After cutting its dividend by 48%, Walgreens Boots Alliance (WBA -2.68%) is no longer the highest-yielding stock in the Dow Jones Industrial Average. But even after the cut, Walgreens yields 4%. And investors might be eyeing the stock as a potential turnaround play now that management has lowered one of its higher expenses and freed up cash to improve the business.

However, weak fundamentals and declining earnings make Walgreens too risky for the potential reward. Here’s why Apple (AAPL 0.57%), Procter & Gamble (PG 0.43%), Johnson & Johnson (JNJ 0.15%), Walmart (WMT 1.24%), and Chevron (CVX -0.82%) are five better Dow dividend stocks to buy now.

Image source: Getty Images.

1. Apple’s true value add: its buybacks

Apple yields just 0.5%, but that’s a result of its outperforming stock price, not a lack of commitment to its dividend.

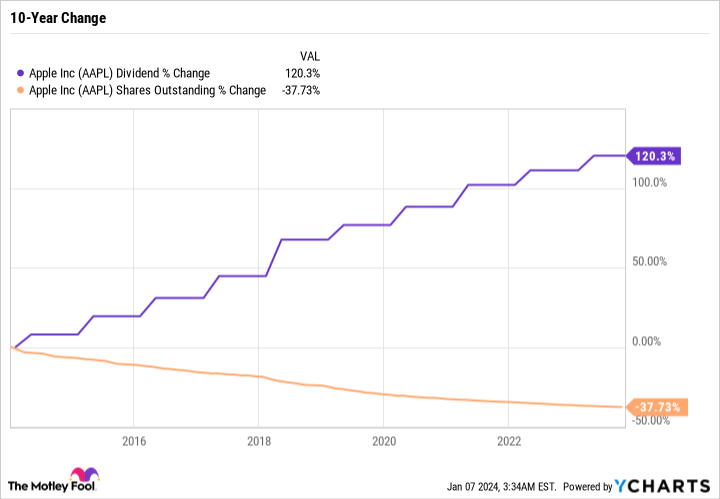

Management has raised its dividend every year since 2012. And over the past 10 years, its dividend has more than doubled while its outstanding share count has fallen 37.7% thanks to buybacks.

AAPL dividend data by YCharts.

Apple’s cash-cow business model allows it to make dividend raises and buy back stock even during a slowdown, which we’ve seen play out over the last couple of years.

It’s a good dividend stock for investors who value a quality business, buybacks, and dividend raises more than a high yield.

2. Procter & Gamble is essentially a perfect business

Like Apple, P&G is not purely a dividend play. It also has a sizable buyback program. And the business is as solid as ever.

The stock underperformed the market big time in 2023. Patient investors should take advantage of the opportunity to buy a quality business at a good valuation.

P&G is one of the best-run businesses out there and arguably the single strongest business in the entire consumer staples sector. It has impeccable pricing power and industry-leading products across a wide variety of categories, including beauty; grooming; healthcare; fabric and home care; and baby, feminine, and family care.

Management has a track record of developing brands. The company’s performance in fiscal 2023 proved that brands really do matter, even for everyday household products like laundry detergent, paper towels, razors, and more.

P&G operates a high-margin business, with recession resilience and a diversified business model. The only question investors should ask before buying the stock is whether it is expensive. At a 23.9 price-to-earnings ratio, it is trading around the same multiple as the S&P 500 — which is reasonable for such a high-quality business even though it is growing slowly.

3. One of the best balance sheets out there

Like P&G, Johnson & Johnson is a Dividend King with over 60 consecutive years of dividend increases. It is one of the most reliable healthcare income stocks out there.

But the J&J of today is different than the J&J of the past, mainly because it spun off its consumer-healthcare products into a new company called Kenvue. The idea is that the “new” J&J will grow faster, with a focus on pharmaceuticals and medical devices.

Dividend Kings are known for their reliability, not for chasing growth. But J&J should have no trouble raising its dividend even with a more growth-orientated business. The company is a cash cow, generating far more free cash flow every year than it uses to pay the dividend.

