Warren Buffett’s company, Berkshire Hathaway, has been buying shares of oil giant Occidental Petroleum (OXY -0.09%) hand over fist. Berkshire currently owns nearly 28% of Occidental’s outstanding shares (and has regulatory approval to buy up to half the company). At 3.8% of its investment portfolio, it’s Berkshire’s sixth-largest stock holding.

However, while Buffett and his team clearly love Occidental, that doesn’t mean it’s the best oil stock for everyone. Chevron (CVX 0.30%), EnLink Midstream (ENLC -2.28%), and Enterprise Products Partners (EPD 0.49%) stand out to a few Fool.com contributors as better options in the energy sector. Here’s why they like them better than Occidental.

Chevron is built to weather the cycle

Reuben Gregg Brewer (Chevron): Shortly before the coronavirus pandemic, Occidental got into a bidding war with Chevron over Anadarko Petroleum. With the help of Warren Buffett, Oxy won the deal. In the end, Chevron didn’t want to overpay, which might have put its rock-solid financial position at risk.

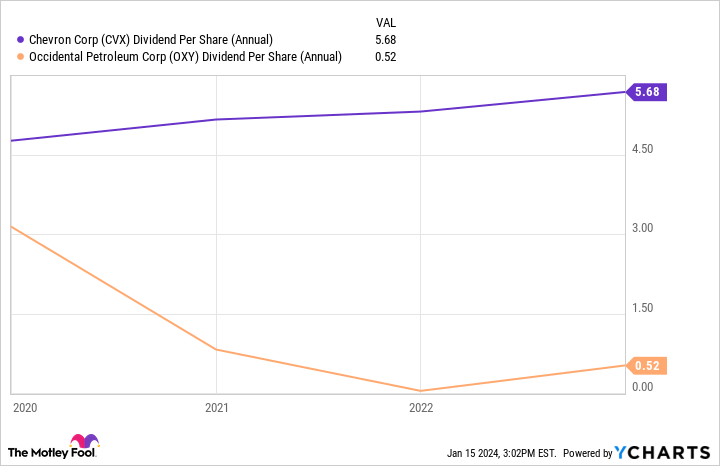

Then the pandemic hit, and low oil prices coupled with a heavily leveraged balance sheet forced Occidental to make a dividend cut. Chevron just kept increasing its dividend, largely thanks to the balance sheet flexibility it has so long worked to protect.

CVX Dividend Per Share (Annual) data by YCharts.

At this point, after an oil price rally, Occidental is in better financial shape. But its debt-to-equity ratio at 0.65 times is still dramatically higher than Chevron’s 0.12 times. The deep 2020 oil bust, which saw oil prices fall below zero in the U.S. market, was a clear indication of Chevron’s ability to weather the inherent ups and down in the highly cyclical energy industry. Investors wanting consistency throughout the cycle have clearly done better with Chevron, and that’s not likely to change soon.

But while Occidental won Anadarko, that setback hasn’t stopped Chevron from making acquisitions. Indeed, it recently inked a deal to buy Hess. If you want a company that doesn’t have to sacrifice dividend investors for growth, Chevron and its 4.1% yield will be a better choice for you, even if it doesn’t win every deal.

Taking another path to capture this potentially massive opportunity

Matt DiLallo (EnLink Midstream): While oil is Occidental’s main fuel source these days, the company is investing heavily to capture a potentially massive future growth driver: carbon capture and storage (CCS). CEO Vicki Hollub has stated that the company could eventually make as much money from CCS as it does from producing oil and gas. It’s investing heavily to build out direct air capture (DAC) projects that would suck carbon dioxide from the air for permanent sequestration underground.

Occidental isn’t the only company seeking to capture the potentially massive CCS market. EnLink Midstream wants to become a leader in transporting carbon dioxide by leveraging its existing pipeline network in the Gulf Coast region to move the gas from capture sites to sequestration hubs.

The company signed a first-of-its-kind carbon dioxide transportation agreement with ExxonMobil in 2022. Exxon initially reserved the capacity to transport 3.2 million metric tons of carbon dioxide on EnLink pipelines starting early next year. It could ultimately take up to 10 million tons of capacity.

EnLink is also in discussions with several other energy companies, including Occidental Petroleum, for carbon takeaway capacity. The company sees the potential to eventually transport nearly 90 million tons of carbon dioxide annually.

Carbon transportation could become a very lucrative business for EnLink. The company estimates it could generate an additional $300 million of annual adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from this business in the coming years. That’s a 25% increase from last year’s level. It will require a minimal capital investment over the next five years to capture that earnings growth opportunity since it plans primarily to repurpose existing pipelines.

EnLink’s growing cash flow from carbon transportation will give it more fuel to pay dividends. The midstream company recently increased its payment by 6%, pushing the yield over 4.5%. It could grow its payout even faster in the future as it starts capturing carbon cash flows.

Building investors’ wealth slowly and steadily

Neha Chamaria (Enterprise Products Partners): Warren Buffett has always loved boring companies as long as they generate steady cash flows. He loves dividends, too. Enterprise Products Partners offers both — stability in cash flows and dividend growth — thanks to its midstream energy infrastructure business, which earns fees under long-term contracts.

There’s much to like about Enterprise Products Partners, and many of those factors check Buffett’s list. Enterprise Products is one of the largest midstream energy companies in the U.S., with a pipeline system spanning more than 50,000 miles. That gives the company a wide moat in the industry. It was also the fifth-largest producer in the Permian Basin in terms of Q2 2023 production, right after Occidental Petroleum. Meanwhile, Enterprise Products also operates the world’s largest ethylene export terminal, giving it an edge over rivals.

Enterprise Products’ balance sheet is also among the strongest in the industry, with ample liquidity, manageable debt, and the highest credit rating in the midstream energy space. Over the last 10 years, the company has generated an average return on invested capital (ROIC) of 12%, indicating management’s efficiency in spending capital on high-return projects.

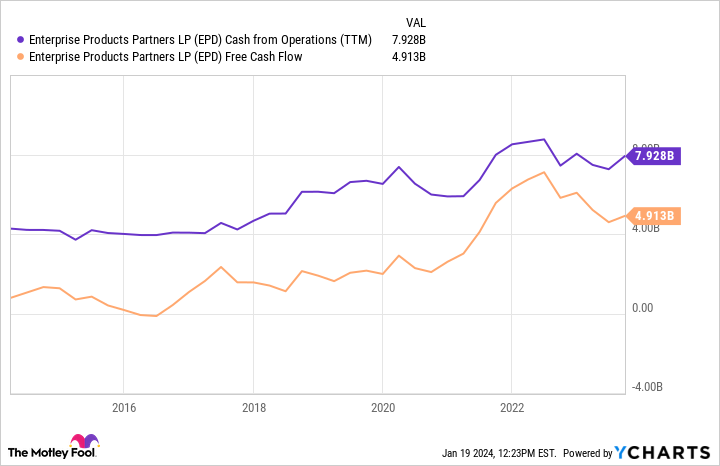

In yet more evidence of efficient capital allocation, consider that Enterprise Products’ cash flows have grown steadily in the past decade. It also increased its dividend for the 25th consecutive year in 2023.

EPD Cash from Operations (TTM) data by YCharts. TTM = trailing 12 months.

All of these combined have driven strong returns for shareholders in Enterprise Products over the years, with dividends playing the biggest role in those returns. So, with dividends reinvested, Enterprise Products stock generated nearly 42% returns for shareholders in the past five years.

Occidental stock, on the other hand, eroded investors’ money as it lost around 6% of its value during the period. With its 7.5% yield, Enterprise Products remains a top energy stock to own.