Justin Sullivan

Walgreens Boots Alliance, Inc. (NASDAQ:WBA) announced fiscal first quarter earnings earlier this month. The struggling pharmacy retailer also announced that it was cutting its dividend nearly in half. While the company is projecting earnings decline in 2024, management and analysts are optimistic that a turnaround is coming. Based on the most recent financial data, I believe it is too early to buy Walgreens shares outright, but investors can set a lower entry point, and earn decent income, by selling $20 strike price put options.

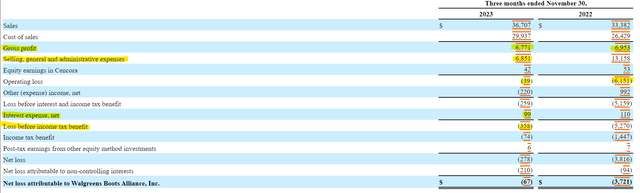

Walgreens’ Q1 2024 earnings results showed a solid boost in sales. Unfortunately, the company’s cost of goods sold rose by more than its revenue, which led to Walgreens’ gross profit falling by nearly $200 million to just under $6.8 billion in the first quarter. The gross profit was not enough to cover selling, general, and administrative expenses, leading to an operating loss for the quarter.

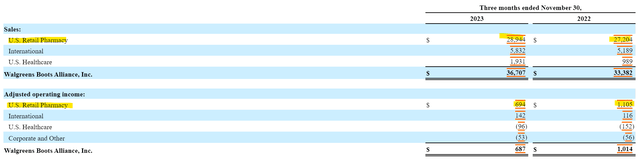

It is important to note that Q1 2023 earnings were negatively impacted by a $6.5 billion charge related to opioid litigation. If we remove that one-time charge from the analysis, operating income would be $400 million lower in the present quarter versus the same quarter a year ago. The operating income struggles are coming from the US Retail Pharmacy segment of the company, which accounts for 80% of overall revenue.

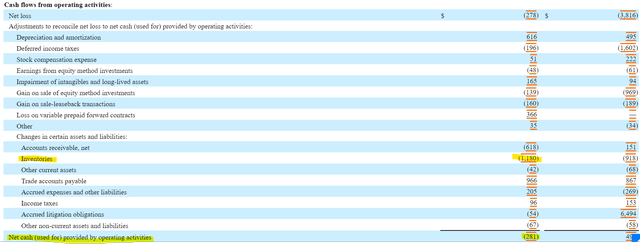

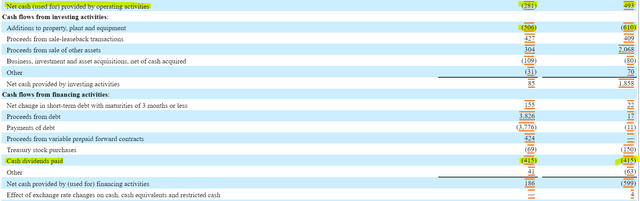

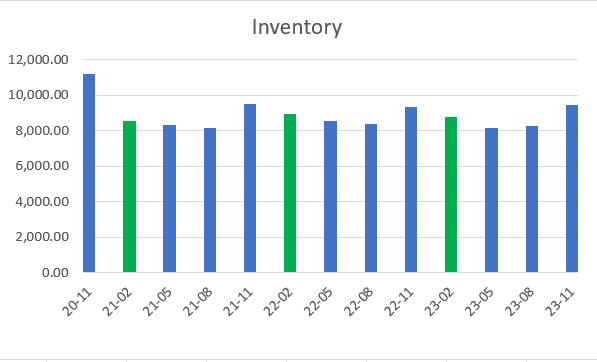

An analysis of the company’s cash flow trend leaves no question as to why Walgreens slashed its dividend. Going back to the fourth quarter of fiscal year 2021, Walgreens free cash flow has been in freefall. On a trailing twelve-month basis, free cash flow has gone from over $4 billion to negative, clearly lower than the company’s dividend obligation. The first quarter saw negative operating cash flow of $281 million and negative free cash flow of nearly $800 million.

