ipuwadol

The share of US ecommerce sales in Q4 hit a record, surpassing the crazy days of 2020 for the first time.

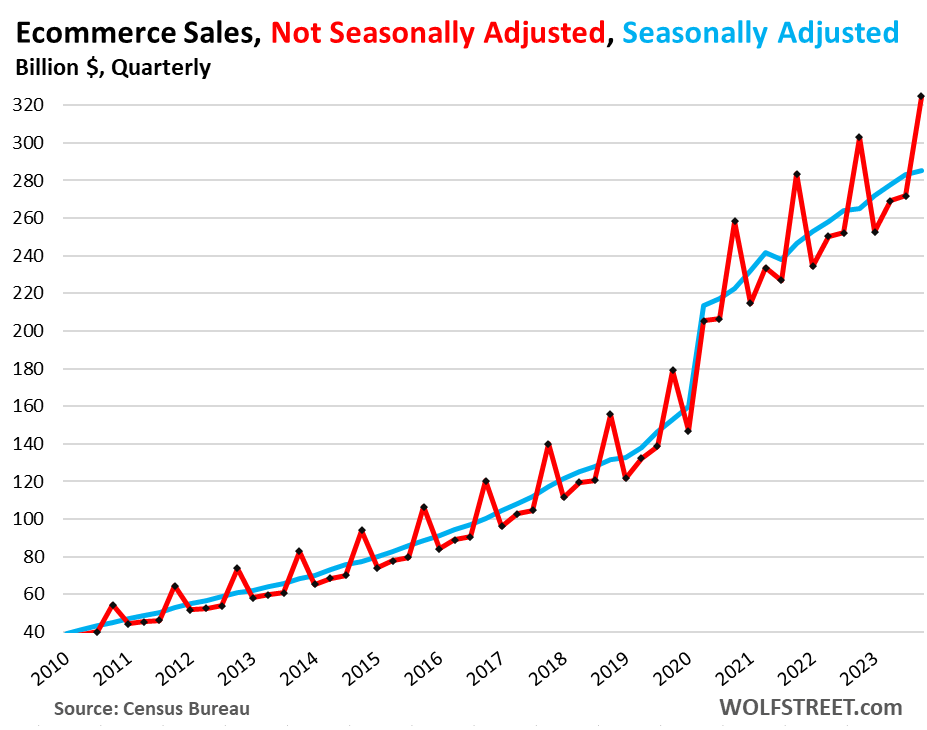

Total US ecommerce sales in Q4 jumped by 7.2% year-over-year to a record $325 billion, not seasonally adjusted, according to the Census Bureau today.

Ecommerce sales exploded in 2020 during the lockdowns, when many retailers had to close and when people weren’t willing to take the risks and go shopping, while the free money was being pumped into households.

Over the year from Q4 2019 through Q4 2020, ecommerce sales spiked by 44%, from $179 billion to $258 billion. And each year, they continued to surge, and in Q4 2023, hit $325 billion, up by 82% from Q4 2019.

Walmart (WMT), which reported earnings today, is an example of the effect of ecommerce on retail sales. Walmart is the second largest ecommerce retailer in the US, but far behind Amazon (AMZN). At Walmart US, ecommerce sales soared by 17% year-over-year, while total Walmart US sales, including ecommerce, rose only 3.4%.

Comparable sales (ex fuel), which include ecommerce, grew 4.0% in Q4 year-over-year. Of this 4% growth, 2.4 percentage points were contributed by ecommerce, and 1.4 percentage points were contributed by all other sales, including grocery sales.

Walmart is the largest grocery seller in the US, and grocery sales growth was “mid-single digit,” with “strong growth in fresh food,” it said today. Within the overall US grocery market, it gained share, it said, citing Nielsen.

With ecommerce growing at 17% and with its huge grocery sales growing in the mid-single digits, sales of the rest of its merchandise at its brick-and-mortar stores – so minus ecommerce and grocery – must have been uninspiring. And it said so in its presentation when it mentioned the “softness in general merchandise.”