J&J also has one of the strongest balance sheets, with total net long-term debt of a mere $6.4 billion. That’s a drop in the bucket for a company with a market cap of $388 billion.

With a 3% dividend yield, a reliable business model, and a phenomenal balance sheet, Johnson & Johnson is a dividend stock that investors can count on in 2024 and beyond.

4. Walmart is a stock you want to own during a bear market

Walmart is another example where the quality of the business, not the yield, is the primary focus. Its shares yield just 1.5% — which is far less appealing than a stock like J&J.

But Walmart is also a Dividend King. It tends to make small dividend raises, choosing instead to reinvest and grow the business.

Perhaps Walmart’s greatest quality is its ability to perform in a challenging environment. The business is all about undercutting the competition with the lowest prices and providing the best value for its customers. When the economy is faltering, or there’s a changing business climate, it is a safe haven with the sophisticated supply chain needed to take market share.

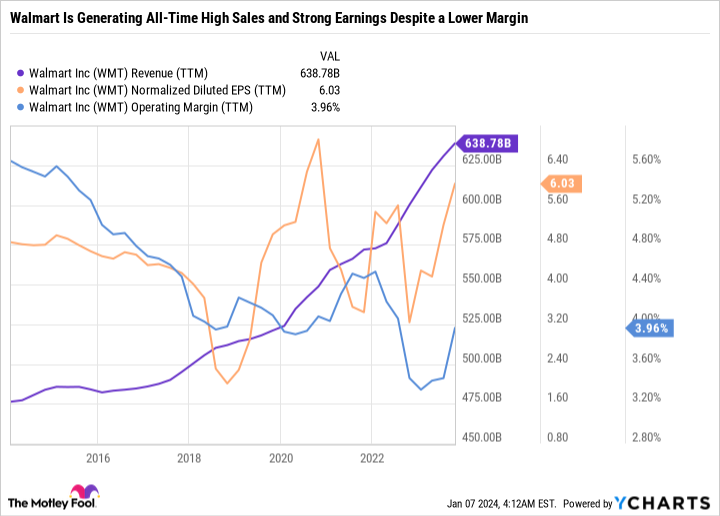

Recent conditions provide a good stress test:

WMT revenue (TTM) data by YCharts; TTM = trailing 12 months.

The company’s results have been excellent, even as consumers have shifted from discretionary categories to staples. Walmart doesn’t have nearly the same exposure to discretionary categories as its competitors, like Target. Years of long-term investments and expansions, paired with precise execution throughout this challenging time, have helped Walmart put up solid results, given the circumstances.

Walmart is the perfect stock for investors looking for a company that is less dependent on a strong economy to do well.

5. Chevron is poised to perform even if oil prices have a steep drop

Coming in with a 4% dividend yield and nonstop annual payout raises since 1990, Chevron is an underrated dividend stock. It might not generate the consistent cash flow that Walmart, J&J, or P&G do. But it has an incredibly strong balance sheet and can fund the dividend and its operations even when oil is $50 a barrel.

Chevron is also geographically diversified and includes much more than just the upstream side of the industry. It has a sizable downstream business and is investing in low-carbon efforts.

It can do incredibly well and generate outsize profits when oil is a relatively high or even mediocre price like today’s $78 Brent crude per-barrel price. That upside potential, paired with a large margin for error, makes Chevron a reliable income stock in a volatile sector.

Dividend quality over quantity

Apple, Procter & Gamble, Johnson & Johnson, Walmart, and Chevron are five completely different companies in five different industries. But all five Dow stocks are components for a reason.

Each company should be able to fund dividend raises by growing its business. It sounds simple, but often we see powerful companies gradually lose their edge to competition. Or in the case of Walgreens, it lost market share and sustained ill-fated dividend raises for far too long.

All 30 Dow components are meant to represent their respective sector as a role model. Apple, P&G, J&J, Walmart, and Chevron do that well, which can’t be said for every Dow stock. All five stocks are worth buying in January for investors looking for quality businesses they can count on, no matter what the new year brings.