AzmanL

Back in April, I placed a “Hold” rating on Waste Management (NYSE:WM) saying that while the company had some solid margin improvement and growth initiatives in place, the stock looked close to fairly valued at the time. Since then, the stock has returned about 5% versus an over 11% rise in the S&P 500. Let’s catch up on the name.

Company Profile

As a refresher, WM operates a waste disposal business in the U.S. and Canada, providing collection, disposal, transfer, and recycling and resource recovery services. It owns a network of vertically integrated assets including landfills, transfer facilities, and material recovery facilities (MRFs), where it recovers recyclable items to be resold. It serves residential, municipal, commercial, and industrial customers.

WM also operates landfill-to-gas energy facilities, as well as facilities that convert landfill gas to renewable natural gas (RNG). It then uses this RNG in its compressed natural gas (CNG) fleet of vehicles.

Q3 Results and Margin Improvement

In my initial write-up, one of the big near-term opportunities I said WM had was margin improvement. There have been periods in the past where it and rivals would fight for volumes at the expense of margin, but the industry as a whole has become more disciplined.

This showed up in the company’s most recent quarterly results last month, with gross margins improving 90 basis points to 38.7% from 37.8%, while SG&A costs fell from $473 million to $470 million. As a percentage of sales, SG&A was 9.0% versus 9.3% a year ago. Overall operating expenses were 61.3% of revenue versus 62.2% a year ago.

Discussing its cost management on its Q3 earnings call, COO John Morris said:

“We’re pleased with the progress we’ve made in managing our labor costs as well as expenses related to repair and maintenance. Our efforts have resulted in a meaningful refuse in WM’s underlying cost of inflation since the beginning of the year to mid-single digits in the third quarter. Our focus on efficiently managing labor expenses is yielding positive results. So far this year, we have automated 141 residential routes and have a target to convert more than 400 routes in 2024. As we shift to more automated routes, we’ve seen a nearly 14% decrease in the number of helpers needed in our residential business. In addition, our focus on reducing turnover continued to produce improvements in Q3, building on the consistent progress we’ve made over the past 12 months. Our collection efficiency has also exhibited steady progress throughout the year with commercial, industrial and residential business line showing improvements every quarter. All these focus areas on managing our business are contributing to the improvement in labor costs. Turning to repair and maintenance expenses. Despite some lingering effects of inflation and the timing of fleet deliveries we’re making progress. For the first time in several years, we expect to get an allotment of vehicles that aligns with our fleet replacement strategy with more than 1,200 received to date. This has allowed us to eradicate older trucks from our fleet and also reduce rental truck usage by over 40% since the start of the year. Furthermore, our spending on third-party technicians has been reduced by 2/3 compared to the second half of 2022 and continues to better. With the progress we’ve achieved in the third quarter, we believe we’ve turned the corner on this expense line and are optimistic about ongoing improvements as we close out the year.”

This is some good process on these fronts. High maintenance costs for its fleet had been a headwind for the company, so removing older trucks from its fleet and getting in new vehicles should help keep these expenses down.

Management also noted that it completed technology and automation upgrades at 2 recycling facilities in the quarter and that it will complete 2 more upgrades by the end of the year.

Revenue, meanwhile, rose 2.4% to $5.2 billion, just missing the analyst consensus of $5.27 billion. Organic revenue rose 1.6%, while acquisitions added 0.9% of growth. Collection revenue rose 3.6% to $3.5 billion, while landfill revenue climbed 5.3% to $1.3 billion and transfer revenue jumped 5.7%. Recycling revenue fell -12.9% to $366 million.

Core price was 6.6% in the quarter compared to 8.2% a year ago and exceeded inflation by 100 basis points.

Collection and disposal yield, meanwhile, was 5.0%. However, recycling and renewable energy yield was -23.3% and energy surcharge yield was -18.4%

Total volumes rose 0.5% and were up 1.0% on a workday-adjusted basis. Collection and disposal volumes edged up 0.3% and increased up 0.7% on a workday-adjusted basis. On a workday-adjusted basis, residential volumes were down -3.0%, and industrial was down -2.5%. Transfer volumes rose 1.4% and MSW (municipal solid waste) volumes increased 1.7%. The company noted some of the declines were intentional as it continues to take price at each contract renewal.

Adjusted EBITDA rose 6% to $1.54 billion. Adjusted EPS climbed 4.5% to $1.63, topping the consensus by 2 cents.