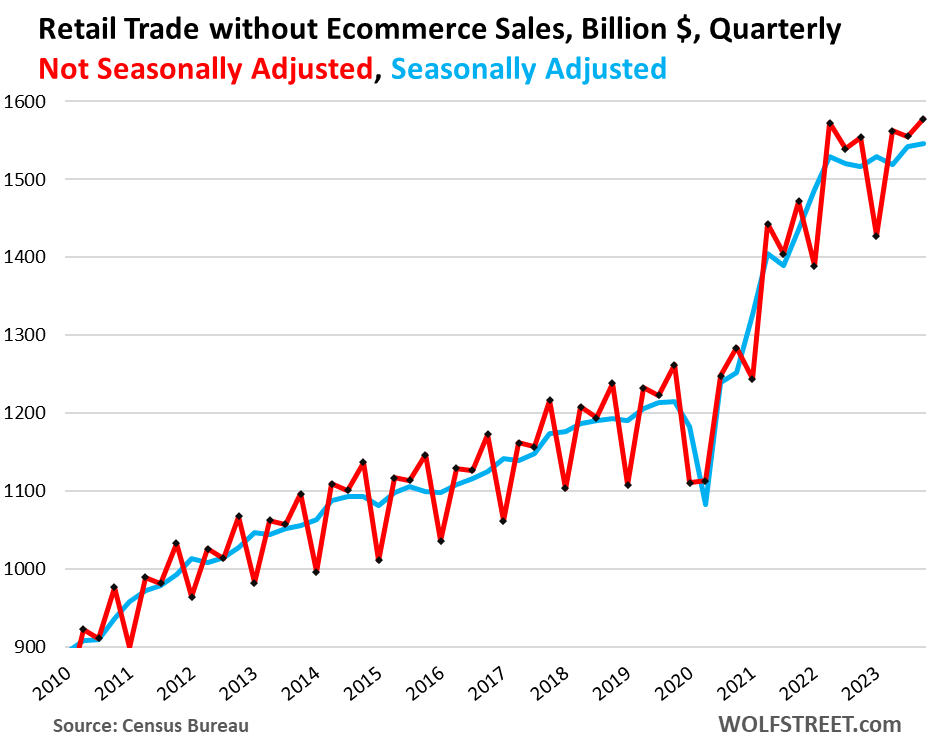

But retail trade sales without ecommerce rose only 1.5% in Q4 year-over-year, to $1.58 trillion. We note:

- Q2 2020, sales stayed down at the same level as Q1 2020, instead of resurging from the seasonal Q1 plunge.

- In Q2 2021, sales spiked as stores had reopened and another wave of stimulus checks was put to work.

- In Q2 2022, sales spiked again, this time driven in part by price spikes, with CPI inflation running at 9%, and with many categories of goods experiencing double-digit price spikes.

Since Q2 2022, growth in retail sales without ecommerce has been somewhat languid, as the growth in total retail trade sales was carried mostly by ecommerce (chart above):

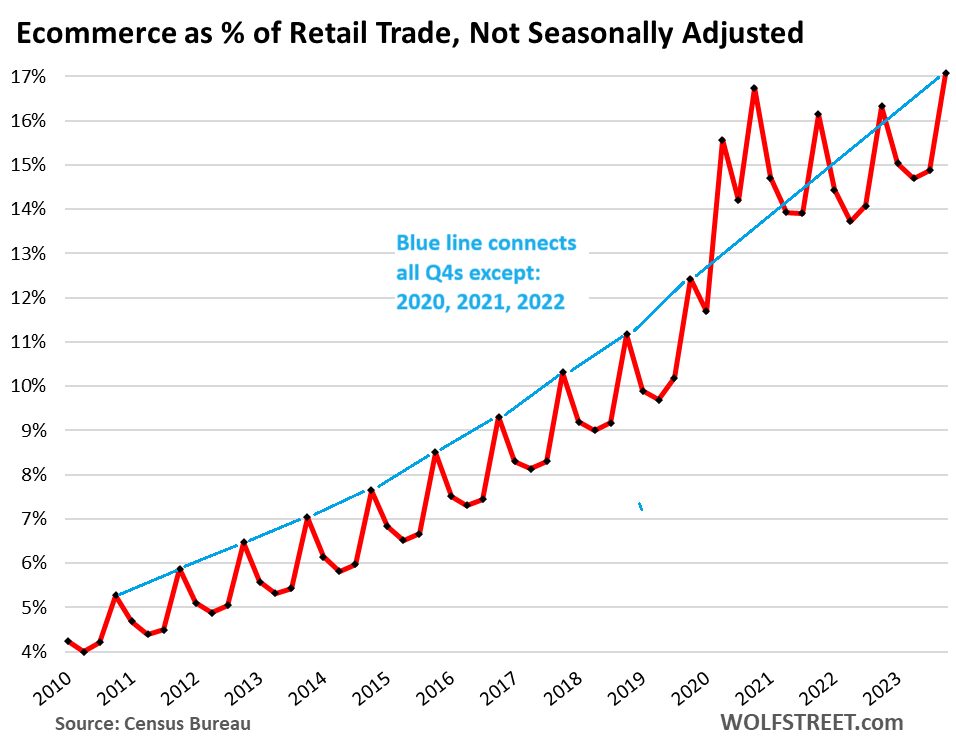

The share of ecommerce sales hit a record for the first time since Q4 2020, rising to 17.1% of total retail trade sales, not seasonally adjusted, according to the Census Bureau today.

Ecommerce sales had spiked massively during the pandemic, from a share of 12.4% in Q4 2019 to a share of 16.7% in Q4 2020, as brick-and-mortar sales had gotten hit by the pandemic, including many stores having to shut down, and people shifted their spending to ecommerce, even for grocery sales. This 16.7% share turned out to be hard to beat after people started going to stores again. But in Q4 2023, that record fell.

We connected all the Q4s, except 2020, 2021, and 2022, to show the long-term trend line (blue), which produces another crazy chart about the pandemic excesses:

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.