to the stock.