Justin Sullivan

Introduction – Visa is an extraordinary company

I maintain my Buy rating on Visa Inc. (NYSE:V) stock following the company’s fiscal Q4 and FY23 earnings, which topped the Wall Street consensus. In addition, Visa management guided for another strong year ahead as the company continues to see strong and resilient consumer spending and continues to build on its global importance and market share. Visa remains a no-brainer investment.

It has been a while since I last covered Visa here on Seeking Alpha. I last covered the company in April when I rated shares a buy after it released its Q2 results, which topped the Wall Street consensus for the 13th consecutive quarter and came in above my own estimates. In the meantime, the company continued to perform by reporting solid fiscal Q3 results and reported its fiscal Q4 and FY23 earnings on October 24.

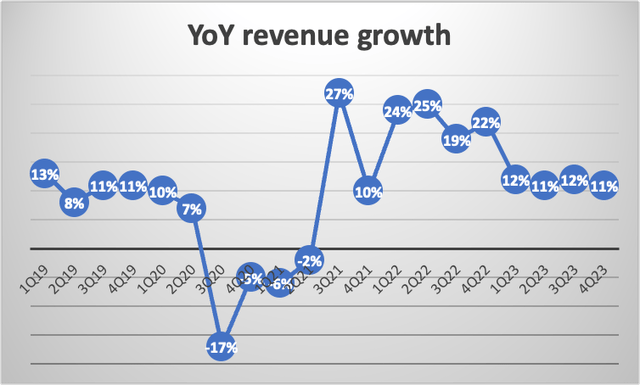

As we have gotten used to by now, the company beat the Wall Street consensus and delivered solid double-digit growth. To put this into perspective, over the last 28 quarters (7 fiscal years), Visa has only reported net revenue growth of below 10% in 7 quarters, of which four were negative (during the first months of the COVID lockdowns). Furthermore, results have only missed the revenue consensus two times over the same time frame and have not missed earnings a single time.

I believe this is all one needs to be informed of to know just how exceptionally high quality this company is, as it reports incredibly consistent revenue growth and manages to outperform expectations pretty much every time. This is remarkable, especially when considering we are talking about a company with a market cap approaching $500 billion.

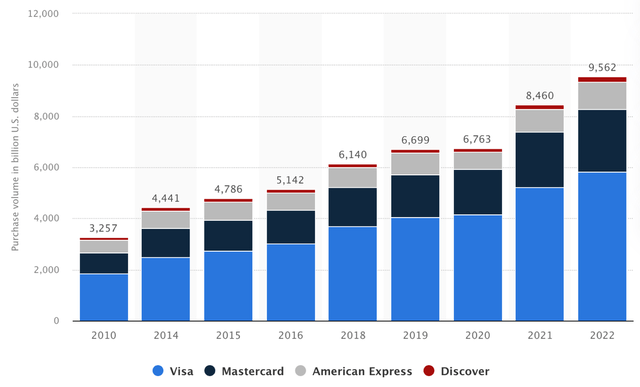

Visa is able to display this level of consistency and revenue growth thanks to its incredible strength in the digital payment processing industry as the company practically operates a duopoly here with Mastercard (MA). 85% of all digital payments flow through the networks of these two companies, with Visa being responsible for the majority of these with a 60% market share. On top of this, 84% of all credit cards globally are issued by either Visa or Mastercard, with Visa once again taking the lead with 48%.

Payment processors market share of US payment volume (Statista)

As a result of this duopoly and the global importance of the platform (considering that if Visa’s networks fail, global economies would practically fail), the company holds incredible pricing power and is a primary beneficiary of the shift from physical to digital payments.

This has been driving growth for the company for many years now and this will continue to drive growth as digital payments volume is projected to keep growing at an 11.8% CAGR through 2027. With Visa consistently taking more share in the market over the last decade by introducing new payment methods and integrating innovative technologies to make payments more conventional and accessible, it should be able to grow payment volumes at a similar rate.

Furthermore, as Visa takes a piece of each dollar processed through the platform, it is safe to assume Visa will continue to keep growing its transaction revenues at a similar growth rate as well. In addition to this, the company is also seeing rapid growth in so-called “value-added services.”

Visa offers various value-added services to financial institutions, merchants, and consumers as part of its efforts to enhance the overall payment experience and provide additional benefits beyond basic payment processing. These value-added services are designed to improve security, convenience, and engagement for various stakeholders in the payments ecosystem. These services include security, data analysis and insights, and payment solutions for businesses, among others.

Value-added services revenue is driving additional growth and is opening the company up to new ways of revenue generation, growing the TAM. Furthermore, it solidifies Visa’s relationship with users (banks, other financial institutions, and businesses), contributing to its moat.

