Arsenii Palivoda

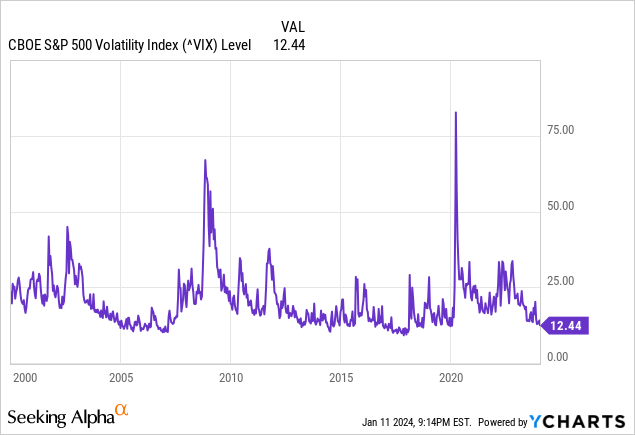

Recent lows in the CBOE Volatility Index (VIX) have created an opportunity rarely seen in the post-pandemic era. There are fundamentally-based reasons galore for the VIX to be high, low, uncertain, or at times, just plain wacky. I suspect that as 2024 progresses, we’ll see all the above, and very likely, the latter. I use out of money put options frequently to provide my portfolio with “tail risk protection” since I have never forgotten the lessons of the 1987 crash, the quick fall from grace of the Nasdaq in 2000, the financial crisis of 2007-2009 which looked to be over, then kept coming back with worse news, like a Freddie Krueger movie.

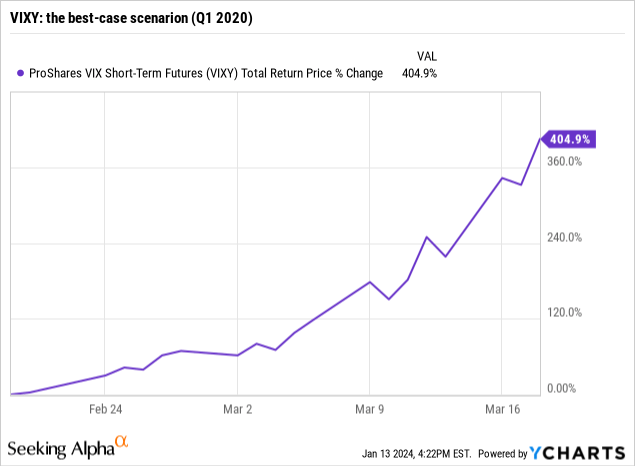

And, the most recent example of when a small tail risk position in an otherwise long-only or long-short portfolio has been an investor’s best friend was from February 19, 2000 through March 23 of that same year. Five weeks where the S&P 500 Index fell by 33%.

The model portfolio I ran for my clients at the time (I sold the practice that year and continue to provide a “model signal research service” to the buyer) actually gained a couple percent during that shocking period, and it was more my willingness to spend a little capital to protect against “big loss” than any genius on my part. As shown above, VIXY gained 400% in a month. That, some put options and a general posture that the market was at above-average risk even before the pandemic hit, all contributed to the success during that time. I have the track record on that strategy, and only mention that in case someone asks me to “prove it.” I’ll readily admit I could have done a better job in that model coming out of the pandemic crash, the rest of 2020. So there you go, both sides of navigating 2020 with real money on the line. Wow, did I learn a lot that year that has helped me since!

That type of portfolio protection drags total return a bit during years like 2023, just as it keeps portfolio values within striking distance of previous high water marks during years like 2022. So, every investor other than those who just started within the past year has experienced the potential value-added of tail risk protection.

VIXY: high reward potential, high risk, so I keep my position size very low

The ProShares VIX Short-Term Futures ETF (BATS:VIXY) is one of my “go-to” ETFs for when I want to include a dash of disaster protection in a portfolio, and options are either too pricey or otherwise not the best choice for a particular account or portfolio I oversee. VIXY is taxed with a form K-1, so that’s a turn off for some, but not for me. And it should be used in small doses, given its huge volatility potential. It is the embodiment of what I call “take big risks with small amounts of money.” But in this case, the risk is that the market doesn’t crash before you decide to sell it.

With VIX trading toward the bottom of a multi-year range of 12 to 35, this is one of those times I want VIXY to occupy a small position in my total portfolio. “Small” is up to every investor, and everything I write here is opinion, not personalized advice. But for the sake of disclosure, I have about 1% of one of my tactical ETF model portfolios I run with my own capital in VIXY right now. That might go to 2% or 3% but it would take a crisis of historic proportions to ever buy north of a 5% position. VIXY is more like owning options or a highly-levered equity bear ETF. It is something that requires extra due diligence before buying more than an amount you can afford to lose.

Some background and basics on volatility

Volatility is a curious beast, and an inseparable part of the markets. When it’s high, fears of further declines run rampant; when it’s low, there’s always the shadow of bad news potentially lurking around the corner. But either way, investing in anything but the safest of assets requires embracing (or at least tolerating) its presence.

And when you get past the fear of the uncertain, you might even be wondering if volatility is a force that could be harnessed in a portfolio. VIX is the go-to measure of volatility in the market, and there are a handful of investment vehicles available.

VIXY provides a good balance of the pros and cons that various options have. None of the VIX ETFs are designed to be long-term holds, but as the VIX starts approaching its all-time lows, it once again becomes interesting to explore what a position here could look like.

A quick primer on the VIX

If you haven’t looked too closely at the VIX or its related ETFs, there might be a lot of confusing elements involved. Unlike many indices, the VIX isn’t just a collection of stocks or bonds – it’s actually a calculated number that is based off of the prices of puts and calls on the S&P 500, and the index value represents the implied volatility of the market – a higher number means investors are expecting more volatility in the next month or so. This, in turn, expresses negative sentiment on the overall stock market.

But because of its complex calculation, it isn’t possible to simply replicate it and offer that as an ETF. Instead, there are futures contracts on the VIX itself with various maturity times, and the different ETFs that do exist make use of these futures differently. But no matter which futures are used, there is the eternal problem of constantly having to “roll” the existing futures into new ones, an ultimately expensive process that can be seen when looking at the price of any VIX ETF over time and watching its downward drift.

Generally speaking, the best way to approach these volatility products is to think of them as insurance – you pay for coverage for a certain time period, and if you end up not needing it, it’s hopefully because the rest of the portfolio is doing well.

The VIX is currently below 13. As a rough rule of thumb, VIX in the 0-15 range is modest, 15-25 is more typical, and over 30, a lot of investment tenets go out the window. For context, the lowest the VIX has ever been is 9.14 in November 2017.

There will always be uncertainly and volatility in the markets, but now might be a good chance to acquire insurance at a more favorable risk-reward. That’s why VIXY gets a buy from me.