Berkshire Hathaway Chairman and CEO, Warren Buffett. Chip Somodevilla

Recent economic data has given provoke for optimism that the Federal Reserve has a chance at pulling off the elusive soft landing. The CPI inched 0.1% higher in November, which was above the 0.0% consensus. However, CPI increased 3.1% year-over-year, which was better than the 3.2% that was expected and the 3.2% rate in October.

This shows that while there is still work that needs to be done to bring inflation down, progress is being made. On the job front, U.S. nonfarm payrolls rose by 199K in November. This was better than the 180K add consensus. Thanks to this job growth, unemployment made its way lower from 3.8% in October to 3.7% in November. This defied the expectations of an uptick in unemployment to 3.9%.

Finally, employers are having to vie against each other lately to attract and keep talent. That’s why the overall average salary growth rate for 2024 is currently projected at 4%. U.S. workers could benefit from real wage growth, which could help claw back some of the purchasing power that has been lost over the last four years.

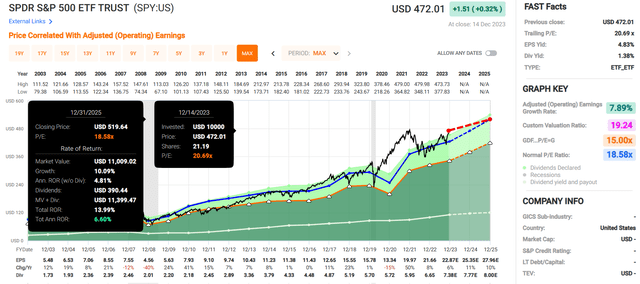

There is some potentially discouraging news, however: Even assuming the Federal Reserve pulls off a soft landing, the S&P 500 (SP500) is still overvalued currently. The soft landing 18.7X earnings multiple of the index suggests it is trading at an 11% premium to its historical valuation multiple of 16.8.

If a recession can’t be avoided, corporate earnings historically have fallen by between 10% to 15% in a typical recession. This is why even a mild recession would push the valuation multiple of the S&P 500 over 20, which could set it up for a meaningful correction.

As soon as I begin investing again in about six weeks, that is why I strategize on positioning my portfolio for such an event in the months ahead. A good place to start in my opinion is by examining the holdings of Warren Buffett and Berkshire Hathaway (BRK.A)(BRK.B). Due to our vast differences in age and wealth, Buffett and I aren’t in complete alignment with each other in terms of investment objectives.

Thanks to the influence of the late great Vice Chairman of Berkshire Hathaway, Charlie Munger, Buffett has been buying excellent businesses at fair or better valuations for several decades. This is what I work to do as well, so there is at least some overlap between us. Here are three dividend-paying stocks that could collectively double the S&P over the next 10 years.

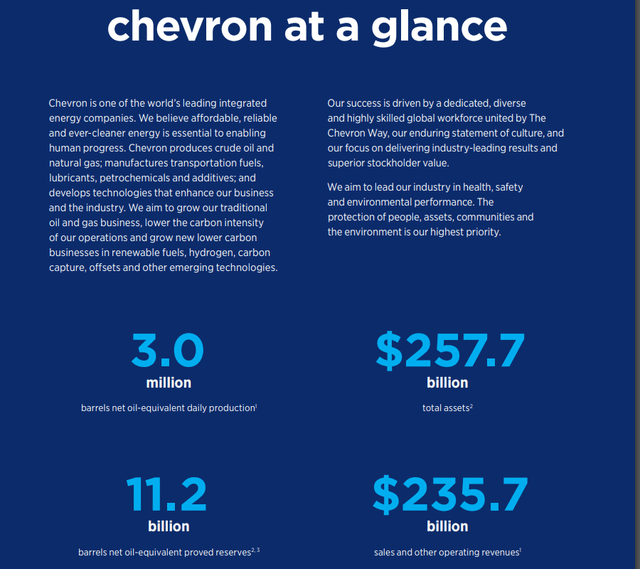

Chevron: An Energy Titan For The Present And The Future

The world can’t live without energy. The global economy would shut down. The standard of living would revert to the Stone Age. And life would be a living hell for all of us, sans perhaps the rugged mountaineer types. It’s a universal truth that I’ve said in a variety of ways here on Seeking Alpha.