Visa continues to build out its moat and positions itself from strong continued growth

Now, with Visa’s business model clarified, before we dive into the financial numbers, it is worth highlighting some incredible FY23 statistics, which show that Visa is still working on solidifying its position in the industry and that it is very much working.

First, it is worth highlighting that Visa processed 276 billion transactions over the last twelve months, meaning Visa’s payment platform was used a staggering 757 million times a day. Let that sink in.

Even more impressive is the fact that this number was up 15% YoY. A big part of Visa’s ability to keep growing despite its already massive size are its efforts to expand its network globally. In 2023, Visa signed an additional 500 500 commercial partnerships with fintechs globally, ranging from early-stage companies to growing and mature players. This is an increase of 25% YoY.

In addition, in Q4 alone, Visa renewed its long-term agreement with US Bank, one of the largest card issuers in the US, for their consumer and commercial portfolios. It also renewed partnerships with China Merchants Bank, the largest issuer in Mainland China; a long-standing partnership with DBS, the largest bank in Southeast Asia; and expanded a long-term global agreement across more than 60 countries with Citibank (C) for their commercial card business, which also encompasses over 20 value-added services. Visa also rapidly expanded its number of Visa B2B Connect partner banks, part of its “new flows” business, by more than 70% YoY, making incredible progress.

These agreements are crucial for Visa to maintain its lead and expand its network. This is why the company spends 27% of its revenues on client incentives to close these deals. This was up 20% in FY23. Do note that these costs are already deducted from net revenue reported by Visa.

All these efforts have paid off for Visa in its fiscal FY23, with total active Visa cards growing by another 7% and the number of merchant locations (where Visa cards are accepted) growing 17% YoY, helped by strong growth in Latin America and CEMEA. This, in turn, has supported Visa’s incredible Q4 and FY23 performance and will continue to do so going forward, making Visa an incredible compounder.

Visa’s Q3 results did not disappoint, with no weakness visible

Moving to the Q3 financials, Visa delivered revenue of $8.6 billion in its fiscal Q4, up 10.3% YoY and coming in roughly in line with the consensus. Growth has normalized for Visa in its fiscal FY23 and has now stabilized in the low-double digits.

Despite a number of headwinds, including FX, volatility, interest rates, and inflation, Visa delivered another excellent full fiscal year with 11% revenue growth. The company saw consumer spending across all segments remain stable from March despite the inflationary pressures and higher rates impacting other industries. As far as Visa can see, the consumer remains resilient and shows no signs of weakness, supporting the company’s growth.

Visa financial data (By Author)

Diving deeper into the quarterly results, we can see that payment volume was up 9%, driven by 6% growth in the US and 11% international volume growth. The latter saw the benefit of a continued recovery in cross-border travel, leading to 26% higher volumes. Overall, while growth has been slowing this has been stable over recent months and quarters and supports strong underlying growth for Visa.

Contributing to the growing volumes was an increase in transactions, which were up 10% YoY, driven by strong growth in new flows, with Visa Direct growing transactions 19% YoY to 7.5 billion transactions. This was driven by the earlier mentioned new bank partnerships, which grew rapidly. Visa’s efforts in expanding its offering are paying off, with new flows consistently delivering impressive growth.

In Q4, new flows revenues increased 14% YoY, outgrowing overall transaction growth. Another revenue growth driver leading to revenue outgrowing volumes is the outperformance in value-added services revenues, which were up 19% in Q4, leading to FY23 growth of 18%. Visa is rapidly adding new services, and, in the meantime, businesses are increasingly finding value in these offerings from Visa, powered by their incredible consumer data stream. As a result, Visa’s 265 largest service customers increased their number of service products by 8% to 22 in FY23.

Overall, Visa continues to see strong and healthy growth in transactions and volumes, while new flows and value-added services are boasting its growth potential in other directions. In general, this is another very sturdy performance by the company.

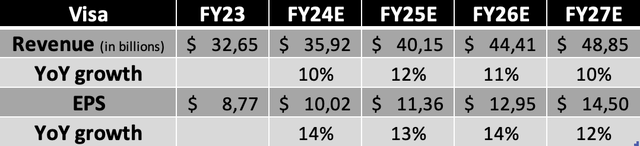

Moving to the bottom line really quickly, as this included little changes to previous quarters, Visa reported a 9% growth in operating expenses, primarily due to personnel expenses from growth in headcount. With expenses sitting below top-line growth, net income improved by 18% YoY to $4.8 billion, leading to EPS of $2.33, beating the consensus by $0.09 and improving 21% YoY. This brought the FY23 EPS to $8.77, highlighting the company’s consistent margin improvements.

Furthermore, Q4 free cash flow (FCF) was $6.6 billion, reflecting an FCF margin of 77% of net revenue, which is incredible. However, the FY23 free cash flow margin of 60% of net revenue is more representable, resulting in a total of $19.7 billion in free cash flow generated over the last 12 months, fully covering the share repurchases and dividends and then some.

