SOPA Images/LightRocket via Getty Images

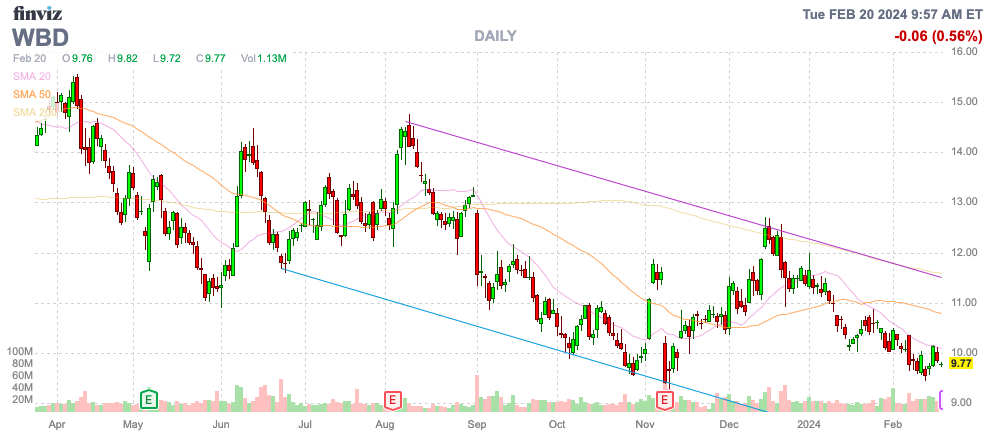

Warner Bros. Discovery, Inc. (NASDAQ:WBD) has completely missed out on the recent stock market rally. The media space has faced a very competitive last couple of years, and the strikes in 2023 will have lingering impacts, but the company is now solidly cash flow positive. My investment thesis is now Neutral on the stock heading into Q4 ’23 results with the stock setting up a double bottom at right below $9.50.

Source: Finviz

Big Friday

Warner Bros. is set to finally report Q4 ’23 results on Friday, with consensus estimates as follows:

- Consensus EPS of -$0.01

- Consensus revenue of $10.42 billion (-5.4%).

As listed, the market isn’t expecting much from the quarterly financials for the December quarter with Warner Bros. set to report a 5% revenue decline. The media business naturally faces a tough few quarters due to the strikes that took place over an extended part of 2023.

The forecasts for 2024 don’t get much better, with analysts forecasting only a 1.3% increase in sales to $42.0 billion. The revenue picture remains bleak with DTC growth stalled at 95 million subscribers and potentially declining with the market overly competitive and the recent industry rate hikes pressuring viewers.

Disney (DIS) provides some indication of the media environment, especially considering the media giant no longer generates blockbuster numbers from theatrical releases. The company reported FQ1’24 results a few weeks back and smashed EPS targets, but Disney missed the revenue target by $270 million.

The media company has been able to improve the profit outlook by cutting costs with revenues actually flat on the year. Disney guided to FY24 free cash flow of $8 billion, also benefitting from the strike where less was spent on content.

Warner Bros. will likely have the same revenue struggles while not having the highly profitable parks business. The media company isn’t even expected to be profitable for the year, and Warner Bros. is on a plan to cut $5 billion in costs from the business following the merger with Discovery.

The market will definitely focus on cash flow targets considering the need to repay debt. As mentioned with Disney, the reduced content spend will help cash flows over the short term.

Warner Bros. generated $2.1 billion in free cash flows during Q3’23. The company has forecast $5.3 billion of FCF in 2023 with the DTC business shifting to $1+ billion in profitability in 2025.

The big question is always whether some of the reduced pressure on content spending can last. Warner Bros. has clearly improved the cash flow picture, but the company lacks the growth initiatives in order to generate revenue growth over time.

Key building blocks to consider for 2024 free cash flow are as follows:

- Positive #1 – $1 billion tailwind of cash cost to achieve largely going away

- Positive #2 – lower cash interest expense

- Positive #3 – further progress in AR and AP driven working capital initiatives

- Negative #1 – potential further decline in U.S. advertising market

- Negative #2 – return to a normal content capital spend

- Negative #3 – incremental growth investments.

At the start of 2024, HBO Max isn’t exactly spending on content to maintain any leadership position. HBO was once seen as a competitor to Netflix (NFLX) for streaming superiority, yet it is now a distant player in the sector due primarily to a strong content library.

Disney and Comcast (CMCSA) with Peacock spend vastly more on overall content when including sports. Both Amazon (AMZN) and Netflix are expected to spend more on content in 2024, with a wide gap when excluding sports, while Paramount (PARA) will nearly catch Warner Bros. this year.

Source: Morgan Stanley

The new streaming sports venture with Disney and Fox (FOX) probably helps the sentiment. The big question on the earnings call will center around what Warner Bros. actually has to offer to the venture, if the company doesn’t aggressively bid for the new NBA contract up for negotiations and expected to cost far in excess of the $1.2 billion the media company pays to show games on TNT.

Discount Gap Unlikely To Close

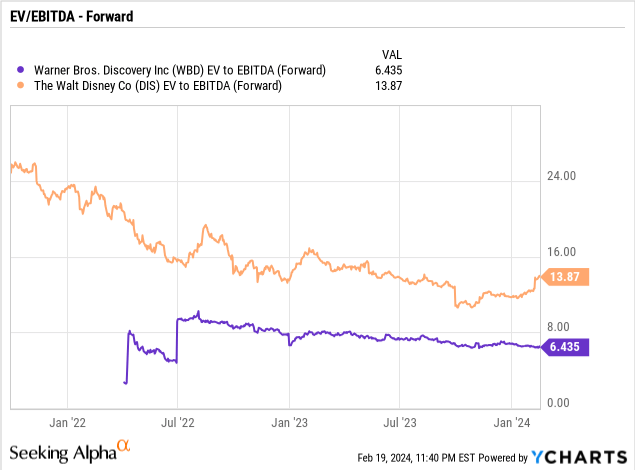

Warner Bros. trades at a major discount to a stock like Disney, but investors shouldn’t necessarily expect the gap to close. Currently, Warner Bros. trades at only 6.4x forward EBITDA targets, or nearly half the valuation of Disney, but as mentioned above, Warner Bros. offers investors limited growth.

Disney solely as a media company probably would trade at a similar multiple. The company generated over half their earnings from the Experiences division that doesn’t face the same competitive threats with Disney World being the premier entertainment destination for kids.

Regardless, the stock appears to have hit bottom here just below $10. The valuation is right, and a company like Warner Bros. producing $5+ billion in annual free cash flow probably has limited downside risk now with a market cap of only $24 billion and the EV around $67 due to net debt of ~$43 billion.

The major caveat is that a new low in the stock could open up major downside risk, and Warner Bros. faces a highly competitive market with tech giants constantly entering the space.

Takeaway

The key investor takeaway is that Warner Bros. Discovery, Inc. has probably hit bottom here with the company shifting towards strong FCF generation. The lack of growth and looming competition along with the large debt load keeps the rating at Neutral for now. The stock could bounce here off a double bottom below $10, but any move is just a short-term trade due to the longer term structural issues in the media space.