Hiroshi Watanabe/DigitalVision via Getty Images

If we have learned anything from the past year’s market behavior, it is that very few predictions turn out to be helpful. The market goes up when you expect it to go down, and vice versa. But one thing is sure, eventually the market corrects, sometimes dramatically. When it does, buy and hold investors investing in taxable accounts get the opportunity to make the proverbial lemonade out of lemons and harvest tax losses.

A tax loss harvesting strategy is so useful that many brokerages are now pitching various robo- and other managed investment schemes that optimize your ability to tax loss harvest. Examples of these include Schwab Intelligent Portfolios and Fidelity Tax-Managed U.S. Equity Index Strategy.

But you don’t need to pay a broker or investment advisor’s fees to take advantage of tax loss harvesting on your own. It is easy to do if you know the relatively simple guidelines and understand how to choose the right investments to use as a tax loss harvesting partner with your existing holdings.

Finding tax loss harvest partners for stocks is relatively easy. You just buy the stock of a company in a very similar line of business to the one you want to sell. But those who hold large core positions in broad market index funds they have owned for long periods of time have to be patient. Our opportunity to tax loss harvest will come only when there is a significant market correction.

Since there has been a lot of talk over this past year suggesting that just such a correction may be on the way, it may be time for investors in one of the world’s most popular ETFs, the Vanguard S&P 500 ETF (NYSEARCA:VOO), currently holding $1.11 Trillion in assets, to start the planning that will let them make the most of this upcoming opportunity.

What Is Tax Loss Harvesting?

Tax loss harvesting is the strategy whose goal is to generate tax losses you can use to offset other income without changing how much you have invested in stocks or the style in which you have chosen to invest. You do this by selling shares that will generate a capital loss and replacing them immediately after that sale by buying the same dollar amount of shares in similar, but not identical investments. There are several reasons you might want to do this:

- It can nullify up to $3,000 a year of otherwise taxable ordinary income, including wages, self-employment income, and interest if you don’t have any other capital gains your capital loss could offset.

- It allows you to get out of stock, ETF, or Mutual Fund investments you no longer wish to own that are carrying significant capital gains without being taxed on those gains just by generate tax losses via your tax loss harvest equal to those gains.

- Any unused losses can be carried over to future tax years and used then. There is no limit on how much you can carry over. You can apply $3,000 of carried over capital losses each year to offset regular income or apply an unlimited amount of carried over losses to any capital gains you have in any subsequent year.

Know the IRS Rules Before You Tax Loss Harvest

The Timing Rules

U.S. investors should be aware that tax loss harvesting incorrectly by selling only a portion of a large holding will generate a wash sale. This will mean that you can’t offset any capital gains with these losses. Instead, the amount of your loss is used to raise the cost basis of shares you still hold in the security where you created the wash sale.

Here’s how you avoid having your share sales of a large VOO holding categorized as wash sales. Make sure before you sell any losing tax lots of VOO that you haven’t bought any shares of VOO within the past 30 calendar days.

Then make sure you don’t buy any replacement shares of VOO during the 30 days following your tax loss sale. There has to be a 30-day period both before and after your sale of losing shares of VOO during which you haven’t bought any shares.

You will still generate a wash sale if you sell older tax lots that have a loss even if more recently purchased shares have a gain if you have bought any shares of VOO within the past 30 days.

Watch Out for Automatically Reinvested Dividends

The “no-buys 30 days before or after” rule includes any dividends you might have received over the past 30 days and had automatically reinvested! You must turn off automatic dividend reinvesting at least 30 days before you attempt to tax loss harvest any VOO shares that are in the red.

The only exception to this is that you won’t generate a wash sale if you are selling your entire position in a security. This is not likely to be possible for anyone who started accumulating shares in VOO several years ago or more. Shares just five year shares have almost doubled in price since they were bought. Only recently purchased shares are likely to generate significant losses. But you can sell your entire position without worrying about creating a wash sale if you recently begin a position in a new tax loss harvest partner and decide to get out of before the 30 day after purchase waiting period is over.

Ideally, you would choose a tax loss harvest partner that is as close as possible in performance to VOO, but there is an issue to consider here.

Identical Tax Loss Harvest Partners Will Be Treated as Wash Sales

For a tax loss harvest to be totally kosher, the IRS specifies that the shares you buy immediately after selling the shares you harvest should not be shares in a “substantially identical security.”

This rule is easy to apply when you are trading stocks. Home Depot (HD) is not substantially identical to Lowe’s (LOW) though they make good tax loss harvest partners. That’s because, though as they are in almost identical lines of business, they are different companies with different levels of debt, market penetration, sales/book ratios etc.