Dividend obligations in FY23 totaled just $3.7 billion, resulting in an FCF payout ratio of just 19%, which is incredible and indicates that the 0.87 yield is very safe while leaving plenty of room for upside, even after management increased the dividend by 15.9%. This highlights management’s confidence in the near-term performance and the incredible financial health of the company.

While the yield is no reason for a lot of enthusiasm, the dividend growth potential certainly is. Visa has been paying a growing dividend for 14 straight years and has grown this at a CAGR of close to 17% over the last five years. With the payout ratio still sitting below 20% and the company expected to keep driving mid-teens EPS growth, I am not expecting a significant slowdown in EPS growth, making this one of the most interesting dividend growth stocks out there.

In addition to the dividend, management has also been committed to buying back its shares. Over the last seven fiscal years, management has reduced the share count by over 13% after buying back another $4.1 billion in shares in Q4. This brought the TTM total to $12.1 billion, still easily covered by FCF.

At the end of its fiscal year, Visa reported a total cash position of $20.1 billion and a total debt of $20.5 billion, meaning the company is approximately cash-neutral. Therefore, management, in addition to the dividend increase, also announced a new $25 billion share buyback program to leverage its excellent FCF and solid balance sheet. The company literally has cash to burn.

This buyback comes on top of the $4.7 billion remaining from the prior buyback authorization, bringing the total to $29.7 billion. I expect management to fully use this authorization over the next two fiscal years, which, based on today’s market cap, represents a further 6% decrease in the share count.

This excellent financial outlook, balance sheet health, revenue consistency, and stellar shareholder returns make Visa a no-brainer investment. Honestly, why wouldn’t you buy these shares at a fair price? This company is a true SWAN buy and hold forever.

Outlook & Conclusion – Is V stock a Buy, Hold, or Sell?

Visa management’s forward commentary looks promising. In the first three weeks of October, management has seen payment volume in the US drop slightly sequentially to 5% as a result of the decline in fuel prices. Excluding this impact, volume growth was stable. Other metrics also showed little change, with transactions up 10% YoY and cross-border volume remaining strong as this increased 19% YoY.

As for the fiscal FY24 guidance, management is not factoring in any impact from Reg II and student loan repayments as it has yet to see a meaningful impact to date. Furthermore, management expects the drivers from fiscal Q4 to generally continue throughout the year, driving the expectation for volume growth and transaction growth to remain in the low-double-digits on a YoY basis. This includes a slowdown in cross-border travel growth to the low 20s, which will primarily be driven by travel volume rebounding in China and, to a lesser extent, improving US inbound travel volume.

This results in fiscal FY24 net revenue guidance of low double-digit growth, including a slowdown in incentives growth and the expectation for new flows and value-added services revenues to outgrow transaction revenue. In addition, management aims to grow operating expenses in the high single-digit to low double-digits, leaving some room for margin expansion and resulting in EPS growth in the low teens, slightly outpacing revenue growth.

As for the split between the two halves of the year, management is currently projecting overall adjusted net revenue growth to be lower in the first half than in the second half of FY 2024. This is driven by different comparables regarding the cross-border travel recovery, high currency volatility in the first half of fiscal FY23, and the fact that incentives came in 16% higher in the second half of FY23 compared to the first half. These differences are what cause different comparables for both quarters.

Overall, FY24 seems to become another successful year for Visa with strong double-digit growth, margin expansion, and market share gains, which is especially impressive when we look at the success of the company over the last two years already.

Following the strong fiscal FY23 Q3 and Q4 performances, and management’s bullish guidance and strong operational performance, I now expect the following financial results through fiscal FY27.

Financial projections (By Author)

Moving to the valuation, we can see that while the share price is only up 4.5% since my previous article in April, the valuation has come down from 26/27x earnings to just 24x due to the company’s incredibly strong (out)performance over recent quarters and the higher revenue and EPS expectations. This means shares are now valued at a discount of close to 24% to their 5-year average valuation.

However, with the company projected to grow revenue at low-double digits, EPS at mid-teens for the foreseeable future, and continuously strengthening its competitive position and expanding its market share, I remain of the firm believe that shares continue to deserve a premium valuation. There are simply few other companies with a global moat, revenue consistency, and growth outlook as strong as Visa’s.

Therefore, I believe an earnings multiple of at least 28x is fully justified here, leaving room for further upside as well. Based on this belief and my fiscal FY25 EPS projection, I calculate a target price of $318 per share (up from $294). This means that from a current price of $243 at the time of writing, investors can expect annual returns exceeding 14%, making shares incredibly attractive today.

Therefore, I maintain my Buy rating on Visa shares.