Despite the heavy downward trend, there are signs that Walgreens may have hit bottom. The cash flow statement from the first quarter showed over $1.1 billion in operating cash flow consumed towards the purchase of inventory. Historically, the second fiscal quarter shows a reduction in inventory balances, so investors can expect working capital to help cash flow in the next quarter.

Tikr

In the first quarter earnings call, management indicated that there will be $500 million in working capital improvements and $600 million in reduced capital expenditures for fiscal year 2024. If they deliver on those expectations, free cash flow should be over $1 billion (it was $141 million in fiscal year 2023) and the new dividend obligation of $800 million should be covered by it.

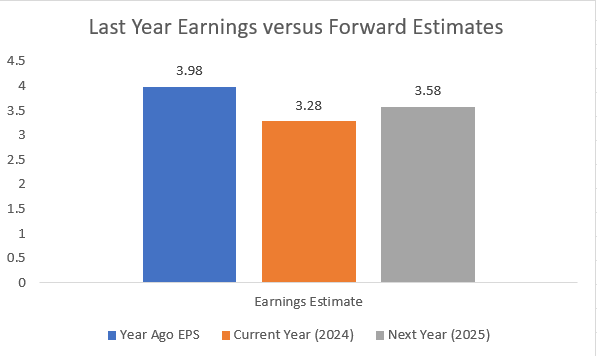

Yet, headwinds remain that make me hesitant to flat-out purchase shares. Analysts are projecting a decent drop in earnings per share for FY2024 and a 10% growth recovery in FY2025. Should the financial headwinds facing Walgreens become stronger, it will lead to more share volatility and more doubt about dividend coverage.

Yahoo Finance

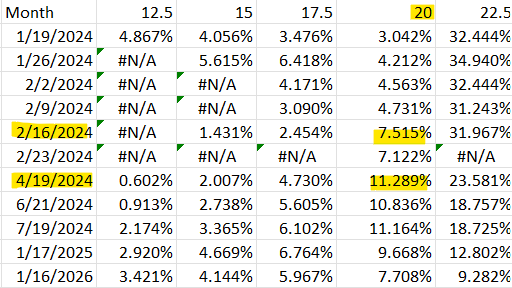

This is why I like the option of selling cash-secured put options at a $20 strike price. Through my broker (Fidelity), I still get interest (currently 5%) on my restricted cash plus the income generated from selling a put option. In the case of Walgreens, a $20 strike put would return 7.5% at a February 16th expiration or 11.2% at an April 19th expiration. The April expiration would require the option holder to ride out one earnings report.

Yahoo Finance, January 15, 2023

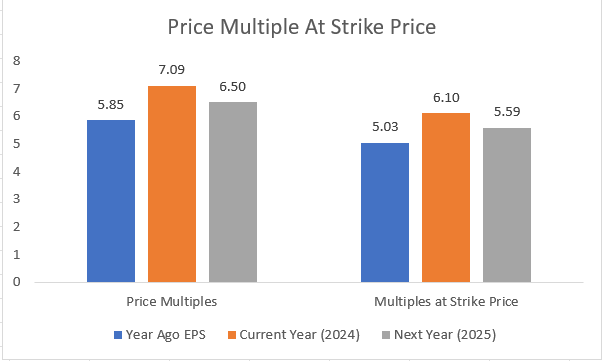

I am comfortable taking on Walgreens shares at $20 per share for two reasons. First, at the $20 strike price, the dividend yield would rise to 5%, equivalent to my current cash yield. Secondly, Walgreens shares are currently trading at cheap forward earnings multiple. At an entry of $20 per share, investors would be assigned shares at 6.1 times this year’s projected earnings. I can also explore the option of selling cover calls for additional income if I am assigned shares. With any put options trade, investors run the risk of missing gains if the stock takes off or inheriting losses if it plummets.

Yahoo Finance

It’s too early to tell if Walgreens is out of the woods and about to stage a turnaround. Management is optimistic that cash flow will improve in 2024, and analysts are optimistic that earnings will improve in 2025. Despite the unknown, the valuation is compelling and the put option premiums are more compelling. Therefore, instead of placing an open limit trade for $20 and buying on the dip, sell cash-secured puts and earn the income.