When assessing a stock, one worthwhile task is to check out Wall Street analysts’ one-year price target. Analysts aren’t all-knowing or always correct, but seeing their estimates can help you refine your own thinking about a stock.

As I write this, the average price target for Palantir Technologies (PLTR -3.11%) is $19.50 across 19 analysts tracked by CNN. Compared to the stock’s current price of around $23 as I write, that represents a significant downside. So, is Wall Street right?

Palantir’s products are seeing strong demand

Palantir has become a popular investment due to its artificial intelligence (AI) software. The company was built from the ground up to offer highly customizable AI tools for government use. Palantir has expanded into the commercial side, selling to businesses, and its AI prowess remains among the best in its class.

Its latest innovation, AIP (artificial intelligence platform), gives companies the tools to create their own generative AI model without giving proprietary information to other generative AI platforms like OpenAI’s ChatGPT or Alphabet‘s Gemini. Demand for Palantir’s AIP platform is unprecedented in the company’s history and is the source of the hype around the stock.

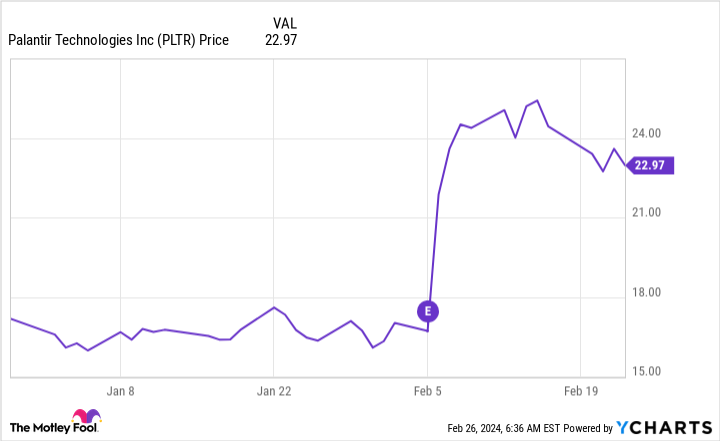

Before Palantir’s Q4 earnings report in early February, the stock was below what the current Wall Street price target is. But after reporting, it shot up well past what analysts are saying Palantir should be worth in one year.

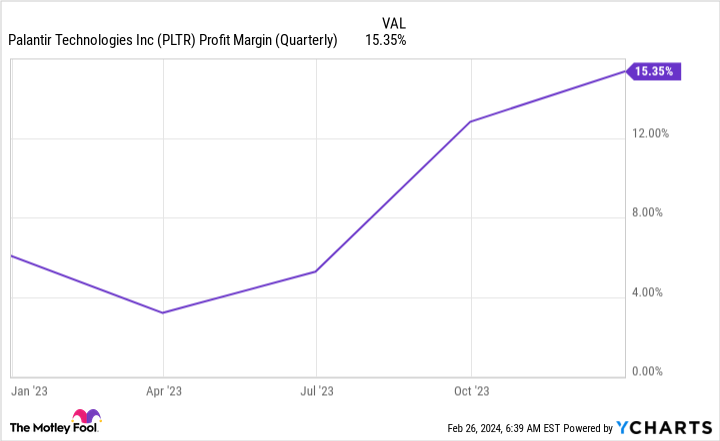

In this report were several key items that sparked investor enthusiasm, including U.S. commercial revenue rising 70% year over year and overall revenue rising 20% (which exceeded management’s guidance). Palantir’s profit margin also improved, showing the company’s dedication to maximizing its profitability while balancing growth.

PLTR Profit Margin (Quarterly) data by YCharts

Palantir also gave guidance for a strong 2024, with full-year revenue expected to be about $2.66 billion, indicating 20% growth — an acceleration over 2023’s 17% growth. Those are strong numbers and can be noted as a reason why the stock shot up so much following earnings.

But why is the analysts’ average price target below what the market thinks the stock is worth right now?

A lot of it has to deal with outdated projections. Not every analyst has updated their price target for Palantir, and one analyst still believes Palantir is only a $5 stock. Still, there are plenty of analysts that have updated their price targets post-earnings to a figure below its current price, indicating they’ve taken the latest report into account and are not convinced the future is totally rosy.

This look at analyst price targets is interesting and useful as one part of research, but they aren’t the only thing to consider. Investors will have to do their own assessment of if a stock is too pricey to buy. To me, Palantir stock does look very expensive.

Would I buy Palantir’s stock right now?

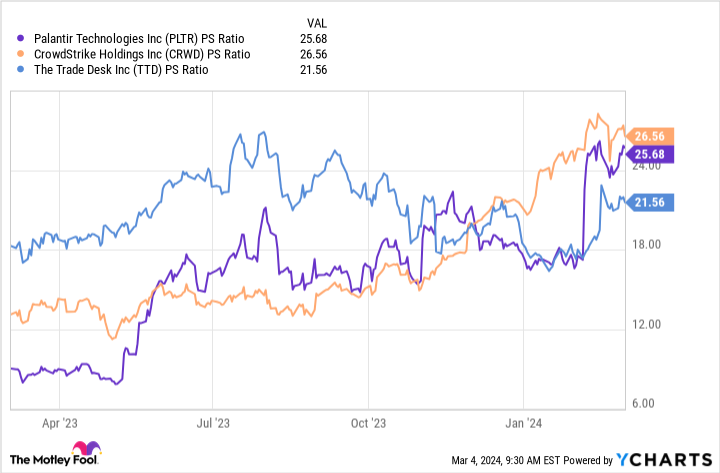

Because Palantir is still working its way to full profitability, I’ll use its price-to-sales (P/S) ratio to value the company. At 26 times sales, Palantir is a very pricey stock especially considering other companies like CrowdStrike (27 times sales) and The Trade Desk (22 times sales) are growing at a much faster space, 35% and 24%, respectively.

PLTR PS Ratio data by YCharts

If Palantir could snap its fingers and achieve a 30% profit margin (the level a fully mature software company like Adobe has achieved), Palantir would trade for 80 times earnings.

That’s an expensive stock, and even though Palantir is growing at a healthy 20% rate, it would take some time for it to reach reasonable P/E levels. Adobe’s average price-to-earnings (P/E) ratio since 2023 has been about 44, so I’ll use that as a baseline of what Palantir’s stock could be worth if fully profitable.

Should Palantir maintain its 20% annual growth rate for the next four years and achieve a 30% profit margin, its stock would be trading at 46 times earnings using today’s price. That’s with maximized profits and strong growth, so in that scenario you’d be giving up three years of stock returns to purchase Palantir now. But if Palantir maintains this 20% growth rate for five years or more, the growth may propel it to a point where the stock could be both reasonably valued while increasing in price, making the stock a buy now.

For example, if Palantir grows at 20% for five years, achieves a 30% profit margin, and is valued at 46 times earnings, the hypothetical stock price would be 43% higher.

The decision to buy or sell depends on Palantir’s growth over the next five years. If it doesn’t grow at a 20% or greater pace for more than three years, it’s too expensive. But if it can do it for five years, then you could purchase Palantir shares today as long as you have the mindset of holding on to the stock for an extended period. But at today’s prices, I’m going to pass.

Keithen Drury has positions in Adobe, CrowdStrike, and The Trade Desk. The Motley Fool has positions in and recommends Adobe, CrowdStrike, Palantir Technologies, and The Trade Desk. The Motley Fool has a disclosure policy.