But the situation is more complicated when you are trading ETFs. Especially when you are trading an ETF like VOO which tracks an index that is tracked by quite a few other S&P 500 ETFs, such as the iShares Cores S&P 500 ETF (IVV) and, of course, the SPDR S&P 500 Trust (SPY). Though their expense ratios differ, as does the skill of fund managers who attempt to track the index’s performance, which makes for tiny differences in their long-term performance, a reasonable person, or even an auditor at the IRS, might consider these ETFs to be “substantially identical.”

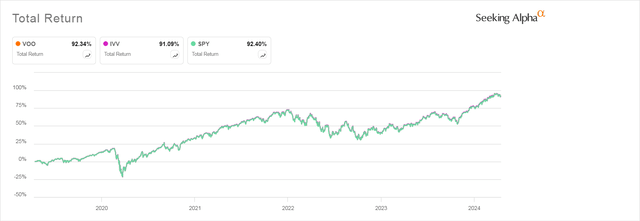

VOO, IVV, SPY 5 Year Performance

There is hot debate on this topic, both in the comment section of a previous article I have written about tax loss harvesting and on every other investing discussion board around the internet, be it Bogleheads or a subreddit. Some investors argue that since brokers only report wash sales when you buy investments with the same CUSIP during the period extending 30 days before and after a sale, you can ignore this stipulation and invest in IVV or SPY instead of VOO for that 60 days.

Others, and I fall into this camp, say that it is unwise to tax loss harvest into an ETF that tracks an identical index, especially if you are claiming large tax losses and/or are at high risk of an audit.

And be aware, your audit risk may have changed this year! I was surprised to learn when I did our family taxes this year that HR Block tax software now shows a Bright red “High Risk of Audit” warning for a return that never threw up that flag before. The reason? We file a Schedule C for a small business that generates a significant income, and it seems that the IRS has recently increased its scrutiny of small businesses like ours. I would therefore prefer to err on the side of caution.

Other reasons you might want to be cautious include if you are claiming a home office exemption, which already sets off audit flags, if you are claiming a large amount of itemized deductions, if your income fluctuates dramatically from year to year. You should also be wary if you run a small business that typically employs unincorporated contractors, like a house painting company. That’s because these companies often attempt to treat employees as contractors or don’t send out 1099s to the people who work with them.

So unless you are reporting a relative low income and applying single digit tax loss harvests, it might be wise to find a tax loss harvest partner for VOO that is not one of the other S&P 500 ETFs. That said, lots of people do seem to use IVV or SPY as tax loss harvest partners with VOO.

The Biggest Problem With Tax Loss Harvesting

Ideally, you would like to eventually move the money you move out of VOO via a tax loss harvest back into VOO a little after the 30-day wait period for new purchases had expired. That way, it remains your core holding.

But this is tricky. Over the many years I have been tax loss harvesting, the biggest issue I have run into is that the market has whipsawed so quickly after a sharp correction where I have tax loss harvested out of VOO that I have found myself locked out of moving that money back into it as within those 30 days after my most recent share sale the price has shot up to give me a significant capital gain in the Tax Loss Harvest partner ETF. Then I’m stuck with those shares sometimes for a couple years!

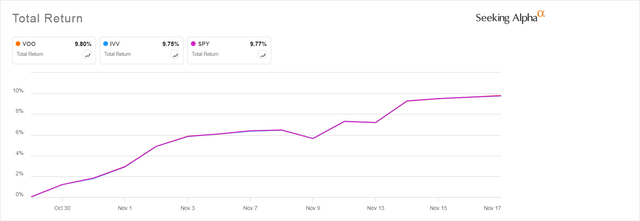

As an example, check out what would have happened to an investor who sold out at the bottom of last October’s decline, on Oct 27, 2023. By November 18, 2023 VOO had not only surged more than 9.8%, but it also outperformed the other ETFs tracking the S&P 500, though they too surged more than 9%. Even the investor who used an ETF that tracked the identical index was now stuck with the alternative investment and has been forced to hold it ever since as selling it now and reinvesting the money in VOO even months later would generate at least a 9%-plus short term capital gain, taxed at ordinary income rates.

VOO’s Sudden Surge After Its Latest Low

The possibility of getting trapped, perhaps for several years, in an investment that underperforms VOO the whole time you hold it, makes it essential to select a partner for VOO that has a history of performance close enough to VOO’s performance over long stretches of market history to suggest that if you do get “trapped” in the new ETF you won’t spend the next year regretting you ever considered tax loss harvesting those VOO shares.

So what ETFs would make the best tax loss harvest partner for VOO today?

Commonly Suggested Tax Loss Harvest Partner Candidates for VOO

The Vanguard Total Stock Market ETF

The most frequently suggested partner for VOO is The Vanguard Total Stock Market ETF (VTI). Where VOO holds only slightly-over-500 Large Cap stocks, all of them selected by a committee and all with a history of at least a year of profitability, VTI holds shares of some 3,717 stocks of all sizes and degrees of profitability.