Well, at the center of what is powering the global economy is Chevron (CVX). This is probably why the energy leader constitutes 4.4% or $16.4 billion of Berkshire Hathaway’s $373.9 billion investment portfolio, making it the company’s fifth-largest position.

In 2022, Chevron averaged daily net-oil equivalent production of 3 million barrels in its upstream segment. For context, that is just over 3% of the 97.3 million barrels per day of oil that was consumed during the year. As of December 31, 2022, the company also had a refining network that was capable of processing 1.8 million barrels of crude oil each day in its downstream segment (page 17 of 135 of Chevron’s most recent 10-K filing).

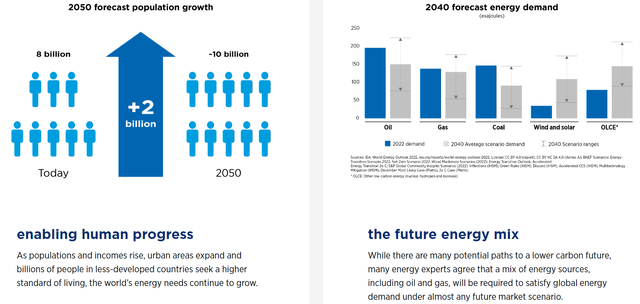

Chevron Sustainability Energy Transition Page

The future also appears to be bright. This is because, with the planet anticipated to add two billion people through 2050, the need for energy has nowhere else to go but up. Chevron is arguably ready to confront this rising energy demand as well. As of the end of 2022, the company had 11.2 billion barrels of net-oil equivalent proven reserves. That’s enough for over 10 years of oil production. Chevron also added 1.1 billion barrels of net-equivalent oil production in 2022, which suggests the company is steadily replenishing its proven reserves to stay around the 10-year mark.

Beyond just meeting the demand for oil and natural gas, Chevron is investing in lower carbon investments to direct the energy transition. The company expects to invest $8 billion in lower carbon investments for 2023 through 2027 and $2 billion in carbon reduction projects (e.g., carbon capture and storage) over that time. For these reasons, FactSet Research thinks that Chevron’s earnings will grow by 8.3% annually long term.

Additionally, Chevron’s 4.1% dividend yield is sustainable. The company’s 30% EPS payout ratio is well below the 40% payout ratio that rating agencies view as safe for the industry per Dividend Kings. Chevron’s 13% debt-to-capital ratio is also substantially lower than the 30% that rating agencies believe to be viable for the industry. This is why the company enjoys an AA- credit rating from S&P on a stable outlook, which puts it at just a 0.55% risk of bankruptcy in the next 30 years. Thus, I would expect it to preserve its status as a Dividend Aristocrat moving forward.

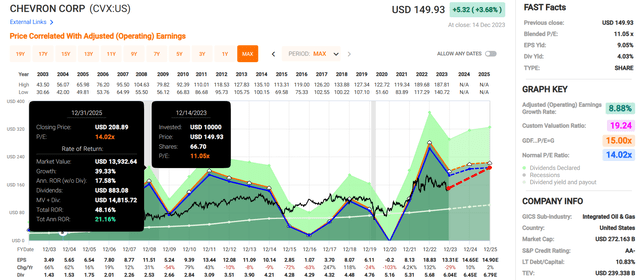

Lastly, Chevron’s $149 share price (as of December 15, 2023) implies that it is priced at a 7% discount relative to its $161 fair value per Dividend Kings. This is according to the average of its historical dividend yield and P/E ratio.