Turning to the balance sheet, WM ended the quarter with $15.4 billion in debt and $150 million in cash and equivalents. Its leverage was 2.7x. About 9% of its debt was variable rate.

The company generated $1.26 billion in operating cash flow and $612 million in free cash flow.

Looking ahead, the company said it expects its full-year revenue growth to be slightly below the midpoint of its July 2023 guidance of 3.25%-4.25%, due to lower revenue in its recycling business. It is still looking for adjusted EBITDA of between $5.775- $5.875 billion. Due to a shift in capex spending, it anticipates free cash flow to be $150 million ahead of its previous expectations and in the range of $1.825-$1.925 billion.

Overall, WM posted solid Q3 results as it continues to show steady margin improvement. Automation continues to be one of the big drivers of this, helping both with automated routes as well as with recycling. Volumes are shrinking a bit in its residential and industrial businesses, as the company pushes prices and is willing to walk away from less desirable contracts. However, overall revenue and margins are improving in these business lines.

The company is seeing some weakness in its recycling brokerage business, although that is a smaller part of its overall business. A rebound here could bolster top-line growth next year, but WM isn’t going to be a big revenue growth company. It also isn’t getting the fuel surcharges it saw last year, which mostly impacts revenue.

Valuation

WM trades at 14.3x adjusted EBITDA based on 2023 analyst estimates of $5.84 billion. Based on the 2024 consensus of $6.32 billion, the stock trades at a 13.2x multiple

On a PE basis, it trades at over 28x the 2023 consensus of $5.98 and 25x the 2024 consensus of $6.73.

It is projected to grow revenue by 3.5% this year and 6.0% next year.

The company pays a 70-cent quarterly dividend, good for a yield of about 1.6%. It has raised its dividend each year for the past 19 years.

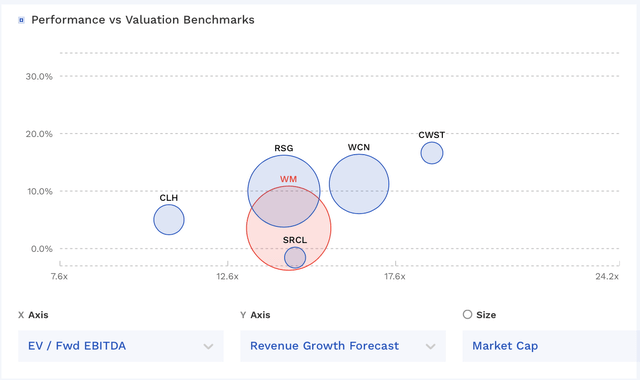

WM is valued in the middle of the pack compared to other waste management and environmental service companies.

WM Valuation Vs Peers (FinBox)

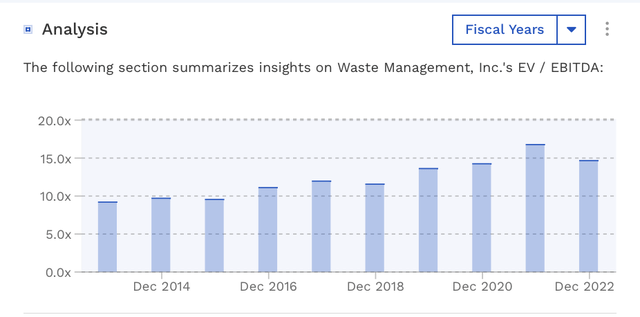

Historically, WM has traded at between 9-17x EBITDA.

WM Historical EV/EBITDA Valuation (FinBox)

Based on that, I’d place a fair value on the stock at about 13x 2024 EBITDA, which is $168, which is pretty close to where the stock currently trades.

Conclusion

WM stock has been a very nice, steady performer over the past decade. While the company faces some general economic risks, as long as the industry isn’t chasing volumes, this is a nice, consistently growing business. At the same time, WM is investing its ample cash flows into things such as improved automation and renewable natural gas plants, which should help drive EBITDA down the line.

Overall, I think WM is a good stock to “Hold” over the long term, but I’d need it to fall about -20% to be a new money buyer. I think it looks close to fairly valued at the moment, but over the next five years, investors are still likely to get a decent return as the company continues to take price, reduce costs, and execute on its growth projects. I just don’t see much upside in the near term.