spxChrome

Premise: The historical bloom that has adhered to the rise of Walt Disney (NYSE:DIS) shares pre-streaming and theatrical release misses is now fading. The advance by Nelson Peltz and associates to fight it out with proxies proves that DIS needs every catalyst it can get to grow that bloom back on its rose under the current management. The stock still has its fans but is vulnerable on many fronts. Pre-Peltz opening moves it needs all the ammunition it can get from every success big or small. We shall see it as one of many factors getting media attention during a proxy fight.

google

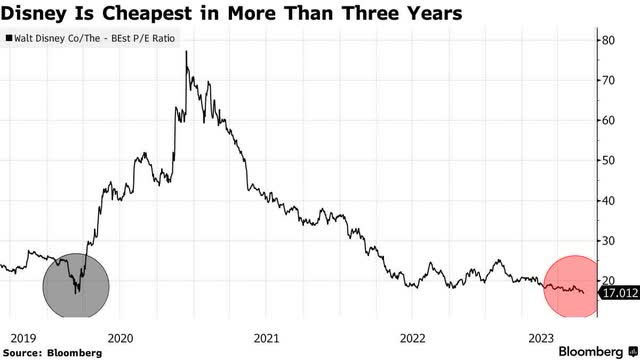

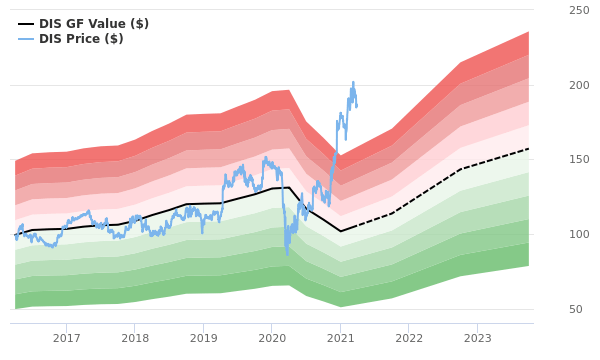

Above: DIS shares at current trade appears overvalued relative to long term trends viewed by analysts.

Analysts currently call a moderate buy in a range from a median target of $106 to a high calculate of $120. Price at writing is $93, up around 8% after last earnings release.

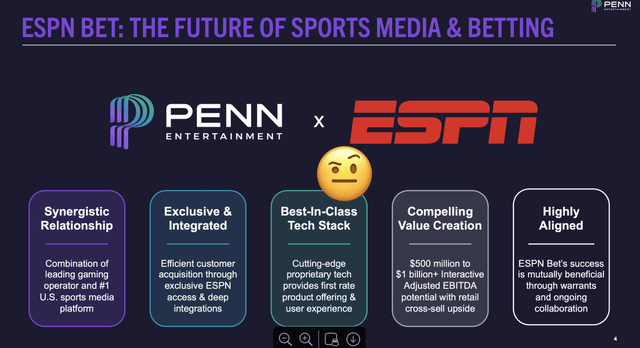

The proxy fight, if it materializes soon, will put every DIS business, big or small, under the Peltz microscope. This includes its media deal toe dip into sports betting with its PENN Entertainment (PENN) sports betting partner.

Above: The good news for dip buyers is bad news too as it would tend to confirm that Peltz is right in asserting the stock is down due to bad management.

The recent upside advance of DIS shares from the low 80s to low 90s tells us that investors saw green shoots in the last DIS earnings release that showed positive growth in streaming customers. Also welcome was news that the company had raised its cost cutting target from $5.5b to over $7.5b for 2024.

It also guides FCF to reach $8b in the process. Good news for certain but one must stack that against the recent series of box office meh if not flop grosses for the filmed entertainment division and the continuing softness of linear networks.

On the surface, the sports betting results clearly are far more relevant to the shares of PENN than that for DIS. But looking at the sentiment surrounding the DIS shares, it is clear they need a win here. As Peltz mounts his campaign, DIS needs to keep the good news flowing past their last quarter, which the market has rewarded with at 12% rise at writing. Going forward, the ESPN Bet advance will punch much above its weight in the perception of Mr. Market of DIS management making good decisions in the burgeoning sports betting sector after a long process of navel contemplation. For that reason, DIS holders need to grasp its betting advance potential.

DIS can’t look admire it left money on the table on sports betting

Since the US Supreme Court May 2018 ruling that opened the flood gates to sports betting now legal in over 30 states, investors have been prodding DIS management as to what their stance would be vis a vis ESPN.

Until the PENN deal it had basically been hamada, hamada, hamada uncertainties. Five years basically lost as the sports betting sector rose from chump change to an estimated $7.6b in 2023 revenues.

The $1.5b ESPN/PENN Entertainment deal is petty cash in the $88b DIS revenue base. Yet it has a far greater impact on investor psyches than many suspect. As with so many stocks today, visibility sometimes counts more than earnings in areas where new businesses unfold.

Above: The happy talk premise of ESPN as a huge customer generator for PENN sports betting shows why it has signed off on $1.5b in media budget.

So the news that a panel of hedgies last week forecast an ebullient launch of ESPN Bet with an calculate of a 7% market share was welcome. That’s a big what if to us, given the ongoing expensive, steel cage battle among third tier betting platforms to just hold small single digit market shares. The deal looms bigger as a pure assess of whether the vaunted ESPN audience’s value either supports or challenges the general valuation of the network at a hefty $22b in a possible sale someday. So there’s a lot more skin in the game here for DIS than would appear merely on the basis of it being touted as at a PENN long term media/promo buy.