If Chevron were to grow as expected and return to fair value, here are the total returns that it could deliver for shareholders through 2033:

- 4.1% yield + 8.3% FactSet Research annual earnings growth consensus + 0.7% annual valuation multiple expansion = 13.1% annual total return potential or a 242% 10-year cumulative total return versus the 9% annual total return prospects of the S&P 500 or a 137% 10-year cumulative total return

FAST Graphs, FactSet FAST Graphs, FactSet

Kroger: Becoming A Giant Grocery Retailer

Kroger September 2023 Investor Presentation

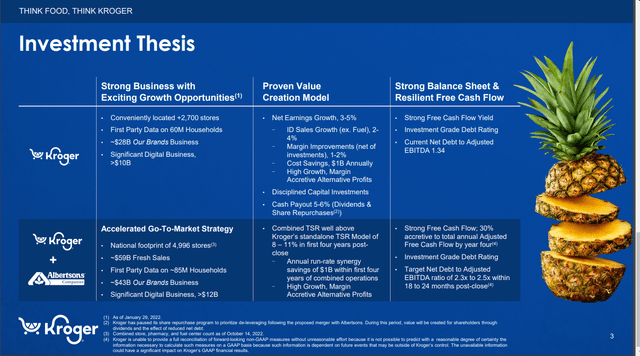

Next up, the U.S. depends on Kroger (KR) for its grocery needs. Berkshire Hathaway owns a $2.2 billion stake in the retailer, which equates to 0.6% of its portfolio value.

Pending the completion of its deal to acquire Albertsons (ACI) in early 2024, the company will have a network of nearly 8,000 stores located throughout the U.S. This proceed will solidify Kroger’s status as the second-biggest grocer in the U.S. behind Walmart (WMT). Together, the two would combine for around $229 billion in annual sales for their current fiscal years based on the most recent analyst estimates ($150 billion from Kroger and $79 billion from Albertsons).

Even if the deal isn’t approved by regulators, Kroger estimates that it can achieve 3% to 5% annual net earnings growth. Along with 5%-6% returns through its 2.7% dividend yield and share repurchases, Kroger forecasts it can drive 8% to 11% annual total shareholder returns (absent valuation multiple expansion). If the deal goes through as is the likely case, the company believes it would achieve $1 billion in annual cost synergies within the first four years of post-close. This is why FactSet Research is projecting 4.9% annual earnings growth long term from Kroger.

As it stands now, Kroger’s debt is rated BBB on a stable outlook by S&P. That’s even with the deal for Albertsons expected to be approved. As I explained in a previous article, this is because Kroger has made it clear that it would prioritize debt repayment to return to its 2.3 to 2.5 leverage ratio target as soon as possible. Kroger’s 24% EPS payout ratio is also well below the 70% that rating agencies consider safe for its industry.

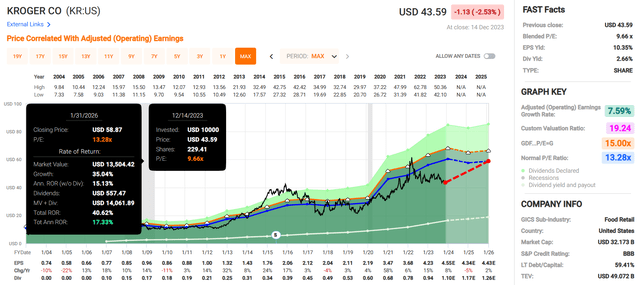

Observing the historical P/E ratio and dividend yield, Kroger’s $44 share price could make it 30% undervalued versus Dividend Kings’ $63 fair value calculate.

