Investing in time-tested brands that people use every day is a proven way to grow wealth in the stock market. Many of these companies are so profitable they can reward their shareholders with regular dividend payments that grow over time.

Here are two dividend stocks to buy right now that have a long record of paying extra income to investors.

PepsiCo

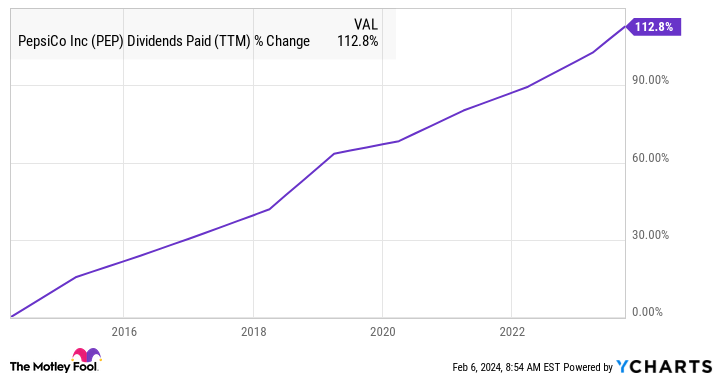

PepsiCo (PEP 0.03%) is one of the best dividend stocks to boost your income. It owns several snack food and beverage brands that people buy every day, including Lay’s, Doritos, Cheetos, Gatorade, Quaker, Mountain Dew, and of course, Pepsi. The company has increased its quarterly dividend for 52 consecutive years and currently pays an above-average dividend yield of 2.96%.

PEP Dividends Paid (TTM) data by YCharts

Most of PepsiCo’s revenue comes from snack food. Investors like to refer to these products as “affordable luxuries.” This is why top consumer brands like Pepsi have been able to get away with charging higher prices over the last few years to offset inflation. Pepsi’s products are not bought out of need but desire, and because they are relatively cheap at the grocery store, shoppers buy them on impulse. This leads to a profitable stream of recurring revenue and dividends.

Unit volume sales got sluggish last year, but price increases drove a 9% year-over-year increase in adjusted sales through the first nine months of 2023. This shows how Pepsi can thrive in almost any environment. Management has struck a good balance the last few years of increasing prices to keep sales growth up but not so much to cause unit sales to plummet.

PepsiCo pays out almost all of its free cash flow in dividends. The company’s resilient brands, profitable business model, and repeat customer behavior should keep income flowing in for shareholders for decades to come.

McDonald’s

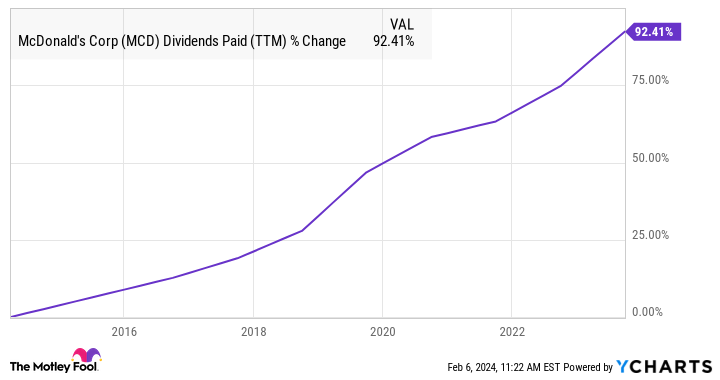

McDonald’s (MCD 0.94%) is another top brand with a global customer base that has everything a dividend investor would want in an income investment. The company has increased its dividend for 48 years and currently pays a yield of 2.34%. The company almost doubled its dividend over the last decade and should continue its streak of dividend increases for a long time.

MCD Dividends Paid (TTM) data by YCharts

There seems to be no limit to McDonald’s store opening potential. Despite already having over 40,000 locations worldwide, the company has maintained solid comparable-store sales growth even as it accelerates store openings. McDonald’s finished 2023 with global comp sales up 9% and adjusted earnings up 18% in constant currency. Management plans to open another 2,100 stores this year.

McDonald’s benefits from a lucrative strategy of franchising almost all of its global stores. This means most of its revenue comes from franchise fees, rents, and royalties. Despite relying on franchise owners, McDonald’s has maintained impressive consistency across its restaurants, creating a well-oiled growth machine.

The company currently pays out about 61% of its annual free cash flow in dividends. With management still finding areas around the world in which it can open more stores, investors should expect McDonald’s to continue growing profits and its dividend for many years.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.