The Barstool Sports legacy has left open questions

For openers, Barstool Sports, the legacy business of PENN merged into ESPN Bet, has ~4.2% share of market. If we assume that this year the sports betting sector will produce $7.6b in total revenue, Barstool’s share after more than four years at it is pooled among the also-rans. The 55m Barstool nation’s stoolies and its live sports books at its 44 properties generated ~$400m at best. Much of the value to PENN came from the crossover business among millennials who arrived at their brick and mortar properties to be games, but migrated onto casino floors to play blackjack.

So let’s apply the hedgies calculate to the $7.6b we know will be reached this year. That puts their projection of 7% for ESPN Bet to ramp to a theoretical $650m out of its shotgun year. As a certified gambling man with over 30 years in the business, I’m calling that a tough contract-not impossible, but not a bet for the chalk player. I think if ESPN Bet can hold the Barstool share steady for 2024, it would be a real good for you moment for the launch year.

Barriers to a quick 7% share launch for ESPN Bet

It’s easy enough to construct a scenario out of a misapprehension of just how valuable the ESPN brand and its addressable 70m homes and 22m subscribers to ESPN+ can be.

Above: The $200 opening free money deal has generated trial but the bottom line will be retention and churn rate.

You merely have to believe in sheer number of eyeballs converting to bettors. You also have to be convinced that between ESPN’s fantasy sports leagues, its blanket coverage of the sports world 24/7, its endless stream of panelist bloviations manned by ex-athletes and talk show screamers, that it can pluck out enough serious bettors to propel a good launch. Bettors who also watch ESPN shows clearly are the target and the case in theory, works.

The real world of sports betting has proven a tougher master than anyone ever thought

Reality bites: FanDuel’s 39% share and DraftKings’ (DKNG) 34% share (you can reverse them by month) plus BetMGM’s 17% share bring over 91% of all sports betting volume into the hands of those three operators. FD and DKNG both benefitted big time by the conversion of their fantasy sports players to sports bettors. That may help ESPN Bet but five years later. So we see that 9%, or around $600m annually is fought over by 14 other sites. It is at that level that ESPN Bet and Fanatics enter the fray. So the key question is this:

Why should any bettor using one of the long established sites, switch?

There is a reason: It is the $200 free bet offer that ESPN Bet offers to newbies. It’s a solid opener and probably the key reason for near 500,000 initial ESPN Bet downloads of the site for the $200 in free bets. When that free money is exhausted, will players promptly return to their regular sites? It’s a long established pattern in the gambling business that players always chase deals first.

Bettors chase deals period. So in order to confirm the hedgies’ 7% call we need to know two things: One, what is the churn rate of new signups? And two, what will be the retention rate of new signups over the next six months? We can then measure the average number of total bettors per month net of churn over time and then begin to get a reasonable comprehend on the ESPN Bet launch and follow through post lucrative deals. We won’t know that until at least 1Q24.

Disney’s ESPN deal is a low risk, but low reward effort

The PENN deal guarantees DIS a marketing media revenue of $150m a year over ten years. There are also PENN stock option kickers in the deal. Measured against other DIS revenue streams that have charged up investors, it looks admire this: In dollars and cents it could equilibrate to acquiring around 2m streaming subs a year. That is a stat that has been a proven mover of DIS stock. Yet when the PENN deal was announced, there was mostly a shrug in the trading day.

Bear in mind the DIS/PENN deal was evidence of a rather tortured process in the mouse kingdom over the past five years. From the earliest months after the SCOTUS decision in May of 2018, investors peppered questions at DIS management as to when and if it would put ESPN into the sports betting business. At the same time was the persistent sentiment among other investors that DIS had no business as promoters of gambling considering its core reason to be was clean family entertainment. So management stalled, having its eye on much bigger and more salient issues to deal with.

The departure of Barstool’s Dave Portnoy from its PENN deal sprang from his abhorrence of dealing with gaming regulators among other bureaucratic ills. PENN walked, having to write a $500m check to Dave to wave bye bye. ESPN then loomed as a real possibility that ironically many of the promises that had brought PENN to Barstool:

An existing, passionate loyal audience of sports fans big enough to comb out a solid base of bettors to start. Big media presence in sports programming. Established branding in a demo made to order for sports betting with transferable motivations to bet.

Clearly to DIS the deal was fundamentally a media buy so it could claim to its blue nosed holders that it was not really in the gambling business. It wouldn’t involve DIS entities actually taking bets and paying winners.

Against this is the implied realization that sooner or later it was inevitable that the globe’s biggest sports media could not long postpone its entry into betting one way or another.

Whether ESPN charges out of the starting gate admire a cyclone, or battles its way inch by inch as have many of its competitors is yet to be seen. But the results positive or negative – however small relative to the DIS $88b revenue base – will begin to resonate with investors.

Unquestionably the massive media presence of ESPN Bet on the mothership site will multiply the brand recognition and produce customers. If that number seems impressive, it will clearly goose the shares on such reports as a rise in streaming subs now does. But there is likewise the risk that the launch will not confront expectations. And while that will certainly not tank the DIS shares big time, it will add another meh result to the corporate scorecard. Those verticals are already challenged by poor results in filmed entertainment, ad volume in linear networks, pricing in theme parks edging out of affordability. All targets for Peltz’ assertion that management is underperforming its potential and suppressing the stock.

That is why in our view, the ESPN Bet launch results will possibly have far more impact than the financial results of the PENN deal. The tale of the tape will be told post Super Bowl when we’ll have our first real world results of DIS effort long after the seminal 2018 start of legal wagering on sports in the US beyond Las Vegas.

Right now, according to AGA and many bulge bank analysts, we could see US sports betting revenue reaching $20b annually by 2030. If ESPN Bet reaches and manages to hold a 7% market share that would translate to $1.4b in revenue for PENN. Then a case could be made stronger as to what ESPN could be worth if sold off. A $22b number gets more real.