If the company met growth forecasts and reverted to fair value, these are the total returns that it could create in the coming 10 years:

- 2.7% yield + 4.9% FactSet Research annual earnings growth consensus + 3.6% annual valuation multiple upside = 11.2% annual total return potential or a 189% 10-year cumulative total return

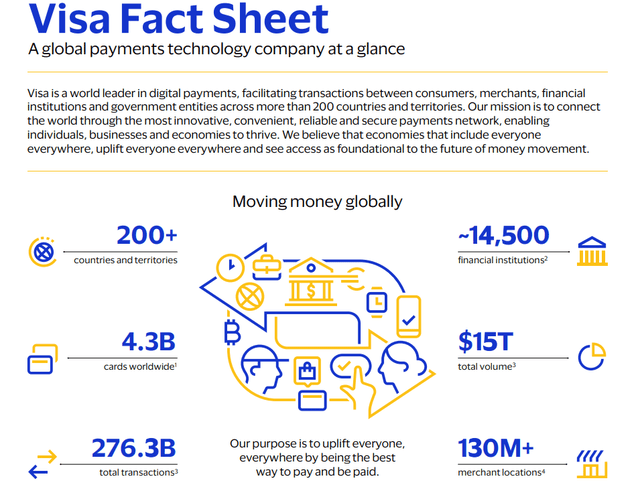

Visa: A Free Cash Flow Machine With Robust Growth Prospects

Visa’s payment network is the glue that holds the modern world together. Without it, e-commerce, traditional retail, and business-to-business transactions would be more difficult to complete. The company’s payment network is used by more than 130 million merchant locations around the world and processed $15 trillion in payment volume in its fiscal year 2023.

As I noted in a recent article, Visa’s dominance helps it to routinely deliver 50%+ net profit and free cash flow margins to shareholders. Of all the publicly traded companies I cover, these are the best margins. That’s probably why Berkshire Hathaway owns a $2 billion stake in the company, accounting for 0.6% of its total investment portfolio.

As e-commerce continues to thrive, Visa should grow its cardholder base and payment volumes. This explains how FactSet Research is projecting 14.9% annual earnings growth from the company long term.

Visa’s 0.8% dividend yield is the lowest out of the trio I’m covering today. However, it makes up for this with an exceptionally low payout ratio of 21%. This is far below the 60% that rating agencies deem to be safe for Visa’s industry. That gives the company room for annual dividend growth in the teens for the foreseeable future.

This is especially the case considering that Visa’s debt-to-capital ratio of 35% is below the 40% ratio that is perceived as safe by rating agencies. That is why Visa enjoys an AA- credit rating from S&P on a stable outlook.

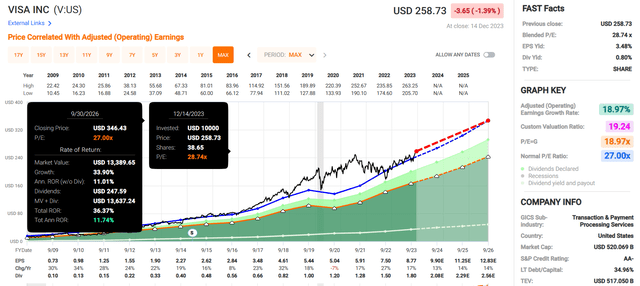

On top of these fundamentals, the company is likely underappreciated by the market. Visa’s $257 share price trades 19% below Dividend Kings’ $317 fair value calculate.

Provided the company grows as forecasted and returns to fair value, here are the total returns that it could create over the next 10 years:

- 0.8% yield + 14.9% FactSet Research annual earnings growth consensus + a 2.1% annual valuation multiple boost = 17.8% annual total return potential or a 415% 10-year cumulative total return

Summary: Three Wonderful Businesses With Valuations That Could Allow Market-Trouncing Total Returns

Chevron, Kroger, and Visa are three above-average quality businesses. This is reflected by their growth prospects, manageable dividend payout ratios, and investment-grade credit ratings.

Their valuations seal the deal to respectively make them each reasonable to strong buys per Dividend Kings’ Zen Research Terminal. Together, the trio averages a 2.6% dividend yield, a 9.3% annual earnings growth consensus, and a 2.1% annual valuation multiple expansion. This could produce 10-year cumulative total returns of 271%. That’s roughly twice the 137% 10-year cumulative total return potential of the S&P 500.