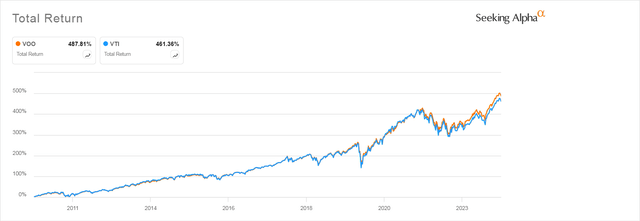

VTI was the ETF I used to use because, as you can see from the chart below, from VOO’s inception in 2010, VTI’s performance matched that of VOO very closely. Until it did not.

From 2010 to 2019 VTI’s Performance

Tracked Closely to VOO’s

As you can see, the performance advantage that VTI had over VOO was largely confined to the period during which the economy was coming out of the 2008 Financial Crisis. Once the FAANGs began to dominate the market, and even more so with the arrival of the Magnificent Seven, the lagging performance of the thousands of small- and mid-cap stocks in VTI caused its overall performance to lag that of VOO significantly.

And as you can see below, VTI’s performance has lagged that of VOO since 2019, quite badly. VOO has outperformed it over that period by a whopping 9.2%

VOO vs VTI Total Return Past 5 Years

This performance history, my personal experience of getting stuck with lots of shares tax loss harvested into VTI whose performance has gone on to lag that of VOO by a depressing margin, and my conviction that the dominance of a small number of very visible stocks will continue to dominate the performance of the market as a whole for the foreseeable future, no matter whether the market rises or crashes, suggests to me that VOO and VTI are a bit more substantially different than investors may realize.

The Vanguard Large Cap ETF

A better choice, based on long-term performance, though one that still has underperformed VOO over that recent 5-year period is the Vanguard Large Cap ETF (VV). This ETF tracks the CRSP US Large Cap Index. That index does not hold a set number of stocks, unlike the S&P 500, but instead appears to hold a market cap weighted selection of selects all stocks traded on U.S. markets that meet its size requirement. I say “appears” because CRSP states about its indexes only that “CRSP Market Indexes are based on a proprietary methodology using publicly-available market data.” So we don’t know exactly how it defines Large Cap. We can, however, visit Vanguard’s site where we see that the smallest stocks held by VV, which include Sirius (SIRI) and Zillow Group (ZG) have market caps of between $10 and $12 Billion.

Currently, Vanguard tells us that VV holds 513 stocks, a number very similar to what VOO holds. As a result, the weightings it assigns the market-dominating top stocks are very similar to those of VOO. Several months ago, however, VV held 543 stocks, which is the number you will still see listed on some ETF-tracking websites.

However, VV’s holdings of cap stocks do differ from those of VOO as they include stocks that do not have a history of profitability as well as other stocks that for reasons known only to the S&P 500 committee were excluded from its index.

Below, you can see how VV has performed during the period when VTI lagged VOO’s performance so significantly. VV’s performance has been much better. Throughout the entire five-year period until now, it has only lagged VOO’s by 2.35%. And over the past months its performance has been far more similar and at times slightly better than VOO’s.

VOO vs VV Total Return Past 5 Years

VOO has a huge investor base. The ETF is just one share class of a mutual fund that holds a whopping 1.112 trillion dollars worth of assets. It trades so actively that you can buy shares safely using a market order.

VV is far smaller ETF, though with $50.7 Billion worth of assets it is still larger than most other ETFs you will hear discussed on investment sites. But you might consider using limit orders if you are buying a significant amount at one time.

The Vanguard Mega Cap ETF

The Vanguard Mega Cap ETF (MGC) is the last large cap blend ETF that is similar enough in its holdings to VOO to be worth considering.

MGC’s Total Return has actually outperformed the S&P 500 over the 10 year and 5 year time frames. It lagged only by .47% over the more recent 3-year period. Over the past month as the market has begun a slow decline and especially during last week’s tempestuous market when that decline heated up, MGC has again slightly outperformed VOO.

VOO and MGC Performance Over Past Month

MGC tracks the CRSP U.S. Megacap index. It holds only 206 of the largest cap U.S. stocks. As is the case with VV’s CRSP index, the details of its methodology are not public. However, we can see on Vanguard’s advisor’s site that the stocks in MGC with the smallest market caps, Hershey (HSY) and Las Vegas Sands (LVS), have market caps above $37 Billion. This is far larger than the market caps of the smallest stocks held in both VOO and VV. VOO’s smallest stocks, including V.F. (VFC) and Paramount Global (PARA) have market caps around $7 Billion. VV’s smallest stocks, as we saw, have market caps between $10 and $12 Billion.

So there is definitely a size tilt in effect here. However, in practice the impact of the size factor in MGC limited because, as Vanguard explains,

With respect to 75% of its total assets, the fund may not: (1) purchase more than 10% of the outstanding voting securities of any one issuer or (2) purchase securities of any issuer if, as a result, more than 5% of the fund’s total assets would be invested in that issuer’s securities

The effect of this is that the largest stocks in MGC, the so called “Magnificent Seven” or even the top 10, are only weighted slightly heavier in MGC than they are in VOO. For example, Microsoft (MSFT) made up 8.49% of MGC’s value at the end of March (Vanguard’s last reported date) compared to the 7.07% it made up of VOO. Similarly, Apple made up 6.83% of MGC and 5.63% of VOO. The only reason you might want to reject the idea of investing in MGC is if you think that today’s leading stocks are going to decline so significantly that future investment gains will be coming from the 300 stocks that are in VOO but not in MGC.

MGC has been trading since December 2007, but has a far lower amount of assets under management than does VOO. Currently, Vanguard reports that it has $5.6 Billion of assets under management. Its 50-day average trade volume is 80,426.48 shares. This is far less than VV’s 50-day average trade volume, which is 288,714.50 shares. This is, however, still high enough to keep its bid/ask spread to an average of .02%. This is only very slightly higher than VV’s average .01% spread. Nevertheless, given the lower volume, you should probably buy MGC using limit orders rather than market orders.

Other Alternative ETFs You Might Consider May Change Your Portfolio Tilt

There are many other large cap ETFs out there, of course, but I don’t see any others that make good tax loss harvest partners with VOO because they are designed in a way that causes them to tilt heavily away from a blended investment approach. Buying one of these can be a form of performance chasing and/or market timing. Most popular Large Cap ETFs tilt towards growth, value, or some dividend metric.

The Invesco QQQ Trust ETF (QQQ), with its heavy preponderance of Tech stocks and stocks of companies whose IPOs were more recent, tilts very strongly towards growth and though it has a history of outperformance since 2013, it is far more volatile than VOO and crashes harder than VOO does when something disturbs investors’ sentiment. Some otherwise interesting Large Cap ETFs are just too small to be safe alternatives, either because their size puts them at risk of being discontinued suddenly, or because they trade slowly with large bid/ask spreads.

I occasionally have indulged in this kind of tilting, most notably when I invested in SPDR Dow Jones Industrial Average ETF (DIA) as a value-tilted tax loss harvest partner last years. Last year this worked out for me, But recently I invested in DIA as a tax loss harvest partner, only to sit on the sidelines while VOO surged and significantly outperformed DIA.

So I am coming to think that the best approach is to select only tax loss harvest partners for VOO that are as near to identical in how they respond to market forces as VOO is. I also plan going forward to tax loss harvest only into ETFs that I would be happy to hold for years because that might be what I end up having to do if the market, unpredictable as always, should experience another double-digit surge over a very short period of time.

The Strategy

The simplest tax loss harvest strategy for VOO is one that alternates between two different partners. If you are preparing for the possibility that a very sudden market collapse may occur soon, the following strategy will let you make the most of the opportunity:

- Turn off automatic reinvestment of VOO’s dividends. If you receive a dividend, either stash it in your brokerage’s money market mutual fund or invest it manually in whatever ETF you have decided to use as a future tax loss harvesting partner. This way you won’t generate a wash sale if you suddenly find yourself with 10-15% losses in some shares of VOO that you want to be able to sell but can’t because the reinvested dividend was too recent a purchase.

- If you have new money coming in you want to invest in your core holding, do not invest it in VOO. Invest it in one of your already selected future tax loss harvest partners.

- Cycle between VOO and two potential tax loss harvest partners every 31 day so that either VOO or one of the two partners always has fulfilled the 30 days since last purchase requirement.

As an example, I have chosen to use VV and MGC as the potential tax loss harvesting partners to use with VOO. As I am taking seriously the chance that we will see a significant correction this year, I am going to invest any new money that goes into my stock allocation this month into MGC. That’s because last month I invested some new money and dividends in VOO, so I can’t tax loss harvest into it for 30 days. I don’t want to buy VV, which is my long-standing tax loss harvest partner this month, as shares I bought a month ago in VV have now met its 30 day no-buy requirement and can be tax loss harvested this month should the market swoon. If the market stays high, in 31 days I will go back to investing in VV as my VOO holding will have passed its 30 day no-buy date and I could tax loss harvest the several lots of VOO in another 31 days that are currently underwater if the market doesn’t rise.

If we get a huge decline, I will sell all shares of VV and MGC, none of which date back before August of 2023 as well as some individual stocks that are sitting on big gains that I want out of my portfolio and move the proceeds back into VOO, my chosen long-term core holding.

If the market surprises us and surges up, I can live happily with a balance of new investments in VV and MGC, as their slight tendency to over and underperformance of VOO should balance out and give me a very similar return to that of VOO going forward.